-

Invest

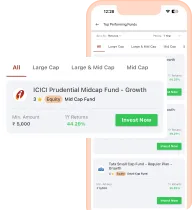

Start Mutual Fund SIP as low as ₹100

- Research Picks

- SIP @ ₹100

- New Fund Offer

-

Trade

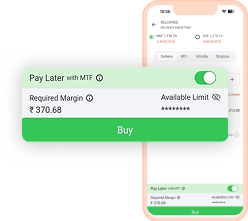

Why pay more?

When you can pay less!With Just 25%* Funds

Buy Stocks and Pay Later

with Ease Using MTF

-

Markets

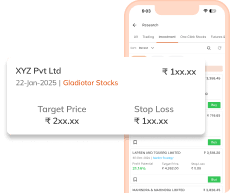

No time to track the market?

Our research picks got you covered!- Daily trading ideas

- Short term

investment ideas

-

Learning

- Offerings

- Pricing

- NRI

- Customer care

-

Accessibility options