Corporate Bond Mutual Fund Picks

Ab dar kaisa? Stay protected from market volatility. Corporate Bond Mutual Funds have delivered ~9% CAGR returns in the last 3 years. Explore our top 3 picks in the calculator below and get started!

Ab dar kaisa? Stay protected from market volatility. Corporate Bond Mutual Funds have delivered ~9% CAGR returns in the last 3 years. Explore our top 3 picks in the calculator below and get started!

Source: ICICIdirect Research, Accord Fintech

Data as on August 12, 2021

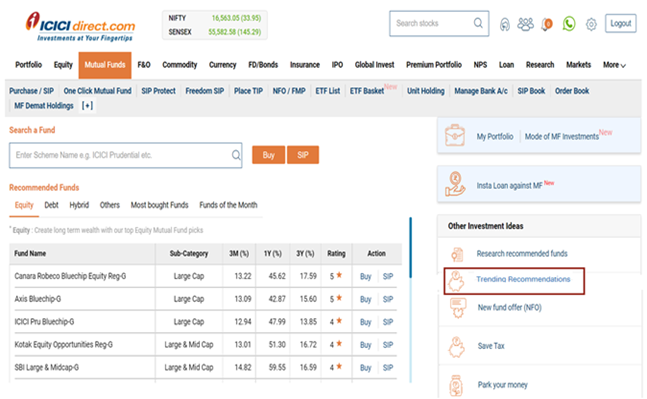

Login to ICICI Direct and click on "Trending Recommendations" in Mutual Fund section

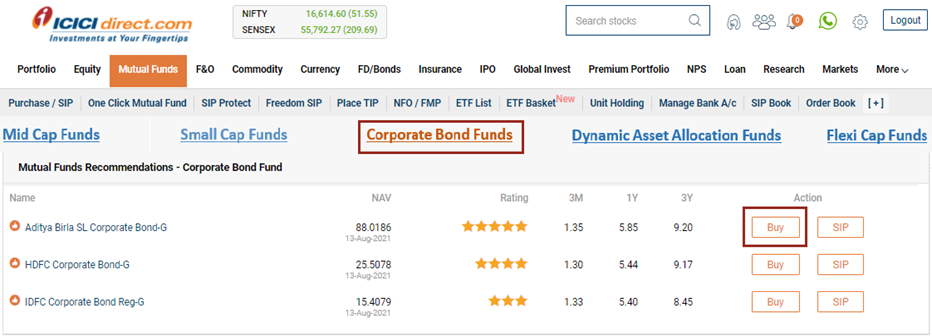

Click on Corporate Bond Funds, select a scheme from recommendations & click on 'Buy'

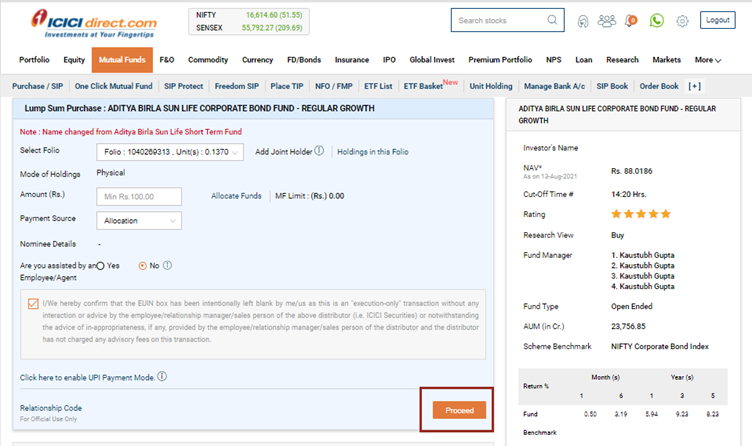

Provide investment details & confirm to place the order

A Corporate Bond Fund is a mutual fund which invests more than 80% of portfolio in high-rated corporate bonds. A Corporate Bond is a financial instrument that allows a private or public corporation to borrow money from investors. In exchange, the company promises to repay the money on a specified date on maturity and makes regular coupon payment to investors.

There are broadly two types of corporate bonds in which these funds invest in –

1. Top-rated companies which have high credit ratings (AA+ or above) - Generally top public sector unit (PSU) companies, banks and Navratnas

2. Companies having a lower credit rating of AA-

Corporate Bond Funds are a good choice for investors seeking for fixed income allocation to generate stable returns while ensuring safety of the invested capital. These funds are ideal for risk-averse people looking with investment horizon ranging from 1-3 years generally.

It is not necessary to have a large sum of money to invest in Corporate Bond Funds. Most schemes allow you to start a lump sum (one –time) investment with an amount of Rs 5,000. You can also start a SIP in these schemes with an amount as low Rs 500 per month.

Corporate Bond Funds are taxed like debt mutual funds. Capital Gains from investment in these funds held for less than three years will be taxable at the individual's income tax slab rates. At the same time, capital gains from investments with a tenure of more than three years are taxable at 20% with indexation benefits. The latter makes these funds more tax-efficient compared to an investment like fixed deposit.

After you place your order, you can view the details of your transaction from the Order Book in ICICIdirect.com. Also an email will be sent to your registered email address.

Yes, you can transact at any time of the day. However, in order to get the applicable NAV for the current day you would have to transact before the cut-off time of the scheme. If you place any order after the said cut-off time, you would be eligible for applicable NAV of the next day. As per SEBI guidelines the cut-off time for accepting orders in Non-liquid funds (including Corporate Bond Funds) is 1500 hrs. However, taking into account internal transaction processing time, ICICIdirect.com has kept the cut-off time, for accepting orders in Non-liquid funds (including Corporate Bond Funds) as 1420 hrs.

Yes, you can place your request even on a holiday. However, the request would be processed on the next business day and your order will be processed as per applicable NAV of the next business day

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing.

One Click Mutual Fund portfolio related feature is offered by ICICI Securities. Any complaint / dispute pertaining to the same would not be entertained by Stock Exchanges.

ICICI direct Money App is offered by ICICI Securities. Any complaint / dispute pertaining to the same would not be entertained by Stock Exchanges.