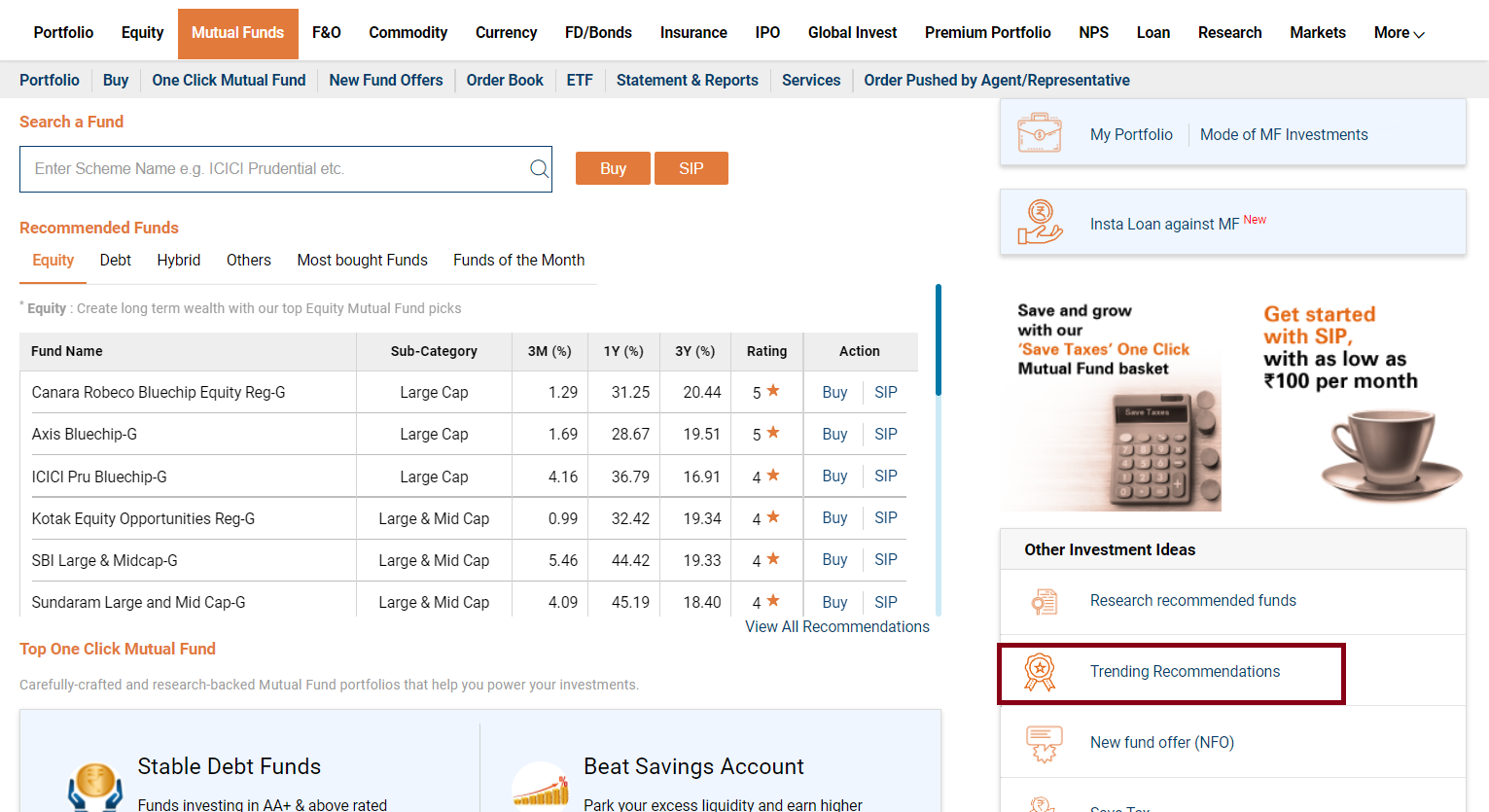

Large Cap Funds – Know what it is!

-

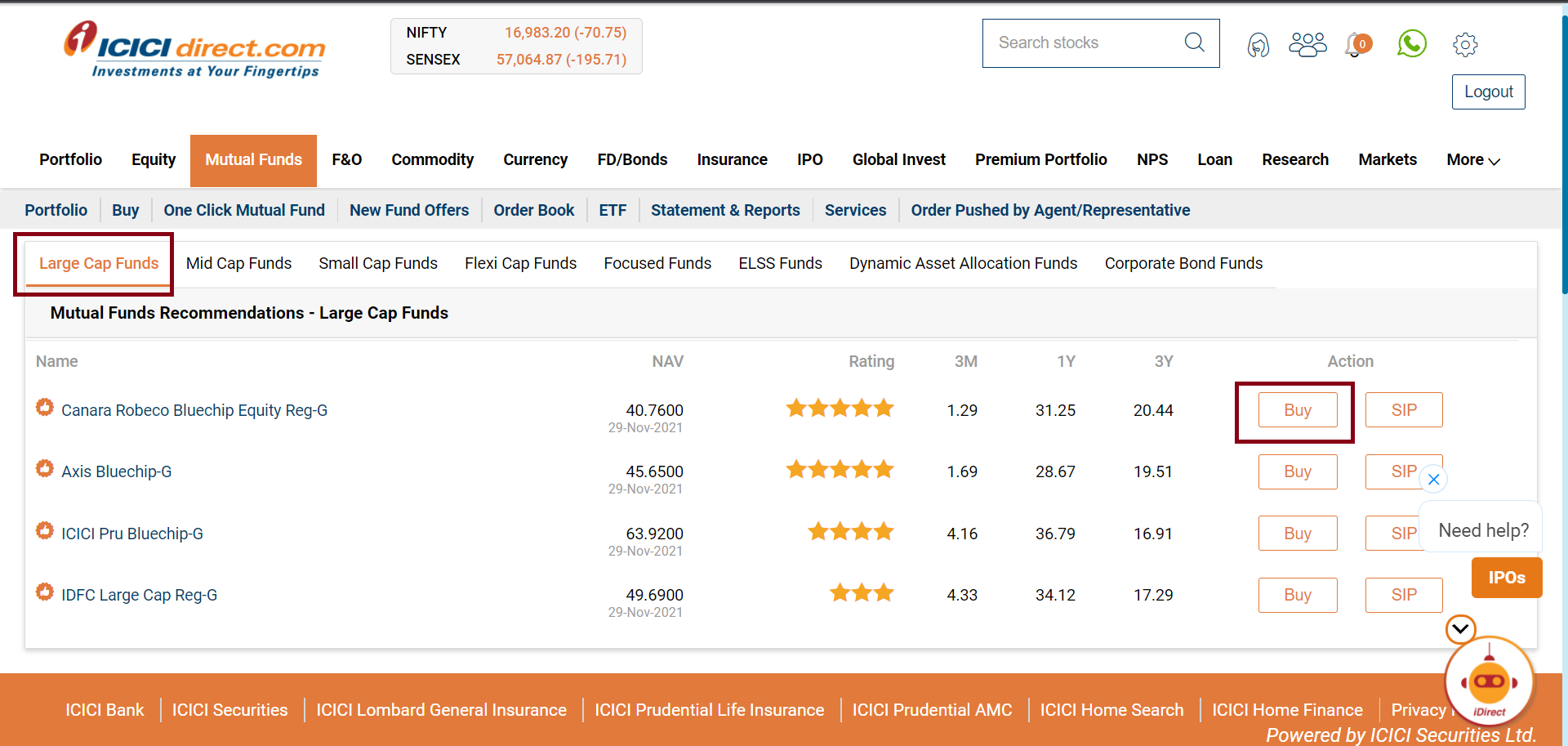

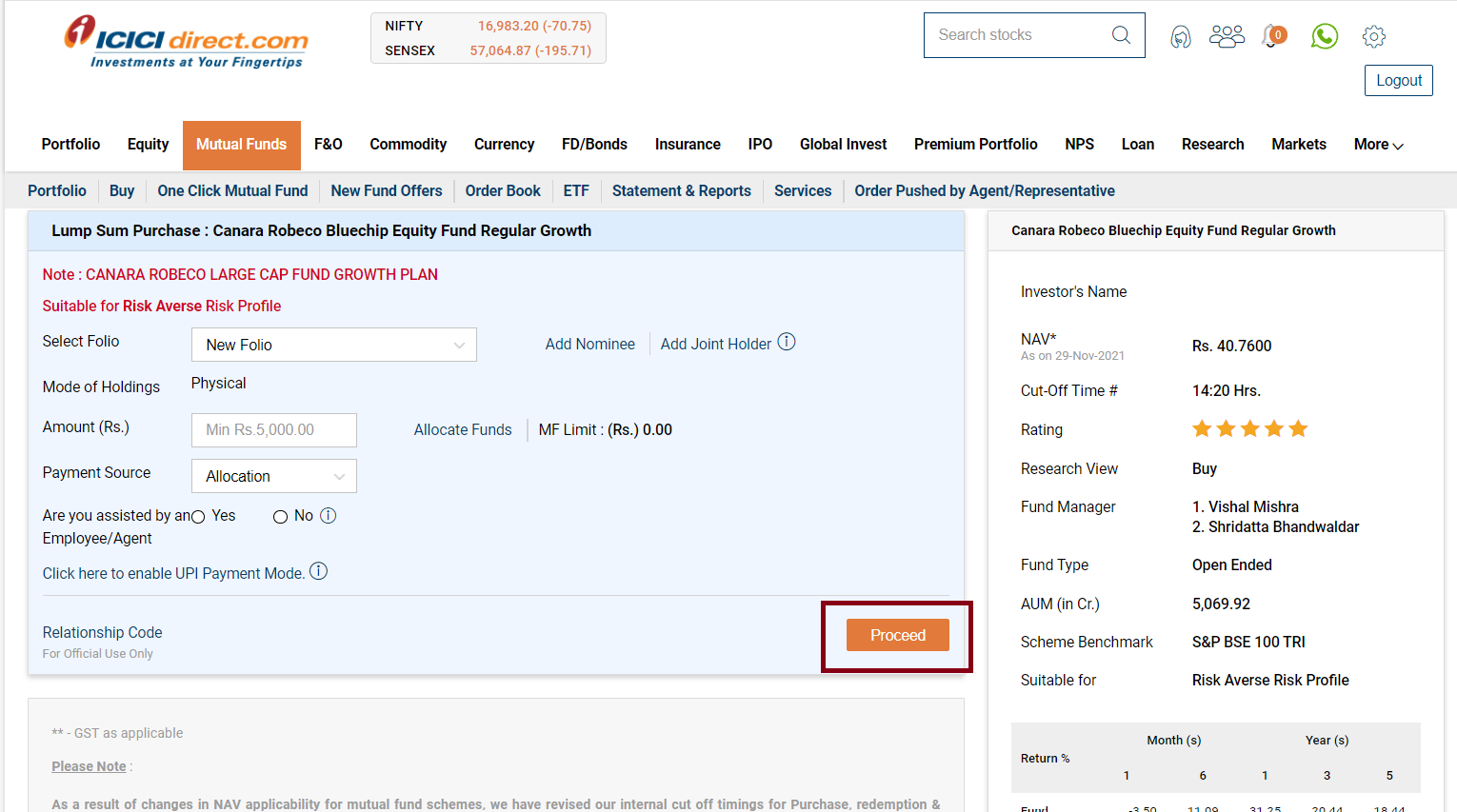

Invests in stocks of market leaders (Top 100 companies basis market cap).

-

Ideal for long term wealth creation in a stable manner.

-

Delivers stable and consistent returns in the long term.