What is the Margin required to take a position in Intraday Product? What is Initial, Minimum Margin and Trigger price? What happens if the margin is less?

Initial Margin is Margin amount required to take position in Intraday Product.

Now let’s understand with an example: If you want to buy 1000 shares of ABC Limit which is trading at 100. The Initial Margin (IM) required is 20% and Minimum Margin (MM) is 15%.

In the above example, you just require Rs. 20,000 (Initial Margin). Minimum Margin (Rs 15,000) is the margin amount that you have to maintain with I-Sec at all points of time for your open Margin position. Trigger price is the difference between IM and MM.

What is Intraday Trading?

In Intraday trading, you can take buy/sell positions in stock(s) with the intention of squaring off the position within the same settlement cycle. If during the course of the settlement cycle, the price moves in your favour (rises in case you have a buy position or falls in case you have a sell position), you make a profit. In case the price movement is adverse, you incur a loss.

- A trader buys a stock and sells it on the same day, or sells a stock and buys it back on the same day.

- If position is not squared off during market hours, it will lead to automated square off by the system.

ICICI Direct has two intraday products Intraday and Bracket.

How does “Intraday (Margin)” work?

In Intraday (Margin), trader only pays some portion of the total trade value upfront. The remaining portion is funded by the broker.

Let’s take an example, say Mr. Q wishes to buy 2 shares of WIPRO however he does not wish to spend his entire available balance on these shares and thus opts for Intraday. If this was a delivery trade, he would have had to pay Rs. 782, however as seen below he only needs to pay Rs. 156 since the trade is being done in Margin segment.

The amount which is blocked as margin is as mentioned below 20%.

Margin facility is available only for particular stocks. The whole list of eligible stocks along with the applicable rates can be viewed on the website.

To view:

- Click on Stocks > Services > Stock List.

- Further, click on Select

- Choose Margin/Flexi Cash from the drop-down list.

- Click View.

The list will now show those shares which can be bought using margin as well as the various margin requirements for these shares.

[When logged in: Stocks > Services> Stock List]

This list provides various all margin requirements for a particular stock under different products.

How is Intraday trading different from trading in Cash Segment/ Delivery?

Transactions in Cash Segment whether buy (or sell) are settled by “delivery” that is deducting the cash from the account and delivering the shares in the demat account whereas in Intraday trading, executed trades are squared off in the same settlement cycle (however there is an option to convert them into delivery in Intraday (Margin)).

For example, when you place an order to buy 100 shares of Reliance in the cash segment, your intention is to pay for and receive the shares in your demat account. However, if the same order were to be placed in the margin segment, your intention would be to sell those shares subsequently in the same settlement at a higher price and thereby make a profit on the same. However, if the price falls subsequently, there may be a loss.

Normally to buy shares, you have to pay 100% of the share value, while to sell shares, you need to have shares in your demat account. But in Intraday, you pay only a part of the share value as margin.

|

|

Delivery

|

Intraday Margin

|

|

BUY

|

- If you place an order in delivery to buy 10 shares of ITC trading at Rs 450, you pay Rs 4500 (=450*10).

|

- If margin required is 20%, then, you only pay Rs900 (=Rs 4500*0.2)

|

|

SELL

|

- If you place an order to sell 10 shares of ITC, 10 qty of ITC shares will be sold from your account.

|

- Having ITC shares in your Demat account is not required. You can sell first and buyback later (within the same day)

|

Can I convert intraday position to delivery? How?

Converting your Intraday trades to Delivery is possible using CTD (convert to delivery). If BUY trade has been executed in Intraday, then the trader has the option to buy the share (and convert to delivery) by paying the full amount,

If SELL trade has been executed in Intraday, then the trader has the option to sell the share if trader holds that share in his Demat account.

Convert to delivery will not be available in case you are mapped to iValue.

You can convert Intraday position to Delivery through open positions page or watchlist.

Via ICICI Direct App:

To convert intraday position to delivery, you need to follow these steps:

- Click on the portfolio tab

- Select open position

- Click on the stock you want to convert to delivery

- Enter the quantity you want to convert then click submit

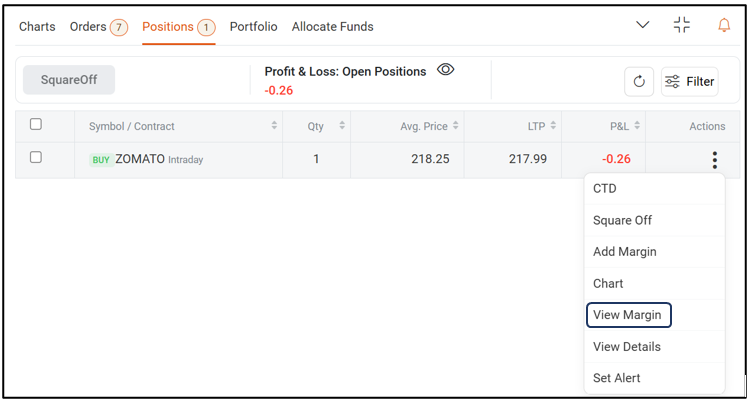

Open Positions Page

- go to the “Open Positions” page under “Stocks”

- click on the “Intraday” option here, the You can view all their open positions.

- under “Actions” click “The three dots” to convert the shares to delivery.

Stocks > Open Positions > Intraday > CTD

Watchlist Page

- Go to “Stocks” page and click on “Watchlist”

- Scroll down to see the following table, click on “Positions”

- Click on the three dots under “Actions”> Click on “CTD”.

Stocks > Watchlist > Scroll > Positions > 3 dots > CTD

Show path and screenshot through watchlist

- If you have taken Margin Sell position, you can convert it to delivery but only if you have same quantity of shares in your demat. Here shares from your demat will be sold and the position will be closed.

What is short sell in Intraday, how does it work?

Short selling involves borrowing shares of a stock and selling them with the expectation that the price will decline. The seller aims to buy back the shares at a lower price, return them to lender and pocket the difference as profit. This strategy profits from a decrease in the stock’s price.

How can I “Square Off” a position?

Via ICICI Direct App:

- In order to square off your Intraday position you need follow these steps:

Click on the portfolio tab

- Select open position

- You’ll see all the positions you have entered

- Click on the stock whose position you want to square off

- Click on the square off option > set the price and continue.

“Square off” action initiates a trade to close the open position.

For Buy position: square off action initiates a sell order to close the previous open position

For Sell position: square off action initiates a buy order to close the previously held position.

In Order to Square off:

Open Positions Page

- Go to the “Open Positions” page under “Stocks”

- Click on the “Intraday” option here, then you can view all the open positions.

- Under “Actions” click “Square Off” to square off your trade.

Stocks > Open Positions > Margin > Square Off

Watchlist Page

- Go to “Stocks” page and click on “Watchlist”

- Scroll down to see the following table, click on “Positions”

- Click on the three dots under “Actions”

- Click on “Square Off”.

Stocks > Watchlist > Scroll > Positions > 3 dots > Square Off

Can I modify intraday position? How?

If the order is still unexecuted or pending, the trader can modify, cancel or reorder as seen below.

Via ICICI Direct App:

In Order to Modify:

- Click on orders

- Click on the stock whose order is pending

- Option to modify will be available

Via website

- “Modify” lets you to edit the order which has been placed earlier.

- “Cancel” will cancel the order placed.

- “Reorder” will place the same order again on the exchange.

What are the options for “order validity”, “disclosed quantity”? Where can I see them?

To view these additional options just click “charges & more” displayed towards the right of the “price” tab under place order.

“IOC” orders

- IOC refers to Immediate or Cancelled orders

- It lets a trader to buy or sell shares as soon as the order is placed in the market, in the event the order is not accepted or failed, it will be removed from the system.

- For example, Mr. S puts in an IOC order to buy 100 shares of ITC at Rs. 450 but 100 shares at Rs. 450 are currently not available in the market. In this case, this order will be immediately cancelled. There will be no open positions created in this case.

Disclosed quantity

You can choose to display the entire quantity or a part of it to the market while placing the order. You can also decide the amount you want to disclose at once.

- For example, an order of 1000 with a disclosed quantity condition of 200 will mean that 200 is displayed to the market at a time. After this is traded, another 200 is automatically released and so on till the full order is executed.

- In NSE, the Disclosed Quantity (DQ) should not be less than 10% of the Order Quantity and at the same time should not be greater than or equal to the Order Quantity.

- In BSE, the Disclosed Quantity should not be less than either 10% of the Order Quantity or 1000 whichever is lower and at the same time should not be greater than or equal to the Order Quantity.

What is “Limit order”? How to place a limit order?

Limit orders are used to buy or sell a stock at a particular price. The order will only be executed at the limit price or better price (than limit price).

- BUY limit order is the maximum price you are willing to pay to buy the share.

E.g., a stock is trading at ₹100, placing a BUY Limit order at ₹90 would ensure that trade is executed at a price lesser than or equal to the limit price of ₹90.

- SELL limit order is the minimum price that you are willing to sell their share for.

E.g., a stock is trading at ₹100, placing a SELL Limit order at ₹110 would ensure that trade is executed at a price greater than or equal to the limit price of ₹110.

Note: Limit order may not be executed if the market price doesn’t reach or cross the limit price.

While trying to place a limit order, follow the same steps as placing a regular intraday order, and while entering the price click on “Limit” option as shown below.

Set the price you wish to set as the limit price and click “Buy”.

What is Initial and Minimum Margin? What happens if the margin is less?

Initial Margin: The margin amount which is to be required to be maintained in the account to execute the transaction.

Minimum Margin: The amount which needs to be maintained in order to hold the position.

Now let’s understand with example:

If Mr. B want to buy 1 share of RVNL which is trading at 391.70. The Initial Margin required is 20% and Minimum Margin (Min. Margin) is 15%, these values can be found via the stocklist.

The initial margin will be (20% x 391.79 = 78.19) that is, margin percentage as pre-defined by ICICI Securities x Share Price X Quantity of shares. Similarly, Minimum Margin will be (15% x 391.70 = 58.5).

In the above example, Mr. B requires Rs. 78.19 (Initial Margin) to make the purchase. Minimum Margin (Rs 58.5) is the margin amount that he will have to maintain with I-Sec at all points of time for his open Margin position.

How to place an Intraday order?

Via ICICI Direct App

- To place an order on intraday, follow these steps:

- Go to stocks tab

- Select the stock

- Select Buy/Sell option

- Click on the Intraday tab

- Set the price and execute the trade

Watchlist

- To place an order through watchlist follow these steps:

- Add a stock to your watchlist

- Select the action (Buy/Sell)

- Click on intraday tab >Set price and execute your order

Via Website

Go to “Stocks” tab and click on “Place Order”. Now, click on “Intraday (Margin)” tab as shown below. This will open the order screen for Intraday Margin, fill in the details and place order.

Stocks > Place Order > Intraday (Margin) > Fill details > Confirm

By when the profits from intraday will be added in current limits?

As per the regulatory guidelines, effective from Friday 23rd Aug 2024, any profit earned from trades in Intraday, Bracket and Pay Later (MTF)) will be available for use in your current limits only after the closure of market hours. The said limits can be used for trading on the next trading day (T+1 day) or for placing overnight orders.

For example, If you conducted trades on August 26th, 2024 where you bought stocks worth 50,000 in Intraday and sold them at 60,000. This means that you have generated a profit of ₹ 10,000 on the trades. Under the revised guidelines, ₹ 10,000 profit will be added in the limits in your trading account after-market hours on 26th August, 2024 and same can be used for trading only on August 27th , 2024 (T+1 day).

Why are my profits from intraday are not available in current limits?

As per the regulatory guidelines, effective from Friday 23rd Aug 2024, any profit earned from trades in Intraday, Bracket and Pay Later (MTF)) will be available for use in your current limits only after the closure of market hours. The said limits can be used for trading on the next trading day (T+1 day) or for placing overnight orders.

For example, If you conducted trades on August 26th, 2024 where you bought stocks worth 50,000 in Intraday and sold them at 60,000. This means that you have generated a profit of ₹ 10,000 on the trades. Under the revised guidelines, ₹ 10,000 profit will be added in the limits in your trading account after-market hours on 26th August, 2024 and same can be used for trading only on August 27th , 2024 (T+1 day).

What is trigger price? Where can I check trigger price for Intraday position?

Every Intraday position has a Trigger Price, which is calculated based on the difference between initial margin price at which you bought the stock and minimum margin required to hold your position.

If the stock’s Last Traded Price (LTP) drops below the Trigger Price, the system will check if you have any limits allocated to Equity. If sufficient limits are available, the system will first attempt to utilize those limits to maintain the position.

If no additional limits are available, the system will automatically square off part of your Intraday position to match the position as per margin availability.

You can check trigger price on your position through open position page.

Website

-202502271028321340292.jpg)

Watchlist

Mobile App

What happens to my intraday position if the stock hits circuit limits?

Circuits are calculated based on the previous day closing price and have different impact on different positions.

Sell Position:

- For a stock with 20% circuit filter all the Intraday sell positions will be automatically squared off if the price rises by 16% or a percentage set by I-Sec in the event of any market volatility.

- For a stock with 10% circuit filter all the Intraday sell positions will be automatically squared off if the price rises by 7% or a percentage set by I-Sec in the event of any market volatility

- This applies for both F&O and Non-F&O stocks.

Buy Position:

- For a stock with 20% circuit filter all the Intraday buy positions will be automatically squared off if the price falls by 16% or a percentage set by I-Sec in the event of any market volatility.

- For a stock with 10% circuit filter all the Intraday buy positions will be automatically squared off if the price falls by 7% or a percentage set by I-Sec in the event of any market volatility.

- This applies for both F&O and Non-F&O stocks.

Buy position will have no effect during an upper circuit & similarly sell position will have no effect during a lower circuit.

These percentages are set to safeguard customer from losses, that may occur due unavailability of buyer or seller in the market because of circuits.

How To add Margin to my Intraday position?

You can add margin to your Intraday position by selecting the particular underlying on Open position page.

Follow the below path:

Stocks>Open Position>Select the position>Click on 3 dots>Select Add Margin

Watchlist

Positions > Click on 3 dots > Select Add Margin

Once you add margin the trigger price will be revised accordingly.

How are profits on Intraday trading taxed?

Gains from intraday trading are classified as speculative business income under Indian tax law. These gains are taxed according to your income tax slab rate, which ranges from 5% to 30%, depending on your total taxable income.

Unlike long-term investments, intraday trading gains do not benefit from capital gains tax exemptions. It is essential to maintain detailed records of your intraday trades for tax filing purposes and report the gains accurately.

Losses from intraday trading are called speculative business losses and can be carried forward up to four consecutive financial years. The said losses can be set off only against the speculative income and not against the any other income like normal business income or capital gain etc.

Let’s understand with this an example

Here are the income details of a 30-year-old intraday trader:

- Annual Salary = ₹10 lakh

- Income from intraday equity trading for the year = ₹2 lakh [speculative business income]

Given these income tax will be calculated as below

Total taxable income would be calculated by adding all the income heads like Salary and speculative income therefore the total income will be:

Total income = 10,00,000 (Salary) + 2,00,000 (Speculative income)

= 12,00,000

Hence, the trader has to pay income tax on ₹12 lakh. Based on the tax slabs.

When does the intraday position get squared off by system?

Intraday Positions can get squared off under the following conditions

- If the position remains open at the time of market closing. All the Intraday positions get squared off at 3:15 PM.

- All the Intraday positions will be automatically squared off in case of circuit i.e., if the stock price moves by 16% (Stocks with 20% circuit filter) or 7% (Stocks with 10% circuit filter) against your position.

- The position can also get squared off due to Margin shortfall. This occurs when the trigger price of the position is breached.

*These percentages for circuit are set to safeguard customer from losses, that may occur due unavailability of buyer or seller in the market because of circuits.

*While trading in a leverage product its necessary to view the trigger price as if it gets breached, the position may get squared off due to margin shortfall.

To check the trigger price on your position you can view it on the open position page.

In case you wish to lower the trigger price you can add margin to your position from open position page. By clicking on the three dots on the left corner.

-202502271028321340292.jpg)

-202502271029263841578.jpg)

-202502271030144809506.jpg)

What is the brokerage charged for Intraday?

Brokerage for intraday is charged as per your brokerage plan. With our prime 9999 plan the brokerage charged for intraday is as low as 0.007% and with iValue plan you're charged 0.05% or ₹20 which ever is lower.

What time does the intraday day position get squared off?

- Intraday trading is done for a day and the position can be squared off any time the trader wishes to close the position during the day before 3:15 PM.

- In case the position is not squared off or converted to delivery before 3:15 PM, the position will be automatically closed (Squared Off) after 3:15 PM.

- It is suggested to square off your position before 3:00 Pm to avoid system square off.

- If your position gets squared off by system you will be charged Rs. 50 if you are mapped to iValue.

- If you are mapped to Prime Plan no system square off charges will be levied.

Will my Intraday positions get squared off due to margin shortfall? What effect will it have on my position?

Yes, your intraday position can be squared off if there is a margin shortfall. This happens when the trigger price is reached. Every Intraday position has a Trigger Price, which is calculated based on the difference between initial margin price at which you bought the stock and minimum margin required to hold your position.

If the stock’s Last Traded Price (LTP) drops below the Trigger Price, the system will check if you have any limits allocated to Equity If sufficient funds are available, system will first attempt to utilize those funds to maintain the position. If no additional limit is available: The system will automatically square off part of your Intraday position to match the position as per margin availability.

It is important to monitor your Trigger Price and ensure you have adequate margin to avoid automatic position closure. You can also add margins to your position and lower your trigger price in case of buy position and vice versa for sell position.

Let’s understand with an Example:

Trader A buys 1,000 shares at ₹100 each Current Limit 20,000

- Total Position Value: ₹1,00,000

- Margin Used (5x): Trader only needs ₹20,000 to buy the shares.

Breakdown of the Margin:

- Initial Margin = ₹20,000 (Required to initiate the trade)

- Minimum Margin = ₹15,000 (Required to keep your trade open)

- Trigger Price Calculation

(Initial Margin-Minimum Margin)/Qty

= (20000-15000)/1000

= Rs 5

= 100-5 = ₹95

So Trigger price is Rs 95

Now, if the stock price drops to ₹95, the trigger price will be hit, and the Margin left in the account will be ₹15,000.

System Action 1: Check for margin allocation under stocks, if margin of 4000 is available system will pull the margin and continue holding the position. If further margin not available system action 2 will be trigerred.

System Action 2:

The system will adjust your position based on the available ₹15,000.

- Current Position Value:1,000 shares × ₹95 = ₹95,000

- Required Margin (20% of ₹95,000): ₹19,000

- But with ₹15,000 available, you can only hold a position worth ₹75,000.

- Leading to shortfall of Rs.4000

New Position Size:

₹75,000 ÷ ₹95/share = 789 shares

Shares to Square Off = 1,000 – 789 = 211 shares

Final Result:

The system will square off 211 shares to make sure your position is within the available margin. The remaining 789 shares will stay open with revised trigger price of 89.90 for open position.

By what time can the positions be converted to delivery?

- If you want to convert your Intraday position to delivery you can convert it any time before 3:15 PM.

- In case you are mapped to iValue this feature will not be available.

- If you have a sell position you can convert it to delivery if you have the stock in your Demat account. In this case you will be charged Demat Debit charges of Rs.20.