ELSS Tax Benefits and Returns

It is an investment product which encourages savings via equity. You would have heard from your CA, that invest in ELSS for saving tax. So, basically it is tax saving mutual fund product, wherein the investor gets an exposure of both; equity investments and fixed income securities in one fund thereby making it a well-diversified portfolio with good asset allocation.

Now, you might be thinking that, by investing in ELSS how could I save tax? So, under section of 80C of income tax act, we do not have to pay any tax on the amount invested in ELSS. The limit of this deduction is capped to Rs 1,50,000 pa and also there is a lock-in period of 3-years. And any ways, since investment has to be for long term, this lock-in is blessing in disguise.

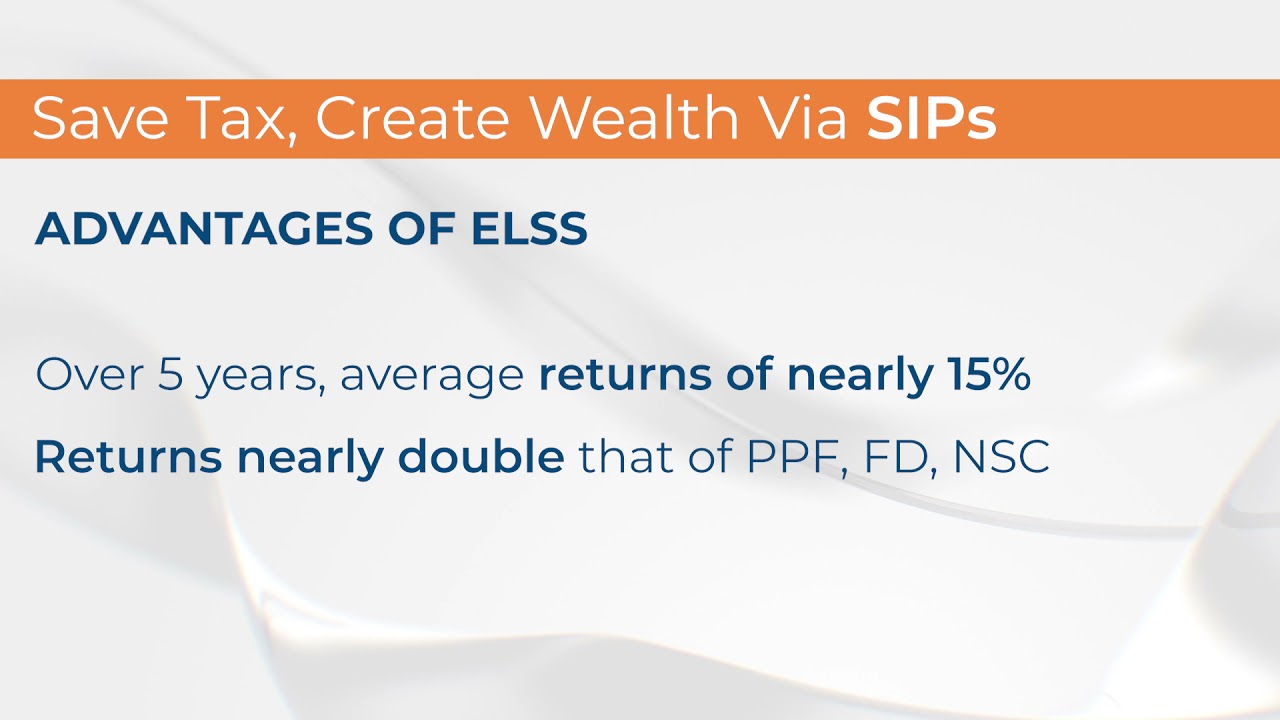

Now, you might be thinking, What about the returns? Well, speaking about the returns, ELSS has given a good 12-15% return pa and considering that it also has tax deduction on the same, then why not go for it. And if we look at a different tax saving investments like PPF, NSC or FD, PPF gives a return around 7-8%, but with a lock-in period of 15-years. NSC on the other hand, gives around 6-7% with the lock-in of 6-years and FD gives a return of around 5% also has a lock-in period of 5-years.

So, here we can conclude, that ELSS is one of the best tax saving investment schemes. And if you are confused whether to invest via lumpsum or SIP, ideally this investment should happen on a monthly SIP basis for better rupee cost averaging.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)