Who is moving crude oil? Recessionary fears or Scarcity

Introduction

Crude oil—Black Gold֫—is also considered the mother of the financial market because of its diverse usage from fuel to petrochemicals to cosmetics. Crude oil finds its usage in fuel for automobiles, trucks, planes, boats, and railways. It is also finding its usage in a wide range of products such as road asphalt, lubricants for various equipment, and plastics for toys, bottles, and food wrapping.

Crude oil contributes greatly to the economic development of the world. In the last 2-years, crude oil price movement had created an uproar in the global financial market in general and the commodity market in particular. Its prices are influenced by the factors such as supply demand, geopolitical tension, weekly oil inventories, trend in international trade, the adverse weather condition in the form of hurricanes in the Gulf of Mexico, etc.

Crude oil prices turned negative in 2020

In April 2020, WTI crude oil futures prices nosedived to its historic levels falling into negative territory because of delivery default by buyers due to lockdown across the globe. The price trend of this product was on rising trend since beginning of 2021 and continued in 2022 as well owing to improved demand following easing of lockdown restrictions after roll out of COVID-19 vaccine across the world.

The crude oil price rally was intensified since February 2022 following the invasion of Ukraine by Russia, which created a supply shock in the growing world oil demand where Russia play a vital role in global oil supply. This attack by Russia resulted in imposition of sanction by the USA and other countries thereby resulting in supply shock.

Global supply demand situation

Let us understand supply demand situation.

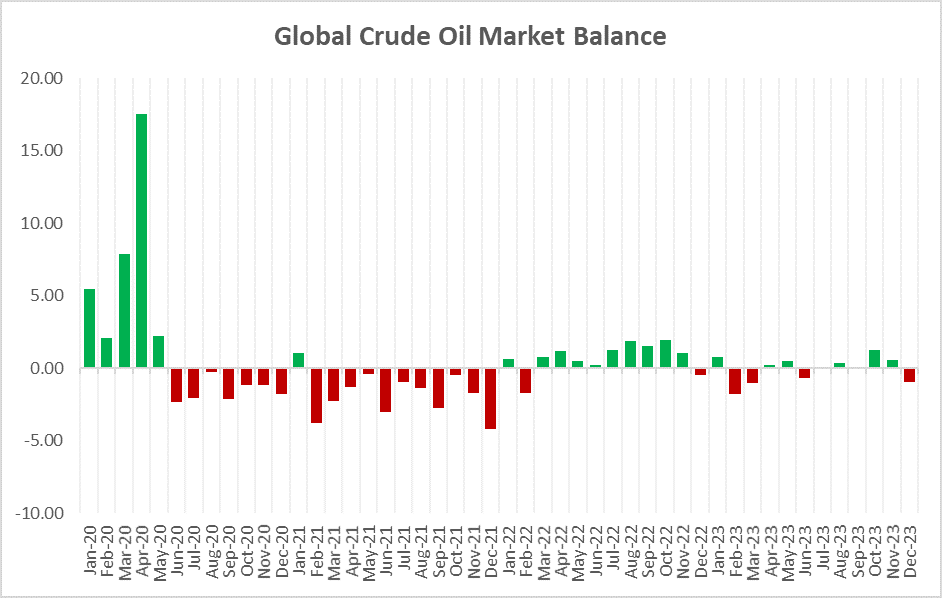

Source: Energy Information Administration

From the above graph, it is clearly seen that the global oil surplus was very high in April 2020 at 17.54 million barrels per day due to above-stated reason of COVID-19. However, this surplus narrowed down in later months and the global oil market was in deficit for rest of 2020 and the same was continued in 2021 due to lower production.

Since beginning of 2022, the global oil market came into marginal surplus where major producers started pumping more oil to meet emerging demand as the global economic activities started picking up. Going forward, the global oil market is expected in marginal surplus as reported by Energy Information Administration.

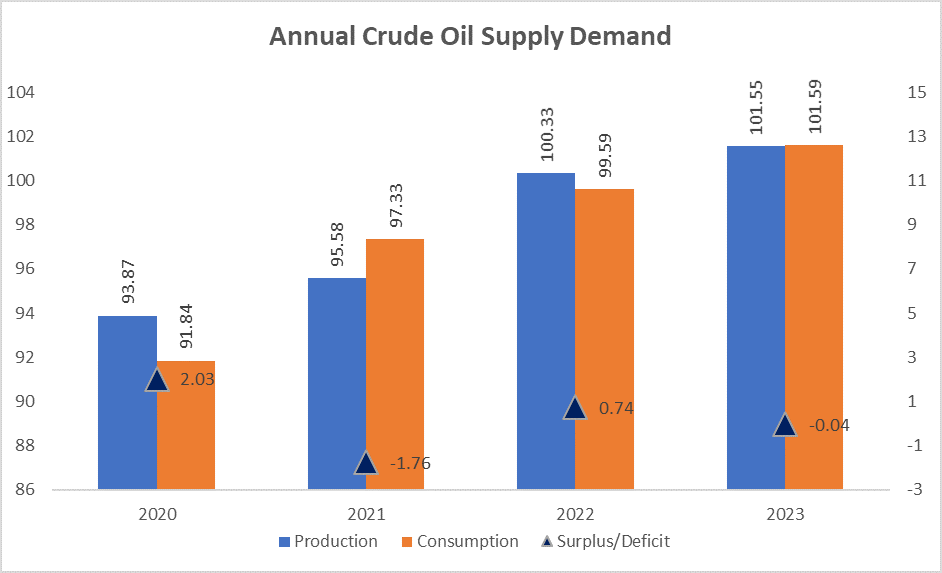

Source: Energy Information Administration

According to projections made by Energy Information Administration, the global oil supply in 2022 would be 100.33 million barrels per day while the consumption would be 99.59 million barrels thereby ending the year 2022 with a surplus of 0.74 million barrels per day.

For remaining part of 2022, the oil supply would be 101.70 million barrels per day while the consumption is expected to be at 100.50 million barrels per day, which would result into a surplus of 1.20 million barrels per day.

EIA made neck-to-neck projection of global oil production and consumption for 2023 at 101.55 million barrels per day and 101.59 million barrels per day, respectively.

Recessionary fears reding global oil demand

The rally in the global commodities in first half of 2022 created a recessionary concern across the globe, which had prompted many central banks to keep on rising their interest rate to stop their country slipping into recession. However, recession fears seem to dampen the market mood, which is in increasing contrast to the supply concerns.

While the global economy looks set to leave inflation and rate scares with bruises and scratches, business activities meaningfully derailed from the ongoing turbulence. The post-pandemic demand resurgence and political restraints are to blame for the current high oil prices.

Hurricane season to impact US oil supply

Apart from macro-economic factors, geopolitical events as well as supply-demand, another factor having a greater impact on crude oil price is the Hurricane season in the United States. According to National Oceanic and Atmospheric Administration (NOAA), the Gulf of Mexico is likely to witness 14-20 storms, 6-10 hurricanes and 3-5 major hurricanes in 2022, which will be further deterrent to global oil supply.

Higher inflation – Cause of concern

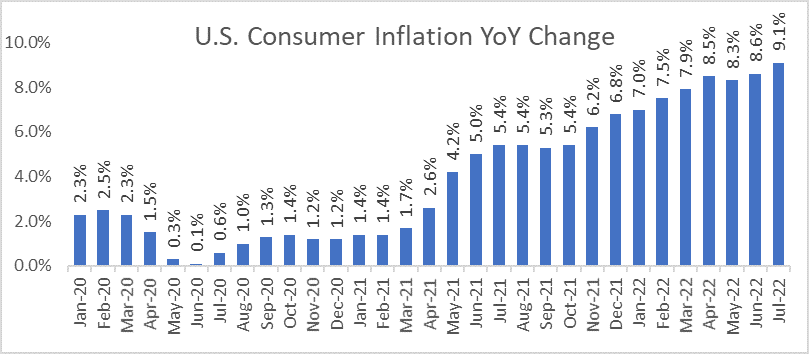

Source: U.S. Bureau of Labour Statistics

The above graph showcases annual growth in the United States consumer inflation, which clearly indicating that the annual inflation is rising led by rise in prices of goods and services post pandemic recovery.

Though the demand started improving the supply for many of the commodities is not yet picked up thereby creating supply demand imbalance. The current CPI is at 4-decade high in the United States, which had prompted the U.S. Federal Reserve to hike their interest rate 4 times this against targeted 3-times throughout 2022.

Conclusion

Given the situation of demand improving drastically and supply remaining stagnant, the oil prices are expected to showcase a volatile trend in rest of 2022. Further, the global oil market is about to witness hurricane season and geopolitical tension is still a cause of concern. It has been a roller coaster ride for the WTI crude oil price as the prices rose to 14-year high in first half of 2022 owing to stronger global demand led by improved economic activities and removal of lockdown across the globe and correcting from those levels to trade near January 2022 levels.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)