Learning Modules Hide

Hide

- Chapter 1: Introduction to the Commodities Market

- Chapter 2: Understand Commodity Market Ecosystem in Detail

- Chapter 3: Understand the Working of Commodity Derivatives

- Chapter 4: Understand the Commodity Indices in Detail

- Chapter 5: Free Commodity Trading Course on Clearing and Settlement Process

- Chapter 6: Learn Risk Management for Commodity Derivatives

- Chapter 7: Understand Gold and Silver Bullion in Detail – Part 1

- Chapter 8: Bullions (Gold and Silver) – Part 2

- Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

- Chapter 10: Understand Crude Oil and Natural Gas in Detail – Part 2

- Chapter 11: Introduction to Base Metals

- Chapter 12: Understand Base Metals Derivatives Trading in India

- Chapter 13: Introduction to Agricultural Commodities

- Chapter 14: Understand the Uses of Commodity Derivatives

- Chapter 15: Learn Non-directional Trading Strategies in Commodities

- Chapter 16: Understand Legal and Regulatory Environment of Commodity Derivatives

Chapter 2: Learn Currency Exchange Rates

The rupee plunged 58 paise to close at an all-time low of 81.67!

The rupee had depreciated by 13 paise to close at ₹82.30!

Rupee falls to record 83.02!

These are the examples of headlines that you often see in the news. But what is the rupee being compared with? Let's understand this concept before diving into currency derivatives.

Currency exchange rates

Currencies are always traded in pairs because you automatically sell or buy another when buying or selling one currency. There is a base currency and a quotation currency in every currency pair – the base currency appears first, and the quotation currency after that. An exchange rate is the cost or price of one currency in terms of another. It is written as

Base currency/Quotation currency = Value

In the USDINR pair, USD is the base currency and INR is the quotation currency. For example, if we are writing USDINR = 80, it means one USD is equivalent to INR80. Similarly, in the EURUSD pair, EUR is the base currency and USD is the quotation currency. If we write EURUSD = 1.07, it means one Euro = 1.07 USD.

Whenever you buy a pair, you expect that this pair's price will go up. For example, suppose you have purchased a USDINR at 80 and expect it to move to 82. In that case, it means you are hoping that one USD will fetch more rupees, i.e., expecting INR to depreciate against USD or expecting USD to appreciate against INR. Thus, when buying a currency pair, you are bullish about the base currency and bearish about the quotation currency.

You can also understand this by currency strengthening (appreciating) or weakening (depreciating) the currency. So, for example, in a USDINR pair, if the base currency (USD) is strengthening, it can fetch more rupees, i.e., one USD can move to, let's say, 82. So when you buy a currency pair, you expect the base currency to strengthen and the quotation currency to weaken in the future.

Bid-Ask price and RBI reference rate

In the market, currency rates are quoted as a bid and ask price, just like a stock price.

|

Currency pair |

Bid price |

Ask price |

|

EUR/USD |

1.0616 |

1.0617 |

|

GBP/USD |

1.2046 |

1.2047 |

|

USD/JPY |

132.8800 |

132.8890 |

|

USD/CHF |

0.9333 |

0.9334 |

|

USD/CAD |

1.3591 |

1.3592 |

|

AUD/USD |

0.6720 |

0.6721 |

|

NZD/USD |

0.6290 |

0.6291 |

|

USD/CNY |

6.9883 |

6.9903 |

|

EUR/GBP |

0.8812 |

0.8813 |

Note: The above rates are only for explanatory purposes.

In the above table, we have taken the spot exchange prices of some popular currency pairs. Let's take the example of the EURUSD pair, where the bid price is 1.0616 and the asking price is 1.0617. So if you want to purchase one Euro, you will pay 1.0617 USD. Similarly, if you sell one Euro, you will get 1.0616 USD. Bid-ask spread is the difference between the bid and ask price.

Usually, the rates are quoted in the market, like EUR/USD = 1.0616/17. For the asking rate, only the last two decimal values are mentioned in the market. Currency prices are quoted up to 4 decimals in the market and a tick value is 0.0005. Tick value is the minimum difference between two bid/quote prices.

RBI reference rate

The news headlines quoted at the beginning of this chapter mention the price of the rupee, but from where this final rate comes? Also, this rate is essential for the currency Futures trades because all settlement happens at this rate.

Financial Benchmark India Pvt Ltd.(FBIL) computes this data as per the RBI website. As per the FBIL website, FBIL calculates and publishes since July 10, 2018, the USD/INR, EURO/INR, GBP/INR and JPY/INR Reference Rates daily on all Mumbai business days at around 13.30 hours. FBIL computes and publishes the USD/INR Reference Rate using the transaction-level data available between 11.30 and 12.30 hours on the electronic trading platforms. A 15-minute random window is selected within the 11.30 and 12.30 hours to compute the USD/INR Reference Rate. Usually, the data are sourced from the electronic platforms of Refinitiv and CCIL. Cross-currency reference rates for INR/ 1 EUR, INR/ 1 GBP and INR/100 JPY are calculated using the EURO/USD, GBP/USD and USD/JPY quotes in the selected 15-minute window.

You can read the complete details here.

Cross currency rates

The cross-currency rate is the exchange rate between two currencies implied by the common third currency.

Let’s understand this with an example. As of December 17, 2022, the following currency reference rates are on the FBIL website.

In the above table, the USD/INR rate is 82.8184 and EUR/INR rate is 88.2629. If we want to calculate the cross-currency rate of USD/EUR, we can calculate it in the following way. Here, INR is the common third currency and we are driving the rate of USD/EUR from USD/INR and EUR/INR rates. The key to calculating the cross rate is that the quotations should be in such a manner that we get the desired result algebraically. We can either multiply the rates or divide the rates. For example, we can calculate the USD/EUR rate by dividing the USD/INR rate by EUR/INR rate. If we have an INR/EUR rate, we can multiply the USD/INR and INR/EUR rate to calculate the USD/EUR rate.

USD/EUR = (USD/INR)/(EUR/INR) = 82.8184/88.2629 = 0.9383 i.e. one USD is equal to 0.9383 EUR.

The cross-currency calculation is useful when you don't have the desired active currency pair.

But what defines the price of these currency pairs? How do these price move up and down? Let's understand the factors that impact the currency exchange rates.

Did You Know?

The value of one USD remained in the range of 4.76 to 4.79 INR from 1950 to 1965.

Source: RBI

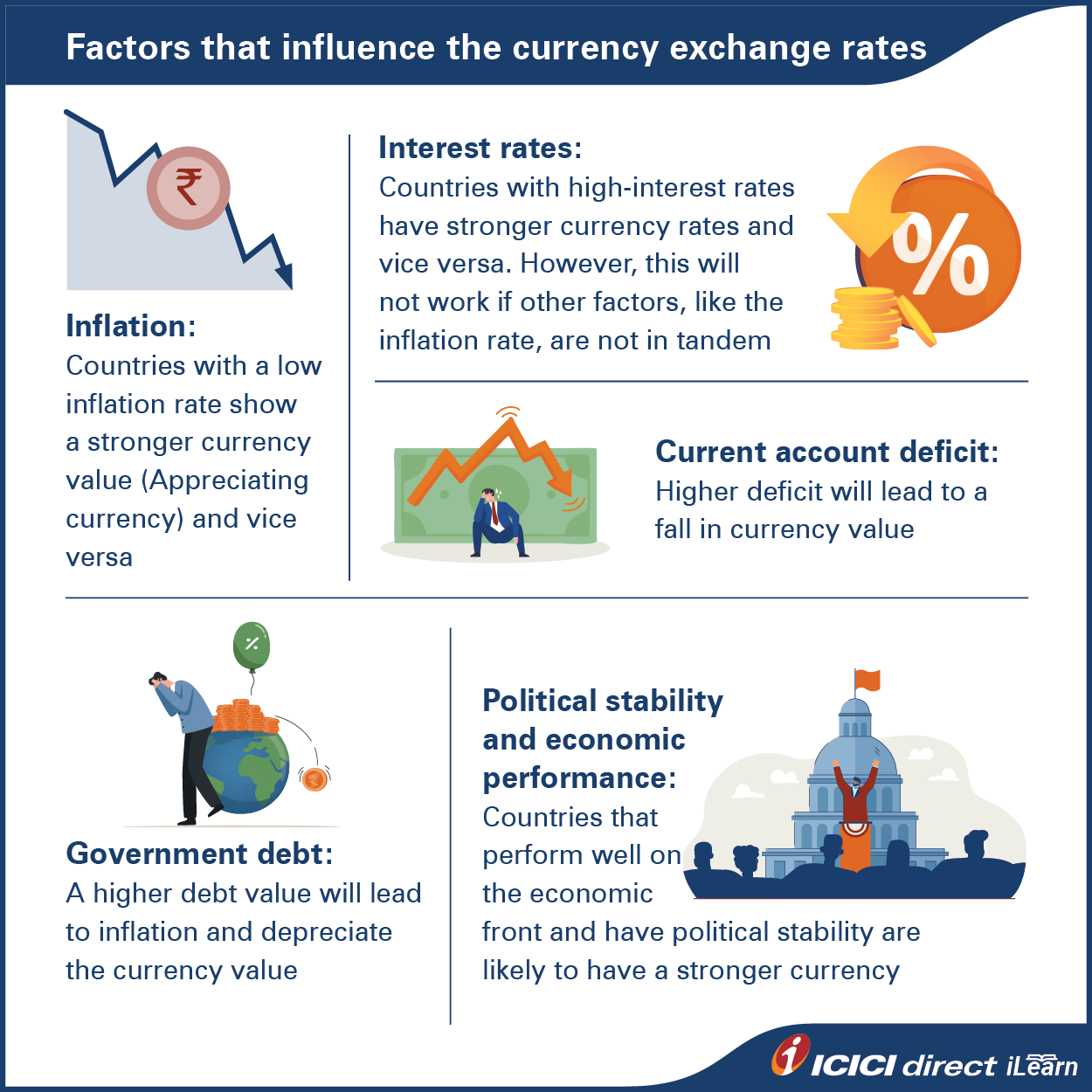

Factors that influence the currency exchange rates

Currency rates are one of the most-watched parameters to analyse the country's economic health. Many factors affect the currency rate of one country with another. Understanding a few of the most common factors that can impact the currency value is essential. A strong currency makes the country's export expensive and imports from foreign countries cheaper. Conversely, the weak currency has an advantage for exports and makes import goods dearer. A higher exchange rate negatively impacts the balance of trade, while a lower exchange rate can be beneficial.

Let us understand a few significant factors which influence the exchange rates:

Inflation

Changes in the inflation rate have an impact on the currency value. Countries with a low inflation rate show a strong currency value, i.e., the currency is appreciating. That's why the prices of goods and services increase at a low rate when inflation is low. Similarly, the countries which have high inflation typically experience depreciation of their currency. High inflation usually leads to high-interest rates.

Interest rates

Interest rates, inflation and exchange rates are highly linked with each other. When a country has high interest rates, it attracts foreign capital as it offers higher returns to investors. Because of this inflow, currency prices start moving upwards. However, the impact of higher interest rates will not work if the inflation is higher in the country or other factors are not in line and driving the currency down. Similarly, if the interest rates are low in the country, the currency rate will exhibit lower currency rates.

Current account deficit

The current account deficit of a country means that the import of goods and services is higher than the export value. If a country's import value is higher, the demand for foreign currency will be more, so domestic currency value will depreciate. The fall in domestic currency will continue until domestic goods become cheap for foreigners and foreign goods become so costly that these will not generate interest in the domestic market.

Government debt

Many countries fund large infrastructure projects in countries that lead to a huge government deficit. These actions can stimulate the domestic economy, but countries with large public debt are not favourable for foreign investment. A higher debt value will lead to inflation and depreciate the currency value. In the worst scenario, the government may need to print more money to pay off the debt. In some cases, the country may start to sell more securities to raise funds to pay off the debts, which will further reduce the price of the securities. Investors are less willing to buy securities of countries with high default risk. That's why the sovereign rating of a country issued by international credit rating agencies like Moody's, Fitch, and S&P is essential for the economy.

Political stability and economic performance

Political stability in a country plays a vital role in a nation's economy. Foreign investors like to invest in countries with political stability and higher economic growth. The countries that perform poorly on the economic front and have political instability like to have a weak currency.

Let us summarise the impact of events on the USD/INR rate.

|

Events likely to impact USD / INR |

General trend for demand / supply of USD |

Impact on USD |

Impact on INR |

|

Increase in imports of India |

Demand for USD increases |

Appreciates |

Depreciates |

|

Increase in exports of India |

Excess inflow of USD into the country |

Depreciates |

Appreciates |

|

Increase in global prices of commodities |

Demand for USD increases due to costlier imports |

Appreciates |

Depreciates |

|

Foreign institutional investors are buying back USD |

Excessive USD outflow |

Appreciates |

Depreciates |

|

RBI is selling USD to meet demand for the Dollar |

Supply of USD increases |

Depreciates |

Appreciates |

|

RBI is buying USD to absorb excess USD due to forex inflows |

Absorption of excess USD liquidity |

Appreciates |

Depreciates |

|

NRI forex remittance is increasing |

Increase in USD inflow |

Depreciates |

Appreciates |

|

Positive trade balance (Exports are greater than imports) |

Increase in USD inflow |

Depreciates |

Appreciates |

Summary

- Currencies are always traded in pairs. Every pair has a base currency and a quotation currency – the base currency appears first, and the quotation currency after that.

- In the market, currency rates are quoted as a bid and ask price, just like a stock price.

- Usually, the rates are quoted in the market, like EUR/USD = 1.0616/17. Only the last two decimal values are mentioned in the market for the ask rate.

- In India, FBIL computes and publishes the USD/INR Reference Rate.

- The cross-currency rate is the exchange rate between two currencies implied by the common third currency.

- A few significant factors influencing the exchange rates are inflation, interest rates, current account deficit, government debt, political stability, etc.

Now you know how to read currency exchange rates and the factors influencing the currency value. In the next chapter, we will discuss currency derivatives.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)