Learning Modules Hide

Hide

- Chapter 1: Introduction to the Commodities Market

- Chapter 2: Understand Commodity Market Ecosystem in Detail

- Chapter 3: Understand the Working of Commodity Derivatives

- Chapter 4: Understand the Commodity Indices in Detail

- Chapter 5: Free Commodity Trading Course on Clearing and Settlement Process

- Chapter 6: Learn Risk Management for Commodity Derivatives

- Chapter 7: Understand Gold and Silver Bullion in Detail – Part 1

- Chapter 8: Bullions (Gold and Silver) – Part 2

- Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

- Chapter 10: Understand Crude Oil and Natural Gas in Detail – Part 2

- Chapter 11: Introduction to Base Metals

- Chapter 12: Understand Base Metals Derivatives Trading in India

- Chapter 13: Introduction to Agricultural Commodities

- Chapter 14: Understand the Uses of Commodity Derivatives

- Chapter 15: Learn Non-directional Trading Strategies in Commodities

- Chapter 16: Understand Legal and Regulatory Environment of Commodity Derivatives

Chapter 3: Learn about Indian Currency Derivatives Market – Part 1

You might have seen the exchange of a rupee for a dollar or vice versa many times at international airports or in the banks. That is the spot market, where one currency can be exchanged with another at the current conversion price. But that price keeps on changing. Have you ever thought about how the importer and exporter manage their cash flow and forex risk when currency value is uncertain? The answer to this is currency derivatives, allowing them to manage their foreign currency transactions efficiently. Let's see the different products and market segments we have for currency.

Currency markets and products

Primarily, the currency market has three segments, spot, OTC and derivatives. Spot currency means where you are dealing on the spot for your currency conversion needs. For example, if you are going abroad and want to carry some foreign currency, you can convert your INR with that country's currency. This is an example of a spot market.

OTC market deals with a forward contract where one party makes a customised contract with another to buy or sell a currency at a fixed price in the future.

Future and Options are commonly used currency instruments in the Indian derivatives market. Futures and Options are derivatives contracts with standard terms and conditions traded on stock exchanges. These contracts don't have any counterparty default risk.

Apart from Futures and Options, swaps are other derivatives instruments in currency. Swaps are generally used to exchange the cash flow of one party for other. So, for example, if an organisation receives a cash flow in dollars, it can exchange it with other currencies at a fixed rate for future cash flow.

Introduction to currency derivatives

Currency derivatives are similar to equity derivatives, but there are a few differences that we will discuss later in this chapter. We assume you have already gone through the derivatives module and can understand the Future and Options.

Just take a quick recap on the Future and Options definition before we dive into the currency derivatives market.

A Futures contract empowers you to buy or sell an underlying asset at an agreed price on a future date.

Call and Put are the two types of Options. A Call Option gives a buyer the right but not the obligation to purchase an underlying asset at the specified strike price by paying a premium. In contrast, the Put provides the right to an Options buyer but not the obligation to sell an underlying asset at a specified strike price by paying the premium.

Similar to equity derivatives, a Currency Derivative is a contract between a buyer & seller agreeing to exchange a particular currency at a fixed price on a future date, similar to equity derivatives. The contract is termed an equity derivative when the underlying asset is stock, like HDFC Bank stock. The contract is termed a currency derivative when the underlying is a currency like the USD-INR.

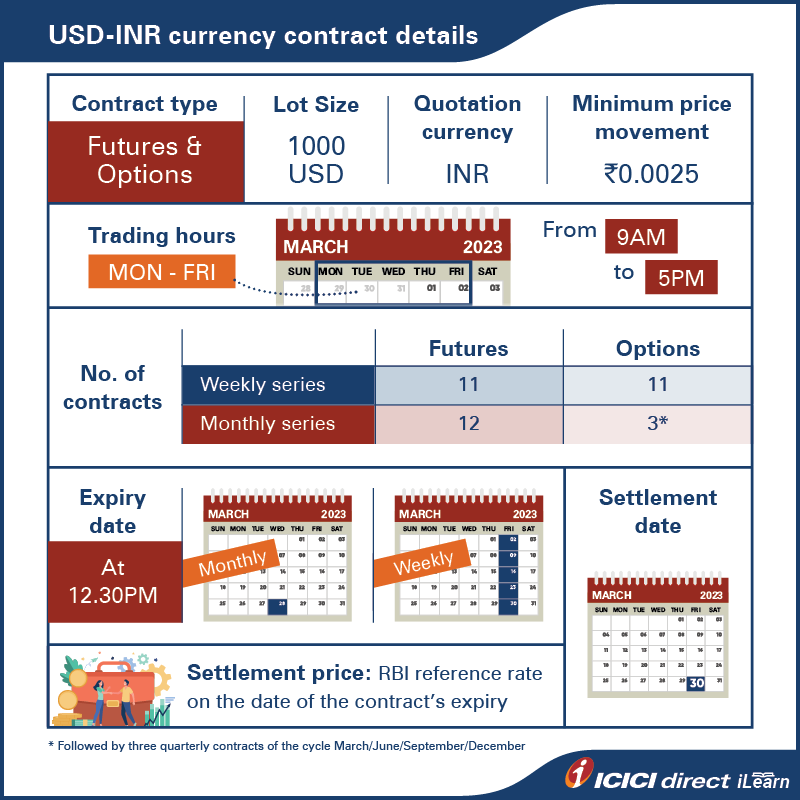

Currency derivatives are also exchange-based and have standardised Futures and Options contracts. Let us understand the contract details and the significant differences between currency and equity derivatives.

Did you know?

CME began trading Futures contracts on several currencies in 1972 on the recommendation of Milton Friedman, the Nobel Prize-winning economist from the University of Chicago. He charged the CME Group about $7,500 for the study, given that FX trading is worth hundreds of millions.

Source: CME Group

Currency pairs available in the Indian market

In equity, derivatives contracts are available in selected stocks and indexes. Several currencies and pairs are available in the global currency market, but at the Indian exchange, only a few currency pairs are traded. NSE launched its currency platform in August 2008 with only Future contracts. Currency Options were later introduced in October 2010.

In India, currency derivative trading is permitted in currency pairs; USDINR (US Dollar - Indian Rupee), EURINR (Euro - Indian Rupee), GBPINR (Great Britain Pound - Indian Rupee) & JPYINR (Japanese Yen - Indian Rupee) and cross currency pair in EURUSD, GBPUSD and USDJPY.

Currency Futures and Options are available on all the above currency and cross-currency pairs.

Currency derivatives specifications in India

Stock exchange and timing

National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) have currency derivatives segments that provide a trading platform for investors in the currency derivative market, like equity and equity derivatives. Metropolitan Stock Exchange (MSE) also provides a trading platform for currency derivatives. No separate demat and trading account is required for currency derivative trading. An investor can trade currency derivatives through an existing trading account with any SEBI-registered broker.

The trading hours on NSE and BSE for currency derivatives are between 9:00 am to 05:00 pm, from Monday to Friday. Trading in cross currency is available from 9:00 am and 7:30 pm. The exchanges may alter the trading hours on any day for any reason that the Exchanges deem fit.

No. of contracts

In currency Futures, 11 weekly series contracts and 12 monthly series contracts are available for all INR currency pairs, while for cross-currency pairs, only monthly series contracts are available. In the currency Option in INR pairs, 11 weekly series contracts and three monthly series contracts followed by three quarterly contracts of the cycle March/June/September/December are available.

For Options in cross-currency pairs, three monthly series contracts, followed by three quarterly contracts for March/June/September/December, are available.

Lot size

The lot size for all currency pair is 1000 quantity except JPYINR, which have a lot size of 100000. This means a minimum of 1000 quantity or in multiple of 1000 is the traded unit for currency derivatives except in JPYINR. As one JPY is equivalent to approx. 0.60 INR, so the price quoted in the market for the JPYINR contract is equal to 100 JPY.

Example: Suppose you want to purchase one lot of USDINR at Rs. 80, then the contract size would be Rs. 80000 (Rs. 80 * 1000 quantity of USD).

|

Currency pair |

Lot size |

|

USDINR |

1000 USD |

|

EURINR |

1000 Euro |

|

GBPINR |

1000 British Pound |

|

JPYINR |

100000 Japanese Yen (The exchange rate quoted for this contract is in Indian Rupees for 100 Japanese Yen) |

|

EURUSD |

1000 Euro |

|

GBPUSD |

1000 GBP |

|

USDJPY |

1000 USD |

Margin in currency derivatives contracts

Currency derivatives also have a requirement of margin like other equity Futures contracts. A trader needs to deposit an initial margin when taking a position and maintain the minimum margin on the open position. However, the margin% is significantly less in comparison to the equity derivatives margin. Usually, initial margins are in the range of 3-5%. These contracts could be held till expiry with daily Mark to Market (MTM) profit or loss adjustment.

Tick size

The minimum price movement of trading instruments is known as the tick size. In the case of INR pairs, it is 25% of one paisa or 0.0025 INR. While in the case of cross-currency pairs, it is equivalent to 0.0001 USD and for the USDJPY pair, it is 0.01 JPY.

Let us understand the tick size for a USD INR pair.

The best buyer in the above price window is available at 83.0375 INR for 1 USD. If you want to be the best bidder, your bid should be at least 0.0025 INR more, i.e., 83.0400 INR. Similarly, currently, the best seller is quoted at 83.0400 and if you want to be a best-seller, you should offer a price of at least 0.0025 INR less, i.e., at 83.0375 INR.

Settlement and expiry

All monthly Futures and Options currency contracts expire two working days before the last business day of the expiry month at 12.30 pm. Weekly Futures and Options contracts expire every Friday at 12.30 pm.

For example, If the last working day of the month is the 30th, the contract will expire on the 28th of the month at 12:30 pm.

The final settlement day for all the contracts is the last working day (excluding Saturdays) of the expiry month and the final settlement price is the RBI reference rate on the date of the contract's expiry. The last working day for these contracts will be the same as for Interbank Settlements in Mumbai. All open positions shall be closed on the last trading day of the contracts at the final settlement price.

All currency derivative contracts are cash-settled, i.e., through the exchange of cash in Indian Rupees. Currency Futures contracts have two types of settlements- the MTM settlement, which happens at the end of each day and the final settlement on the last trading day of the Futures contract. The daily MTM settlement price is the weighted average price of the last half an hour of the trading day on the exchange and accordingly, the daily EOD Mark to Market (MTM) settlement gets completed.

Daily MTM settlements occur on T+1 day; accordingly, the MTM margin gets adjusted (debited/credited). The final settlement takes place on T+2 days from the contract expiry date (last trading day).

Specifications of currency Options contracts

Type of the Option – All the currency Options traded at Indian exchanges are European. It means you cannot exercise your right before the expiry. European Options give the holder the right but not the obligation to buy or sell the underlying instrument only on the expiry date.

No. of strike prices – Strike price is the rate at which you entered into an Option contract. There are 12 ITM (in the money), 12 OTM (out of the money) and one near the ATM (at the money). Call and Put Options are available for trading. The strike price interval for all the INR pairs is 0.25 INR. For cross-currency pairs, the strike price interval is 0.005 USD, except for the USDJPY pair, in which the interval is 0.5 Yen.

ITM Call Options are those where the strike price is less than the spot price. If the spot price is less than the strike price, then the Options are known as OTM Call Options. Similarly, for Put Options, the ITM Put Options strike price is higher than the spot price. For OTM Put Options, the strike price will be less than the spot price. For ATM Call and Put Options, the spot price will be equal to the strike price.

Summary

- Currency derivative trading is permitted in currency pairs; USDINR (US Dollar), EURINR (Euro), GBPINR (Great Britain Pound) & JPYINR (Japanese Yen) and cross currency pairs in EURUSD, GBPUSD and USDJPY.

- The trading hours on NSE and BSE for currency derivatives are between 9:00 am to 05:00 pm, from Monday to Friday. Trading in cross currency is available from 9:00 am and 7:30 pm.

- In currency Futures and Options, weekly and monthly series contracts are available for all INR currency pairs, while for cross-currency pairs, only monthly series contracts are available. In Options, Quarterly series contracts are also available.

- All monthly Futures and Options currency contracts expire two days before the last business day of the expiry month at 12.30 pm, while weekly Futures and Options contracts expire every Friday.

- All currency derivative contracts are cash-settled in Indian Rupees.

Now you know the currency Futures and Options specification; we will cover the payoffs of different derivatives positions in the next chapter.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)