Learning Modules Hide

Hide

- Chapter 1: Introduction to the Commodities Market

- Chapter 2: Understand Commodity Market Ecosystem in Detail

- Chapter 3: Understand the Working of Commodity Derivatives

- Chapter 4: Understand the Commodity Indices in Detail

- Chapter 5: Free Commodity Trading Course on Clearing and Settlement Process

- Chapter 6: Learn Risk Management for Commodity Derivatives

- Chapter 7: Understand Gold and Silver Bullion in Detail – Part 1

- Chapter 8: Bullions (Gold and Silver) – Part 2

- Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

- Chapter 10: Understand Crude Oil and Natural Gas in Detail – Part 2

- Chapter 11: Introduction to Base Metals

- Chapter 12: Understand Base Metals Derivatives Trading in India

- Chapter 13: Introduction to Agricultural Commodities

- Chapter 14: Understand the Uses of Commodity Derivatives

- Chapter 15: Learn Non-directional Trading Strategies in Commodities

- Chapter 16: Understand Legal and Regulatory Environment of Commodity Derivatives

Chapter 4: Learn about Indian Currency Derivatives Market – Part 2

You recently read about USD in a newspaper where they mentioned that the rupee is going to fall further from the current level and in a month, it could be a 5% fall. You are thinking about getting benefits from this news. But how much could you make by a 5% fall, i.e. approximate a fall of 40 paise per dollar, assuming one USD is equal to INR 80? Is it worthwhile to act upon such a small opportunity? If you think of this from a spot market point of view, it may not be an opportunity to look into, but if you want to trade in derivatives, i.e. Futures and Options, then definitely this will be the opportunity one can explore.

Let us understand the currency Futures and Options with an example of the USDINR pair.

Currency Futures and Options example

Example of a Futures contract

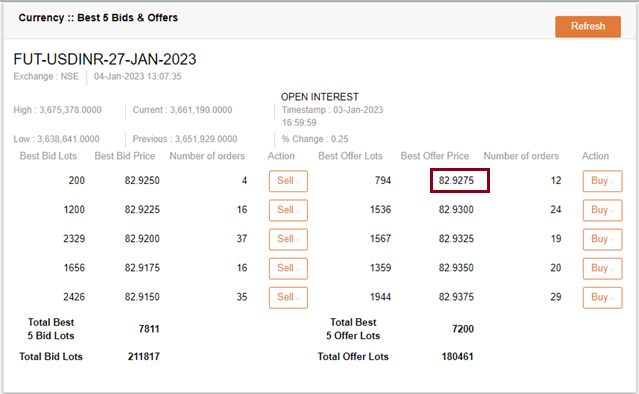

In the USDINR pair, USD is the base currency and INR is the quotation currency. If you are bullish about base currency, i.e. expecting the base currency price to appreciate against the paired currency, you may take a long position and vice versa. For example, suppose you are bullish about the USD and expect USD to appreciate against the INR. Therefore, you have decided to purchase one lot of USDINR Future, i.e., 1000 quantity. You can see in the image below that prices in the currency contracts are quoted up to four decimals and the best price to buy the USDINR contract is 82.9275 on the specified date and time.

First, we will calculate the margin from the ICICIdirect margin calculator. Being a trader in the Futures, we need to pay the margin when placing an order. For example, the margin to purchase one lot (1000 quantity) of USDINR at 82.9275 is Rs. 2487.83. It means you need to deposit this margin with the broker.

This contract will expire on 27 Jan 2023. If USDINR reaches Rs. 84 on expiry, you make a profit of Rs. 1072.5 [1000 * (84 – 82.9275)]

Conversely, if the USDINR price falls to 82, you make a loss of Rs. 927.5 [1000 * (82 – 82.9275)]

Example of a Call Option

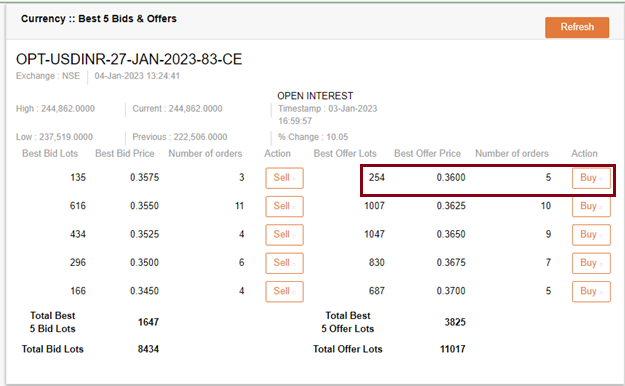

If you are bullish on a base currency, i.e. you expect that base currency will appreciate against the paired currency, you may purchase a Call Option. For example, suppose you are bullish on Dollar and expect the USDINR to touch Rs. 84 soon while the spot price is 82.8275. You have purchased one lot of USDINR Call Option of strike price INR 83 at a premium of 0.3600 with an expiry of 27 Jan 2023. You paid a premium of 1000*0.3600 = Rs. 360 to purchase this Call Option.

If the USDINR contract expired at INR 84, you would receive the amount of 1000 * (84 - 83) = 1000.

The profit, in this case, would be 1000 - 360 = Rs. 640

Conversely, if the price of USDINR doesn’t move as per your expectation and suppose it falls to 82, you will lose only the premium paid, i.e. Rs. 360.

Example of a Put Option

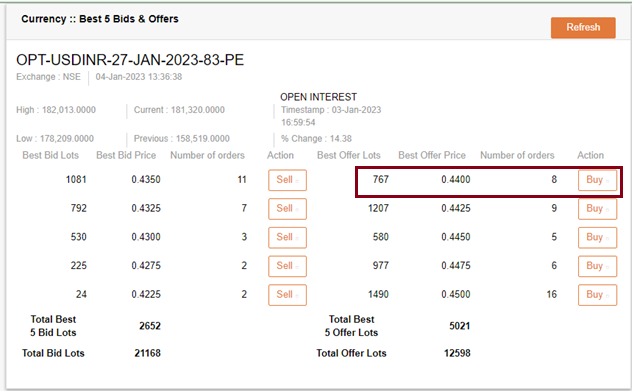

Suppose you are bearish on Dollar and expect that price of the USDINR will touch Rs. 82 soon. You have purchased one lot of USDINR Put Option of strike price INR 83 at a premium of 0.4400 with an expiry of 27 Jan 2023. You paid a premium of 1000 * 0.4400 = Rs. 440 to purchase this Put Option.

If the USDINR contract expired at INR 82, you would receive the amount of 1000 * (83 - 82) = 1000.

The profit, in this case, would be 1000 - 440 = Rs. 560

Did you know?

One famous investor, popularly known as the trader who broke the Bank of England, came to the limelight in 1992. He made a profit of $1 billion after short-selling $10 billion in British pound sterling (GBP).

Conversely, if the price of USDINR doesn't move as per your expectation and suppose it rises to 84, you will lose only the premium paid, i.e. Rs. 440.

Things to remember before taking currency derivatives position

In currency derivatives, before taking a position in any currency pair, you need to keep watch on the different factors that impact the currency rate. These factors could be trade balance, interest rate, inflation, geo-political changes, central banks & government intervention, external borrowing, global & domestic economic situation, international forex market, etc.

While entering into a derivative contract, you also need to check the expiry date, lot sizes, Options strike price, margin requirement, possible MTM margin maintenance, settlement calendar, etc.

Here are a few things you should keep in mind before starting your trading journey:

- A currency's value depends on various macroeconomic factors like interest rate, inflation, etc., so it is better to check fundamentals before taking any position.

- Knowledge is power, especially regarding currency derivatives, and can give you great comfort. However, when looking for information, get into the details and understand the subject deeply.

- Establish a system or set of rules before you set out to trade.

- You should follow your own trading style instead of following someone else's and it should be based on your risk appetite and trading objective.

- Don't allow emotions or ego to come in the way of a sound trading strategy.

- You should decide your entry and exit point before entering the market to gain from the currency fluctuations.

- Take positions in those currency pairs for which you have complete information. Don't switch to other currency pairs unless you check the currency fundamentals.

- Currency derivatives margins are comparatively less and even volatility is also less on most days. But don't try to over-leverage your position because of these things; it would always be better to remain within your limits. Leverage is considered a double edge sword which can multiply your profits and can multiply your losses as well.

- Always choose the right platform for your trades to get regular updates on relevant news and recommendations.

- It is dangerous to be greedy. It could wipe out all the gains you have already made. Once you've made a reasonable profit, look to exit the market.

Summary

- You will prefer to take a long position in Future or buy a Call Option if you are bullish about the base currency. For example, in USDINR, USD is the base currency and INR is the Quotation currency.

- You will prefer to go short on Future or by a Put Option if you are bearish about the base currency.

- Similar to stock or index derivatives, a margin is required for Future positions and premiums need to be paid by Option buyers.

- Future positions are exposed to unlimited profit loss, just like stock derivatives.

- Option buyers can incur a maximum loss to the extent premium is paid, while Option sellers can have unlimited losses.

- Currency traders should have complete information about factors affecting currency prices.

Now you are aware of currency derivatives positions and their respective pay-offs, we will see the use of currency derivatives by hedgers and arbitrageurs in the next chapter.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)