Learning Modules Hide

Hide

- Chapter 1: Introduction to the Commodities Market

- Chapter 2: Understand Commodity Market Ecosystem in Detail

- Chapter 3: Understand the Working of Commodity Derivatives

- Chapter 4: Understand the Commodity Indices in Detail

- Chapter 5: Clearing & Settlement in Commodity Trading

- Chapter 6: Learn Risk Management for Commodity Derivatives

- Chapter 7: Understand Gold and Silver Bullion in Detail – Part 1

- Chapter 8: Bullions (Gold and Silver) – Part 2

- Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

- Chapter 10: Understand Crude Oil and Natural Gas in Detail – Part 2

- Chapter 11: Introduction to Base Metals

- Chapter 12: Understand Base Metals Derivatives Trading in India

- Chapter 13: Introduction to Agricultural Commodities

- Chapter 14: Understand the Uses of Commodity Derivatives

- Chapter 15: Learn Non-directional Trading Strategies in Commodities

- Chapter 16: Understand Legal and Regulatory Environment of Commodity Derivatives

Chapter 6: Learn Risk Management for Commodity Derivatives

Assume that you want to buy a luxurious car. However, there are certain risks to buying a car such as theft, damage, accidents, etc. Would you drop the idea of buying a car because of these risks? No. You may still buy the car and sign up for insurance to cover these risks. Likewise, there are certain risks that may arise in any financial transaction including commodities. In this chapter, you will be studying about the different types of risks and control measures adopted by a regulator, exchanges and member-brokers to reduce such risks.

Risks associated with trading in commodities include:

- Counterparty risk: This risk arises when one party to the contract does not honour the contract and fails to discharge the obligation.

- Market integrity risk: This happens because of price rigging, cartel operations, and cornering of the market to create artificial price rise or fall.

- Operational risk: This may arise due to internal processes, systems, technology, etc.

- Legal risk: Commodity trading is subject to various acts and regulations such as the Essential Commodities Act, FSSAI standards and various tax laws. Any change to these legal aspects will lead to unexpected movement in the commodity market.

- Systemic risk: This may arise when default by one party leads to default of other parties.

However, these risks can be managed efficiently and effectively because of strong risk management policies adopted by exchanges and member brokers.

Position limits and computation of open position

Position limits are fixed at the client and member levels to prevent either from building large buy or sell positions with an intention to manipulate the market to their advantage.

The open position is the amount of a commodity that needs to be squared off before it expires; otherwise, it will be settled either by delivery or cash. The open position limit at the member level is based on the higher open exposure: either buy or sell. If the buy position is 1,500 and sell position is 2,000, then 2,000 is considered the open position. At the client level, the open position is calculated at the net level per commodity. If the buy position is 3,000 and sell position is 3,500, then the open position is considered 500.

Salient features of risk containment measures

Commodity exchanges have implemented a strategy to reduce risks emanating from multiple sources.

Following are important risk containment measures:

- Capital adequacy requirement: Commodity exchanges and SEBI specify capital adequacy and net worth standards for each category of clearing members to ensure smooth functioning.

- Online monitoring: Commodity exchanges have implemented an online monitoring and surveillance system that allows members' exposure to be tracked in real time and notified through alerts.

- Offline surveillance activity: Inspections and investigations are examples of offline surveillance activities used to check members’ degree of compliance with the exchanges’ rules, bye-laws, and regulations.

- Margin requirement: As part of their risk management strategy, commodity exchanges apply need-based margin restrictions. The margin amount may be increased appropriately to discourage traders from engaging in risky and speculative deals.

- Position limits: The exchange sets client and member limitations to avoid concentration risk and market manipulation by a single trading member or group acting in concert.

Margining mechanism

All Futures Contracts of any asset class attract margin from both buyers and sellers. Whenever you want to take a buy or sell position, you are required to pay an initial margin to the exchange through your broker. Whenever you square off your buy or sell position, your margin amount will be released.

You may want to know how the margin is calculated and also understand different types of margins. In the following paragraphs, you will know more about margin mechanisms.

Margining using SPAN

|

Did you know? SPAN margining system was developed by Chicago Mercantile Exchange, and is widely used by most exchanges across the world. |

The margin for taking a buy or sell position is calculated using SPAN (Standard Portfolio Analysis of Risk) which is a scenario-based risk calculation method. SPAN estimates the liquidation value of a position using a set of scenarios that represent market developments. For each contract, there is a collection of scenarios that is updated on a daily basis to reflect current market conditions.

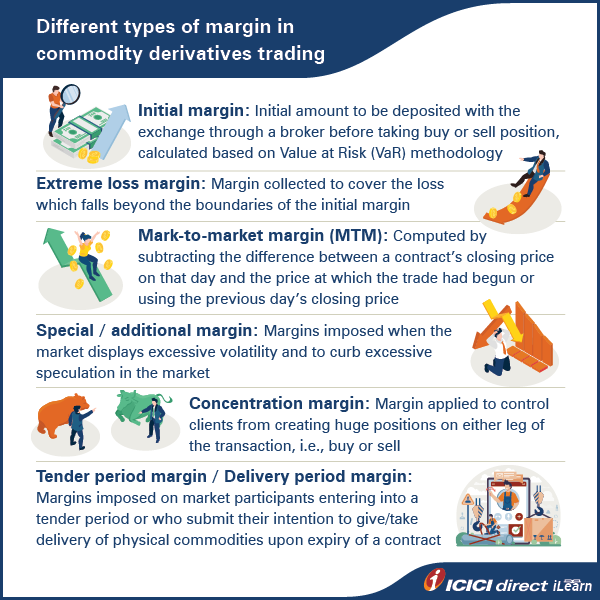

Exchanges collect six types of margins as mentioned below:

- Initial margin

- Extreme loss margin

- Mark-to-market margin

- Special/additional margin

- Concentration margin

- Tender period/delivery margin

Let us understand these different types of margins.

1. Initial margin: While taking any position—buy or sell—in the commodity derivatives market, you need to deposit an initial margin with the exchange through your broker. This margin is decided by exchanges using Value at Risk (VaR) methodology. It is collected upfront before any transaction is made.

Example: If Gold 1 Kg Future contract is trading at Rs. 90,000 per ten grams and the initial margin is fixed at 8%, then you will need to pay a margin as follows: 90,000 * 1000 * 8%/10 = Rs. 7,20,000.

2. Extreme loss margin: This margin is collected by the exchange to manage losses in situations that fall outside the coverage of VaR-based initial margins. The extreme loss margin is collected along with initial margin because of volatility in the commodity derivatives market.

Example: If Gold 1 Kg is trading at Rs. 90,000 per ten grams and the extreme loss margin is fixed at 1.25%, then you will need to pay a margin as follows: 90,000 * 1000 * 1.25%/10 = Rs. 1,12,500.

The total margin payable by you, including the initial margin and extreme loss margin would be Rs. 7,20,000 + Rs. 1,12,500 = Rs. 8,32,500.

3. Mark-to-market margin: On each trading day, Mark-to-market (MTM) margin is computed by subtracting the difference between a contract's closing price on that day and the price at which trade had begun (for new positions taken during the day) or using the previous day's closing price (for carry forward positions from the previous day).

4. Special/Additional margin: These types of margins are imposed when the market displays excessive volatility and, to curb excessive speculation in the market. For example, MCX Nickel prices surged by more than 200% in two trading sessions in March 2022. At that time, the exchange imposed special and additional margins.

|

Did you know? Additional margins are imposed on both buy and sell sides while special margins are imposed only on one side - either buy or sell. |

One side momentum run in Futures prices; rising differences between Futures and Spot prices; large growth in open interest not backed by stocks in warehouses, and client level concentration of open interest on buy or sell sides are the key signs used to determine special and additional margins.

6. Concentration margin: Concentration margin is a great way to charge margin solely to clients that have concentrated contracted open interest on the buy or sell sides compared to overall open interest in a commodity or contract.

7. Tender period margin/Delivery period margin: These margins are collected from those market participants who submit their intention to give/take delivery of physical commodities upon expiry of the contract. This margin is collected to ensure that parties do not default on exchange of commodities between buyers and sellers.

Summary

- There are five different types of risks that could hamper growth of the commodity derivatives market. They are: counterparty risk, market integrity risk, operational risk, legal risk and systemic risk.

- Exchanges have a strong risk containment measure in the form of various types of margins such as initial margin, extreme loss margin, concentration margin, special/additional margin, mark-to-market margin as well as tender period/delivery margin.

- To have a strong control over these risks, exchanges and the regulator have a proper framework to check credibility of market participants as well as surveillance of all trades.

So far, we have understood all about the commodity derivatives market ecosystem and risk management. In the next chapter, you will get an insight into different commodity segments such as bullion, metals and energy.

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Please Enter Email

Thank you.

Track your application

COMMENT (0)