Learning Modules Hide

Hide

- Chapter 1: Introduction to the Commodities Market

- Chapter 2: Understand Commodity Market Ecosystem in Detail

- Chapter 3: Understand the Working of Commodity Derivatives

- Chapter 4: Understand the Commodity Indices in Detail

- Chapter 5: Free Commodity Trading Course on Clearing and Settlement Process

- Chapter 6: Learn Risk Management for Commodity Derivatives

- Chapter 7: Understand Gold and Silver Bullion in Detail – Part 1

- Chapter 8: Bullions (Gold and Silver) – Part 2

- Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

- Chapter 10: Understand Crude Oil and Natural Gas in Detail – Part 2

- Chapter 11: Introduction to Base Metals

- Chapter 12: Understand Base Metals Derivatives Trading in India

- Chapter 13: Introduction to Agricultural Commodities

- Chapter 14: Understand the Uses of Commodity Derivatives

- Chapter 15: Learn Non-directional Trading Strategies in Commodities

- Chapter 16: Understand Legal and Regulatory Environment of Commodity Derivatives

Chapter 9: Understand Crude Oil and Natural Gas in Detail – Part 1

The vehicle you ride every day to office runs on either petrol or diesel, which is processed from crude oil. Likewise, the plastic that is part of your daily life in the form of water/sewage pipes, water in the tank at the top of your house, or the material that you carry in plastic bags, comes from crude oil. The road on which you walk or ride the vehicle is made using tar which comes from crude oil. The petroleum jelly that you apply on your body for protection during winter also comes from crude oil. All personal and beauty care products that you use every day contain crude oil traces in purified form.

Are you stunned by this list?

Yes, crude oil is a multi-faceted product that is an essential part of our daily life.

Let us understand more about this wonder commodity starting with the global oil crisis.

Do you remember that global crude oil prices became negative in 2020? If not, read the following.

Oil crisis of this decade

On 20 April 2020, there was an uproar in the global crude oil market when West Texas Intermediate (WTI) crude oil prices fell into negative territory.

You might be wondering what could have happened to oil prices? Why was the commodity priced in the negative ignoring the cost of its production?

The answer is simple.

The May contract for the commodity was expiring on the next day and there was no demand for crude oil across the globe as 90% of the world was under lockdown to control the spread of COVID-19. Since WTI oil was a deliverable contract at Cushing, Oklahoma and due to lockdown-induced restrictions on oil movement, buyers of contracts were not ready to take delivery of the contract upon expiry. As a result, they were on a selling spree on that day, which had resulted in negative pricing.

Is it the only oil crisis? No, there have been two major oil crises in the world. What were those? Read on.

Historical oil crisis

When we look back at global oil crises, we come across two major crises post World War II. The first oil crisis happened in 1973 when members of the Organisation of Petroleum Exporting Countries (OPEC) decided to quadruple oil prices to almost $12 a barrel. Further, they also prohibited export of oil to the United States, Japan, and western Europe, which were consuming more than half of the world’s oil.

Why was this decision taken by the OPEC?

This decision was taken in retaliation of western support to Israel against Egypt and Syria during the Yom Kippur War in 1973 and also in response to the devaluing of the US dollar which was eroding export earnings of OPEC members.

The world witnessed another oil crisis in 1979 following an Iranian revolt where high levels of social unrest damaged the Iranian oil industry. This revolt resulted in heavy loss of output thereby resulting in a sharp rise in prices. This crisis intensified with an outbreak of the Iran-Iraq war, which added further instability in the region.

The three historical events mentioned here reveal the importance of crude oil in any economy. As it is rightly noted, crude oil is essential for smooth functioning of the global economic engine. Hence, it is popularly called Black Gold.

Having understood the importance of crude oil, let us deep dive into different types of crude oil, major producers, and other relevant factors.

Crude oil is naturally available and is a flammable liquid found in rock formations in the earth. It finds its usage in fuel for automobiles, trucks, planes, boats, and railways. Crude oil also creates various products such as bitumen, lubricating oils, fuel oil, diesel, paraffin, naphtha, and gasoline when it is distilled at different temperatures.

Types of crude oil

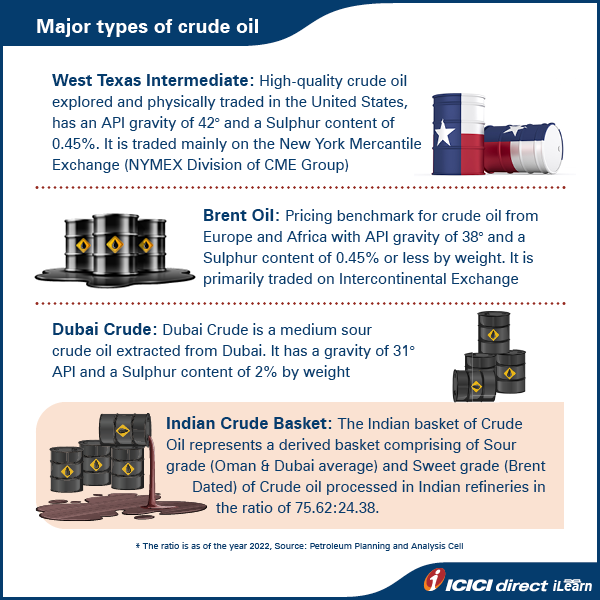

There are two factors that determine the market value of a specific grade of crude oil.

They are:

1) Density, measured in American Petroleum Institute (API) gravity and

|

Did you know? There are 160 types of crude oil grades and of these, three grades are more important: West Texas Intermediate (WTI), Brent, and Dubai Crude. |

2) Sulphur content

|

Did you know? Indian Basket (IB), also known as Indian Crude Basket, is the weighted average of Dubai and Oman (sour) and the Brent Crude (sweet) crude oil prices. It is used as an indicator of the price of crude imports in India. The Government of India watches the index when examining domestic price issues. |

Who are the major producers of crude oil?

The United States and OPEC+ (13 OPEC members + Russia) control global oil market supplies. The Middle East has most of the world's oil reserves, amounting to 64.5% of the OPEC total. OPEC accounts for 79.4% of proven oil reserves, and exports 60% of the petroleum traded worldwide, followed by North America, Africa, Central and South America, Asia, and Europe.

India is the third largest consumer of crude oil in the world after the United States and China. It consumes approximately 4.4 million barrels per day which is 4.6% of global oil consumption. In India, crude oil reserves are very low. Hence, the nation depends on imports from major oil producing nations.

Crude oil supply chain

Crude oil price v/s. Dollar

Crude oil price carries a direct correlation with the US dollar because oil is priced in dollar terms. Whenever the dollar strengthens against major currencies, the price of crude oil also rises and vice versa, assuming other price driving factors remain constant.

Other factors affecting crude oil price movement:

- Supply demand dynamics from the United States and OPEC

- Changing scenarios in oil demand from emerging and developing countries

- Economic factors such as industrial growth, global financial crisis, usage of renewable energy sources

- Weather patterns – Extreme weather conditions or natural disasters like the hurricane season in the US which disturbs oil production

- US crude oil production, export, import, inventories, refinery utilisation rate, rig count, etc.

- Geopolitical events like regional political tensions, wars etc.

Summary

- Crude oil is considered as the engine of global economic growth as it is a very essential commodity for carrying out economic activities.

- So far, we have witnessed three global oil crises: one in 1973, another in 1979 and the latest one in 2020 when WTI oil prices fell into negative territory.

- Crude oil has multiple products and by-products such as fuel, lubricating oil, bitumen, naphtha, when it is processed at different temperatures.

- India is the largest consumer of crude oil in the world after United States and China.

- The United States and OPEC + (13 members of OPEC + Russia) control more than 2/3rd of global oil supply.

- Oil prices are impacted by factors such as supply-demand, geopolitical issues, political stability, growth in the global economy, etc.

Now that you're excited about crude oil, let's look at the natural gas and derivatives of the energy segment in the next chapter.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)