STOCK SPLIT IN DR. REDDY'S LABORATORIES LTD.

-202410161250516347389.jpg)

Dr. Reddy’s Laboratories Ltd. has fixed a record Date of October 28,2024 for the purpose of stock split in the ratio 5:1. The ex-date being October 28,2024.

What is adjustment factor in Dr. Reddy’s Laboratories Ltd?

Adjustment factor for Stock split of A: B is defined as (A/B).

In the case of DR. REDDY’S LABORATORIES LTD, the adjustment factor is (5/1) = 5, since the split ratio is 5:1.

What will be the new Strike price & lot size for Options?

Strike Price: The adjusted strike price will be arrived at by dividing the old strike price by the adjustment factor i.e., 5.

For instance, the new strike price for 6700 = 6700/5 = 1340

Lot Size: The adjusted lot size will be arrived at by multiplying the old market lot by the adjustment factor.

Old lot size=125

Adjustment factor = 5

New lot size = 125*5=625

How price is calculated?

If you have a long / short call option position in Dr. Reddy's

|

Adjustments |

Formula |

Example |

|

Strike Price |

New Strike Price = Old Strike Price/ 5 |

Old strike price = 5000 New strike price = 1000 |

|

Lot Size |

New lot size = Old lot size * 5 |

Old lot size = 125 New lot size = 625 |

|

Option Premium |

New premium= Old premium/5 |

Old premium = 100 New premium = 20 |

Contract Value Before Split:

Suppose you had 1 call option with a strike price of ₹5,000, and the lot size was 100 shares. The total contract value would be:

Contract Value = Lot Size *Strike Price = 100 *5000 = ₹5,00,000

Contract Value After Split:

After the stock split, the strike price is ₹1,000, and the new lot size is 500 shares. The new contract value would be:

New Contract Value = New Lot Size *New Strike Price = 500 *1000 = ₹5,00,000

So, Contract value is not affected.

Key consideration

The adjustments ensure that while individual elements (strike price, lot size, and premium) change, the total position value remains unchanged. Your short position will still reflect the same overall liability, but the numbers will be adjusted proportionately to account for the split.

Same goes for the future contracts, there’s no change in your overall exposure or margin requirement. The price decreases and the lot size increase, keeping the contract value constant.

What is the new price for future contracts?

You can calculate the same as follow

= (Closing price / 5) *New lot size

Will the open interest change after the stock split, and how is it adjusted?

The open interest in terms of the number of contracts or lots held remains the same, but the actual number of shares in each contract changes. So, while the contract count doesn't change, the shares per contract do, ensuring the overall position value is unaffected.

What happens to my futures positions when a stock split occurs?

The futures contract price will be adjusted in the same manner as the stock price (divided by 5 in this case). The lot size will increase by a factor of 5. This ensures the overall value of the position remains unchanged post-split. For example, if you hold a futures contract on 100 shares at ₹5,000, it will become 500 shares at ₹1,000 each.

Is there any change in margin requirements due to the stock split?

Typically, the margin requirements are adjusted to reflect the new lot size and contract price. Since the value of the position remains the same, there is no significant change in the total margin required. However, brokers may notify any minor adjustments for operational purposes.

What is the margin required for revised DR. REDDY’S LABORATORIES LTD contracts?

Margin will be as per the exchange rule of SPAN + ELM

How do F&O expiries get adjusted after a stock split?

The expiry dates of F&O contracts remain the same; only the price and lot size adjustments take place. No changes are made to the expiry or contract duration due to the split.

Can I carry over my existing F&O positions post-split, or do I need to take any action?

Yes, you can carry over your existing F&O positions post-split. The exchange automatically adjusts the strike price, lot size, and contract terms, so you don’t need to take any specific action. However, it’s essential to monitor any notifications from your broker or the exchange for smooth handling of the adjustment.

How my physical settlement works under stock spilt?

If one has gone long in stock option and as on effective date i.e., 28th October, 2024, the customer’s needs to bring 25% of Var + ELM as per the rules, the margin requirement will be as per the contract value that is unchanged.

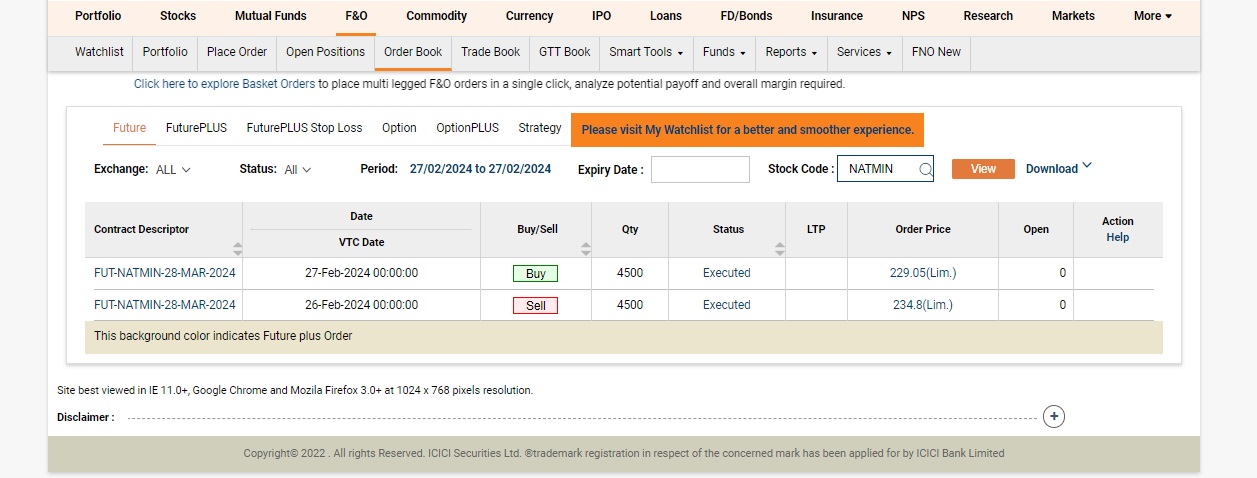

How one can check corporate action while having an open position?

It is shown in order book in offline mode. The changes will reflect before the execution date i.e, 26th October,2024 on F&O open positions.

Will it impact my profit / losses?

No, it does not affect your profit and losses as the contract value remains unchanged.

Only strike prices, lot size and premium will be adjusted accordingly.

What will be the impact on portfolio?

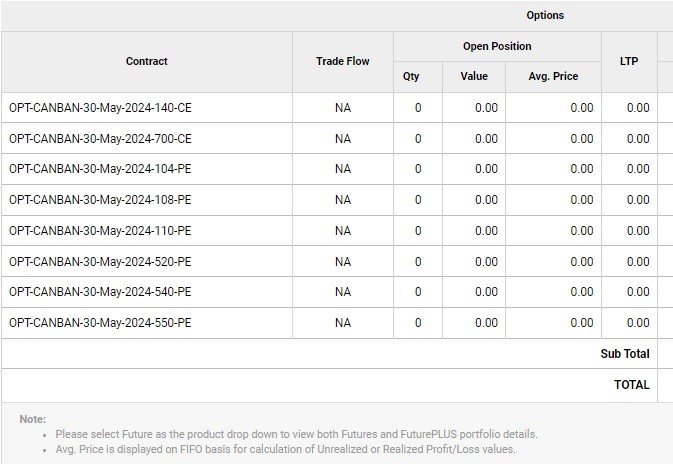

The portfolio will show the following transactions.

Adjustments in portfolio are shown as below:

For Example - 550-PE, 540-PE, 520-PE strikes is valued at 110-PE, 108-PE, 104-PE respectively as shown above in portfolio details.

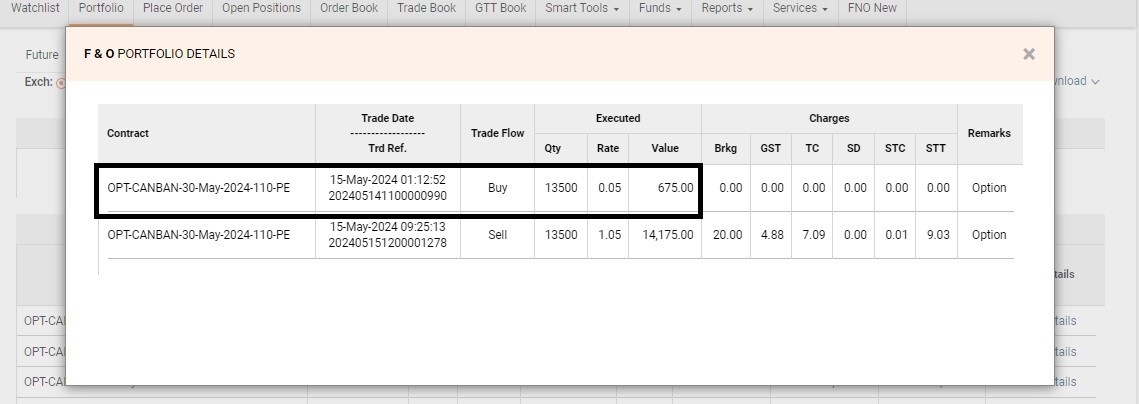

Transactions will show the price adjustment at ₹0.05 with adjusted strike price with adjusted lot size as shown below:

Overall Trading impact on 28th October,2024

|

Adjustments |

Formula |

Example |

|

Strike Price |

New Strike Price = Old Strike Price/ 5 |

Old strike price = 5000 New strike price = 1000 |

|

Lot Size |

New lot size = Old lot size * 5 |

Old lot size = 125 New lot size = 625 |

|

Option Premium |

New premium= Old premium/5 |

Old premium = 100 New premium = 20 |

Your total position value is unaffected by the split; it's just the numerical parameters (strike price, lot size, and premium) that are adjusted accordingly. One can exit its position partially as the number of lot size is increased.

In summary, the stock split only adjusts the numerical values of strike prices, lot sizes, and premiums while keeping the overall value of F&O positions unchanged.

It is advisable to monitor F&O positions in DR. REDDY’S LABORATORIES LTD and take timely action.

Top Mutual Funds

Top Mutual Funds