Why Liquidity Matters to an Options Trader?

Presently, there are 3 indices (Nifty, Banknifty and Nifty Financial Services) and 180 eligible stocks in F&O segments for the investor to trade. Each of the scrips is having its own lot size (Contract size) which is set by the NSE from time to time depending on the price its trading in the market. For example; the Nifty has a lot size of 50, Banknifty -25, ACC Limited – 500, ITC -3200, TATASTEEL – 850 etc. you can find the full list of the F&O stocks with its lot size here.

The reason I have given you the above background of the list of F&O stocks because its lot size will give you the idea of how much you are going to make or lose money while trading options. But before getting into the nitty-gritty of the trading strategy, I would like to explain you the concept of Bid-Ask spread.

Bid-Ask spread is the difference between the bid(buyer) price and the ask (seller or offer) price.

For example:

- Bid 12 – 15 Ask: The difference between the spread here is Rs 3.

- Bid 10.50-10.60 Ask: The difference between the spread here is only 0.10 paise.

So why one stock is having Rs.3 difference and other having only 0.10 paise difference? The primary reason lies in the liquidity. The stocks that are trading with lot of demand (high volumes) in the market are called high liquid stocks whereas the ones that are unpopular and doesn’t have much demand (low volumes) in the market are low liquid stocks. High liquid stocks are having tighter spreads or the difference between bid/ask is very small while the low liquid stocks are having wider spreads meaning bid/ask spread is very high similar to example 1.

Now why this matters to an options trader?

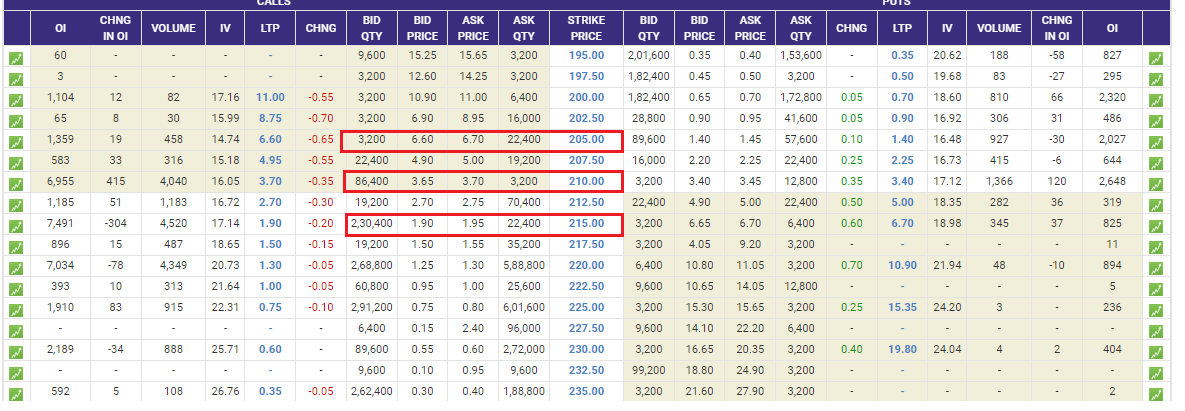

Option trading involve multi-leg strategies for various views in the market. Options trader has to follow minimum steps to successfully deploy the strategies. Let me explain these with an example: Let’s say you are having market neutral view and you are interested in deploying Long Butterfly Strategy on the Call side. For this particular example I have selected a very high liquid stock ITC having a lot size of 3200.The Current Market Price is Rs.209 and the strikes selected as per option chain below:

Step1: Buy 1 x ITM Calls @6.7 (the 205 Strike has spread of 0.10)

Step 2: Sell 2 x ATM Calls @3.65 (the 210 strike has a spread of 0.05)

Step 3: Buy 1 x OTM Calls @1.95 (the 215 strike has a spread of 0.05)

After executing the above legs, the cost of spread I have paid in each leg is

1*3200 *0.10 = 320

2*3200*0.05 = 320

1*3200*0.05 = 160

Total = 320+320+160 = Rs.900

If you try to enter such strategies by executing one leg at a time then there is high chance that you end up having slippages and the cost will be way more than 900. To avoid slippages, you can deploy the above strategy by using of ICICIdirect Basket order feature to place multi-leg options strategies in a single click. Click Basket Order to learn more about this cool feature.

I would like to explain you based on couple of scenarios to give you more insight on why the granular details of trading matters.

Scenario1: Assuming the price of the underlying after 3days remains more or less the same and I want to get out of this strategy. The bid/ask will have similar spread while closing the above position and I will have to bear the cost of spread of Rs. 900 again. Thus in total I have already assumed the cost of Rs.1800 for this particular strategy just by entering and exiting the strategy one time. This means that I have to first make profit equivalent to the cost (cost of spread + cost of brokerage + taxes) to breakeven.

Scenario 2: Let’s assume, if the market has moved significantly on the up side and I have left the existing position till the expiry day and all three legs of the trade has now become ITM strikes. It has been observed that the deep ITM strikes near expiry dates have wide spreads as the liquidity in those strike is low due to less open interest from the investors. On the other hand, in NSE there is a concept of physical delivery of stocks at the end of settlement period, thus many investors are forced to exit their strategy before expiry by bearing higher cost of spread. The overall cost could go in excess of 3000.

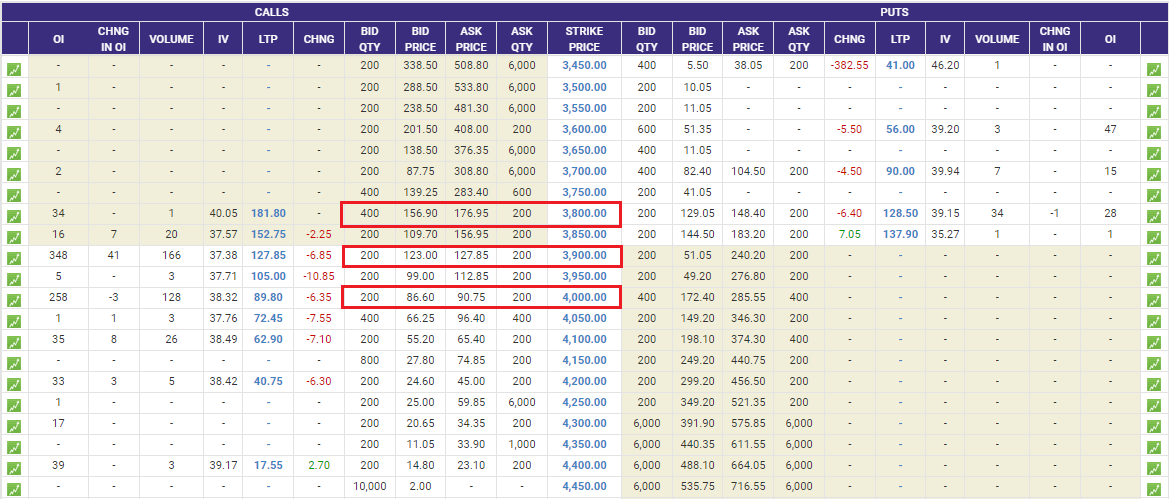

Let me take another example for the less liquid Stock – ALKEM Laboratories having a lot size of 200. The strikes selected from the options chain is as given below. I would like to deploy similar Butterfly spread as per previous example. Current Market Price for ALKEM is 3880.

Step1: Buy 1 x ITM Call @176.95 (the 3800 Strike has spread of 176.95-156.90 = 20.05)

Step 2: Sell 2 x ATM Call @123 (the 3900 strike has a spread of 127.85-123=4.85)

Step 3: Buy 1 x OTM Call @90.75 (the 4000 strike has a spread of 90.75-86.60=4.15)

After executing the above legs, the cost of spread I have paid in each leg would be:

1*200 *20.05 = 6416

2*200*4.85 = 1940

1*200*4.15 = 830

Total = 6416+1940+830 = Rs.9186

The Rs.9186 is based on the fact that the investors buys at Ask price and sells at Bid price which is the worst price an investor can get. The irony is these are called as best Bid/Ask prices. But let’s be reasonable and optimistic here. Thus, I have considered the executed price for each of the leg somewhere in the middle of the bid/ask spread. Then my cost of trades would be around Rs.4593. When we compare this number with the high liquid stock ITC, the cost of spread is over 5 times. If I consider the round trip including exiting the position with similar spread the total cost would be in excess of 9186 including the cost of brokerage, taxes etc. I need to first make a profit more than 9186 to breakeven.

Most advanced traders who have just graduated from being the naked option buyers/sellers to deploying the multi-leg strategies learn this lesson the hard way by making series of losses. One needs to be very careful while selecting strikes as the liquidity in odd strikes is very low as compared to the even strikes. For example, in Nifty, odd strikes are 16050, 16150 while even strikes are 16100, 16200 etc. Advantage of trading in even strikes is that a trader can scalp in and out of the trades very frequently due to high liquidity.

To sum up, I believe the above two example of high liquid and low liquid stocks will help the option traders to re-evaluate their approach to trading and choose their stocks wisely to keep profiting in this trading game.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)