Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 2: Futures and Forwards: Know the basics – Part 1

Derivatives is an umbrella term for a financial instrument that derives value from an underlying asset. There are different kinds of derivative products. The four major types are:

- Futures

- Forwards

- Options

- Swaps

In this chapter, we will look at the basics of Futures and Forwards contracts.

The basics

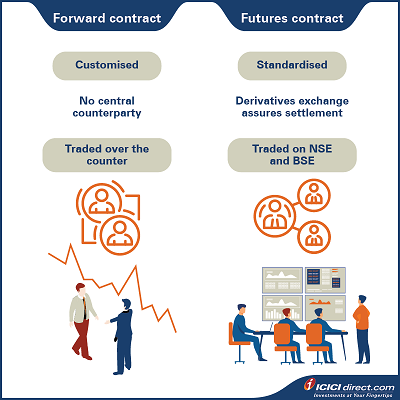

In a Futures contract, the buyer and the seller agree to buy and sell a specific amount of an underlying asset at a future date at a particular price. The derivatives exchange guarantees the settling of the contract upon expiry.

On the other hand, a Forward contract is a customised contract (OTC) where buyers and sellers decide the contract specifications. There is no central counterparty between the two.

Let’s put it in another way: A Futures contract is like a standardised Forward contract.

Forward contract example

Seema runs a large factory that manufactures tomato sauce. To keep the operations running efficiently and profitably, Seema needs to buy large quantities of tomatoes at fair rates. Her constant worry is that the price of tomatoes will rise. Such an increase would push up the factory's raw material costs and reduce its profit margins.

On the other hand, there’s Anant, an organic farmer, who regularly supplies high-quality tomatoes to sauce factories. Anant’s target is to sell his produce on time and at a profit. Once harvested, he needs to sell them off quick. Otherwise, they might spoil. He also has to keep an eye on the market price of tomatoes. If the price declines, Anant’s profits would drop as well.

Seema is worried that price of tomatoes will rise and Anant is nervous that the price will fall. To protect their bottom-lines, both parties enter into a Forward contract with the following terms:

‘Anant (the seller in the contract) agrees to supply Seema (the buyer in the contract) with 10,000 kg of tomatoes of a certain grade at the fixed price of Rs 10/kg in two months.’

This seems like a typical business contract. But to understand how it is a derivative, let’s ask two questions:

- Why do they need this particular contract?

- Can’t they buy and sell tomatoes in the open market?

The simple answer is this: Both parties want to fix the price in advance to avoid losing money if price of tomatoes fluctuates.

Take a look at how things stand for both parties with a Forward contract:

- Seema: As a producer of tomato sauce, Seema cannot change the price of her product every time tomato prices go up. If the price of tomatoes does rise, Seema’s profit margin could decline.

- Anant: Anant incurs individual costs while farming. If the market price of tomatoes declines, he might not recover those costs and his profit margins would reduce as well.

Now, consider their reasons for entering into a Forward contract:

- Seema: Seema is worried that the price of tomatoes will move upwards. She wants to secure a steady supply for the future at today’s low prices.

- Anant: Anant fears that the price of tomatoes will fall. He wants to secure trade at the current prices to lock in his profits.

Point to remember

Each party of the contract should have the opposite view. If both parties expect prices to move in the same direction, they will not enter into a contract.

Profit and loss scenarios for Seema and Anant

How will Seema and Anant fare if tomato prices rise, fall, or remain unchanged? Let’s find out.

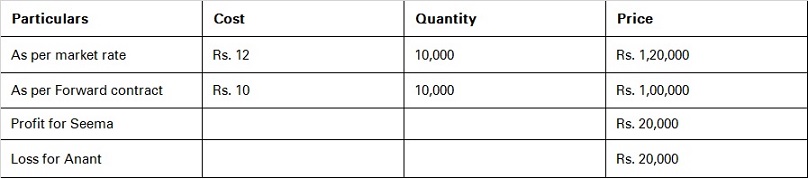

- Scenario 1: Tomato prices close at Rs 12/kg after two months

Great news for Seema! Thanks to the terms of the Forward contract, she can buy tomatoes at Rs 10/kg. That is Rs 2/kg lower than the market rate at the time of expiry. She will end up saving Rs 20,000 on 10,000 kgs of tomato.

On the other hand, Anant will have to sell tomatoes at Rs 2/kg less than the market rates. He will lose Rs 20,000 on the transaction.

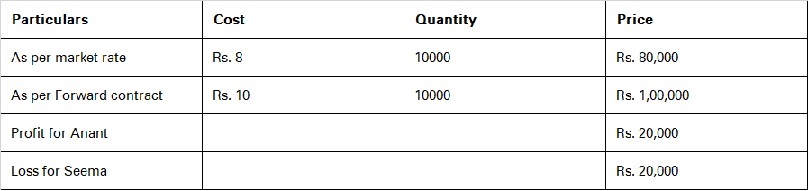

Scenario 2: Tomato prices close at Rs 8/kg after two months

Here, the tables are turned. Anant will profit! By selling 10,000 kgs of tomatoes to Seema at Rs 10/kg, he earns more than the prevailing market rate. He gains Rs 20,000 through the transaction.

Seema loses out in this scenario. She pays Rs 2/kg more than the market rate, thus losing Rs 20,000 on the Forward contract.

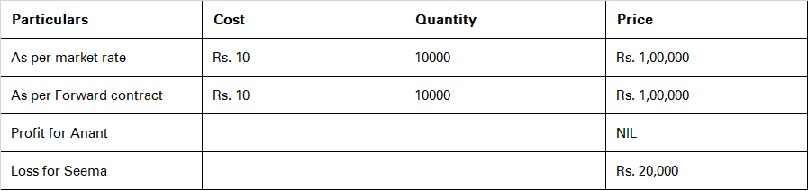

- Scenario 3: Tomato prices close at Rs 10/kg after two months

Since both parties transact at the market price, neither earns nor loses any money. If the market price and the contract price are identical on the expiry date, there is no gain or loss for either party.

Settlement of Forward contracts

There are two ways to settle a Forward contract: via physical delivery of the underlying asset or through a cash settlement.

-

Physical settlement:

In the example above, Anant delivers 10,000 kg of tomatoes to Seema at Rs 10/kg upon expiry of the contract. That is the preferred method of settlement for traders and consumers of the underlying goods.

-

Cash settlement

Only the profit or loss on the derivative transaction is transferred from one party to another. Traders who neither produce nor consume the underlying asset prefer cash settlements. Their goal is to profit from fluctuations in the price of the asset.

For instance, if Seema and Anant had agreed on a cash settlement, this is what would have happened:

- In scenario 1, Anant would have had to pay Rs. 20,000 to Seema.

- In scenario 2, Seema would have had to pay Rs. 20,000 to Anant.

- In scenario 3, where neither profit from the contract, no transaction would take place and the contract would end.

Risk assessment with pay-off graphs

A pay-off graph illustrates the profit or loss based on the changing price of the underlying asset.

The graph usually looks like this:

- The X-axis represents the spot price. Spot price is the current or prevailing market price of the underlying asset that can be bought or sold for immediate delivery.

- The Y-axis depicts the profit or loss.

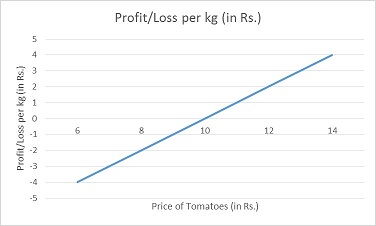

a) Pay-off graph for Seema (buyer)

Based on the graph, you can see that as the spot price increases, the Forwards contract will be beneficial for Seema. It will be a loss for Anant.

If the price of tomatoes increases, Seema earns a profit. If the price dips, she incurs a loss. The breakeven point—where there is no profit or loss—is Rs 10/kg.

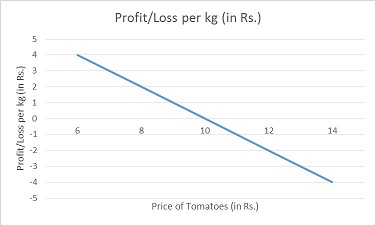

b) Pay-off graph for Anant (seller)

Here, as you can see, when the spot price is lower than the Forwards price, the contract will be beneficial for Anant.

|

Did you know? Pay-off graphs are also known as risk graphs. They represent the risk you face from a derivative transaction. |

If the price of tomatoes decreases, Anant earns a profit. If the price rises, he incurs a loss. The breakeven point for Anant is Rs 10/kg.

Summary :

- In both contracts — Futures and Forward, there is an agreement made by two parties that consists of the buyer and seller to purchase and sell the asset by a certain date at a specific price.

- There are two ways to settle a Forward contract — physical settlement and cash settlement.

- A payoff diagram is important as it helps to assess the risk of your position in one glance.

This ends part one of the Futures and Forwards chapter. In part two of Futures and Forwards, we study all about risks and the differences between the two.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Track your application

COMMENT (0)