Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 11: Learn Option Greeks – Part 1

The objective of all trading in any asset class is to buy low and sell high. But with all other traders also trying to do the same, to come up one better, a trader must be able to value the traded asset in a way such that he knows the 'right value' before and better than anyone else.

In Equities, fundamental investors use large complex models called 'Discounted Cash Flow' (DCF). The company's cash flows are the 'underlying truth' used to estimate a stock's 'right value'. If this comes out higher than the current market price, traders will buy the share because there's value to be unlocked, not yet factored in by the market. And if the DCF model says the stock's value should be lower than the current market price, traders short the stock.

The higher the cash flow the business generates, the greater value the DCF model assigns that company's stock.

The model allows a trader to price an asset. Therefore, the more accurate a model, the more confidently the trader can make money.

|

Did you know? Mathematically, prediction is not a yes-or-no game, mathematics likes to express games as ‘probability’. The probability of winning a coin toss is 50% (1/2), of winning a dice throw is 16.667% (1/6), of picking a winning card is 1.923% (1/52), of winning Kerala's Akshay AK-518 Lottery is 0.00001111% (1/90,00,000), and so on. |

Models to value Options look at probability as the ' underlying truth'. More specifically, they try to predict whether a given Option Contract will be profitable at the time of expiry.

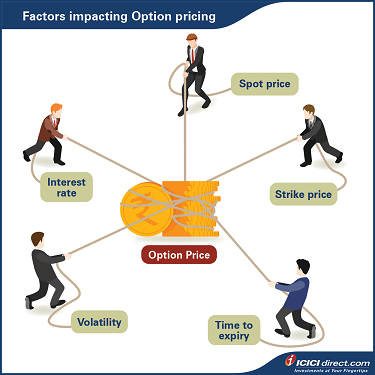

Factors impacting Option pricing

Unlike a coin, dice, or lottery, an Option's price isn't completely random, it depends on a few other observable quantities. It depends on

Spot price: The very definition of ‘derivative’ is that the asset derives its value from an underlying. If the current price is close to an Option's strike, there's a higher probability that the Option will expire in the money.

If the underlying is a business, its value is determined by the stock (equity) market, where different traders and investors try to figure out how well (or poorly) the company is doing by looking at its cash flows and future prospects.

Strike price: With multiple strikes to choose from, the closer a given strike is to the Spot, the higher the probability that the strike will be in the money. If Reliance Industry share is at Rs. 2000, then an Option with strike Rs. 2100 has a higher chance of expiring in the money than an Option with strike Rs. 3000

The strike is like a hurdle a trader aims at achieving or exceeding. Depending on how far above that hurdle the trader's prediction goes, the position will be more profitable.

Time to expiry: An Option with a longer time to expire will see more events happening to its underlying. For a single stock Option like Reliance Industries, oil prices have a longer time to change, the company's cash flows can fluctuate, the company's competitors can strengthen or weaken. In general, the longer time there is to expiry, the more random events can occur. Therefore, the probability of change in Option price also increases, making it more likely that some event will lead to an Option expiring in profit.

This factor is like an unstoppable train. Once the train of time has left the station, it will not stop until it reaches the end, and there's nothing the market or the trader can do to stop the train. Only when there's zero time left to expiry will the truth about whether the Option has any value left, or whether it's worthless, be finally known.

Option sellers try to make the most of this single biggest certainty by selling Options they think are bound to expire worthless, while Option buyers try to predict changes in other factors that will allow the Option to become profitable.

Volatility: We've all heard of bull and bear markets. We also see extended periods when the market 'moves sideways', neither bull nor bear. While Options allow one to profit from either bull or bearish moves, the probability of a change in value becomes less likely when markets' move sideways'. At such times we can say that 'volatility is low'. As volatility increases, the probability of significant movements in the price of the underlying increases, and therefore the price of Options also increases.

In a world of bulls and bears, volatility is like an elephant. Regardless of whether bulls or bears are winning, if the elephant of uncertainty starts moving, it will pull the entire market around with its volatility.

Interest rates: People who trade on margin understand that capital comes at a cost. This is the money they pay to the broker for borrowing capital to trade with. Option models incorporate this cost in the form of 'interest rate' where the traders' costs of allocating capital to taking the position is factored in.

Since most Options are traded relatively close to expiry, the annual interest rate doesn't influence Option prices much. However, it becomes an essential factor if the banks suddenly start charging significant interest on borrowing. The other reason could be if the Option being valued has a long time to expiry (like in years or even decades in case of some weather derivatives (which are used to hedge weather insurance like for the farm sector) then interest rates will become an important factor in the determining the price of an Option.

Here's a tip: Knowing these five factors, the first step is to plug them into an Option pricing model and get the 'right value' of an Option contract. If this 'right value' is above or below the current market price, there's a gap that can be exploited. Exploiting this gap is called 'arbitrage'.

In the case of Equities, once an investor or trader takes a position, they monitor the news for changes to the inputs and assumptions they made while creating their Discounted Cash Flow model. The information might tell them that the company will face rough times, or that the company's competitors have suddenly gained an advantage, or even that the entire world is now facing an epidemic that could cause the company to do worse, and hence the share price is expected to drop. Depending on changes in modelling assumptions, the trader then adds or reduces his position in that company's stock.

Similarly, in Options trading, a position was taken based on the five factors. As time goes on, these factors change, causing a change in the Option's price.

With all the factors trying to pull the Option price their way, whether the trader clears his chosen hurdle or not depends on which factor moves strongest or fastest during the time a trader is holding his position.

To help untangle these factors from each other, to allow the trader to study and monitor each factor in isolation, we study the dynamics of each as 'Option Greeks'.

Summary

- Option prices depend on the Spot price, Strike price, Time to expiry, Volatility and Interest rate.

- If the current price is close to an Option's strike, there's a higher probability of the Option expiring in the money.

- The longer the time to expiry, the more random events can occur, and therefore the probability of change in Option price also increases.

- High volatility increases the probability of significant movements in the price of the underlying increases, and therefore, the price of Options also increases.

In the next chapter, we will learn about the two Option Greeks, Delta and Gamma.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)