Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 2: All About Bull Call Spread

Abhinav is a fresh graduate working in a hedge fund’s Option team. With limited knowledge of Options, Abhinav was at a loss when his manager asked him if he knows what multi-leg Options are. He admitted his unfamiliarity with the subject and realized that there was a lot that needed to be learnt.

So, let’s make a start with bullish market strategies.

Looking at the Bull Call Spread

By its very nature– that of comprising two Call Options that create a range with a lower and upper strike price – the Bull Call Spread is ideal for the investor with an outlook in which he expects prices to rise only moderately. Though this Options trading strategy enables the investor to limit his losses, it also caps his upsides or gains.

|

Did you know? Bull Call Spread is also known as debit spread due to net cash outflow. |

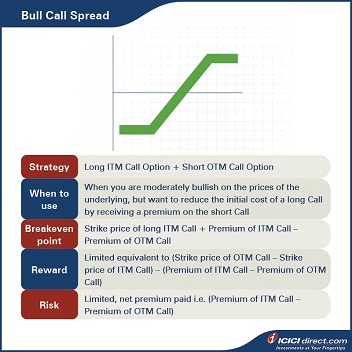

This strategy involves the use of two Call Options. The trader buys an In-the-Money (ITM) Call Option and simultaneously sells an Out-of-the-Money (OTM) Call Option. These two have the same expiry date, the same underlying, and involve the same number of Options. The trader will have a net cash outflow at the start of trade, and the premium paid will be more than the premium received.

In conversation with Abhinav, his manager explains that this strategy is used when the investor is moderately bullish about the prices of the underlying but want to reduce the initial cost of a long Call by receiving a premium on the short Call.

- Maximum profits will be incurred when the spot price is higher than the strike of the Option sold, i.e., when a trader can exercise the Option.

- Maximum losses will be incurred when Options are not exercised, and the spot price is lower than the strike price of the long Call.

Strategy: Long ITM Call Option (Leg 1) + Short OTM Call Option (Leg 2)

When to use: You should enter a Bull Call Spread when you are moderately bullish about the prices of the underlying, but want to reduce the initial cost of a long Call by receiving a premium on the short Call

Breakeven: Strike price of long ITM Call + Premium of ITM Call – Premium of OTM Call

Maximum profit: Limited equivalent to (Strike price of OTM Call – Strike price of ITM Call) – (Premium of ITM Call – Premium of OTM Call)

Maximum risk: Limited net premium paid i.e. (Premium of ITM Call – Premium of OTM Call)

Let’s understand this strategy with an example:

Assume that the spot price of ABC Ltd. is Rs. 1,000. Abhinav buys an ABC Ltd. ITM Call Option of strike price Rs. 900 at Rs. 140, and sells an OTM Call Option of strike price Rs. 1,200 at Rs. 30. He paid a total premium of Rs. 140 – Rs. 30 = Rs. 110, and this will be the maximum loss he will bear. He will get maximum profit if the stock moves beyond the strike price, i.e., Rs. 1,200.

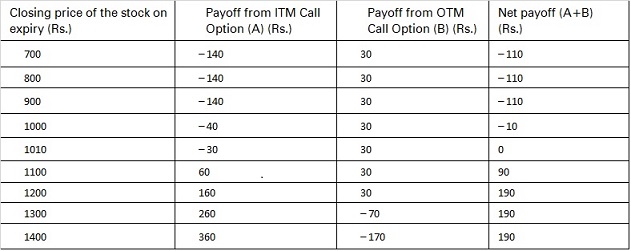

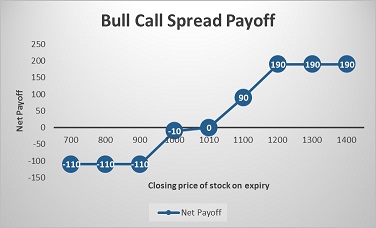

Let’s take a look at the cash flows in various scenarios:

Let’s understand the payoff in these multiple scenarios, as it will give you a fair idea of how we have arrived at the above values.

If the stock closes at Rs. 800 on expiry: Both the legs expire OTM

Leg 1: Premium paid on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium received on the ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (800 – 900)} = Max (0, –100) = 0

So, payoff from the ITM Call Option = Premium received – Premium paid = 0 – 140 = – Rs. 140

Leg 2: Premium received on the OTM Call Option of strike price Rs. 1200 = Rs. 30

Premium paid on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price– Strike price)} = Max {0, (800 – 1200)} = Max (0, – 400) = 0

So, Payoff from the OTM Call Option = Premium received – Premium paid = 30 – 0 = Rs. 30

Net Payoff = Payoff from the ITM Call Option + Payoff from the OTM Call Option = (– 140) + 30 = – Rs. 110

If the stock closes at Rs. 1010 on expiry: Leg 1 expires ITM, while leg 2 expires OTM

Leg 1: Premium paid on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium received on the ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1010 – 900)} = Max (0, 110) = Rs. 110

So, the payoff from the ITM Call Option = Premium received – Premium paid = 110 – 140 = – Rs. 30

Leg 2: Premium received on the OTM Call Option of strike price Rs.1200 = Rs. 30

Premium paid on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price– Strike price)} = Max {0, (1010 – 1200)} = Max (0, – 190) = 0

So, Payoff from the OTM Call Option = Premium received – Premium paid = 30 – 0 = Rs. 30

Net Payoff = Payoff from ITM Call Option + Payoff from OTM Call Option = (– 30) + 30 = 0

If the stock closes at 1200 on expiry: Leg 1 expires ITM while leg 2 expires OTM

Leg 1: Premium paid on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium received on the ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1200 – 900)} = Max (0, 300) = Rs. 300

So, payoff from the ITM Call Option = Premium received – Premium paid = 300 – 140 = Rs. 160

Leg 2: Premium received on the OTM Call Option of strike price Rs. 1200 = Rs. 30

Premium paid on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price– Strike price)} = Max {0, (1200 – 1200)} = Max (0, 0) = 0

So, the payoff from the OTM Call Option = Premium received – Premium paid = 30 – 0 = Rs. 30

Net Payoff = Payoff from the ITM Call Option + Payoff from the OTM Call Option = 160 + 30 = Rs. 190

Summary

- A Bull Call Spread is a strategy that involves the use of two Call Options, buying an In-the-Money (ITM) Call Option and simultaneously selling an Out-of-the-Money (OTM) Call Option, with the same expiry on the same underlying asset, and involving the same number of Options.

- This strategy is used when the trader is moderately bullish on the prices of the underlying but wants to reduce his initial cost of a long Call by receiving a premium on the short Call.

- Breakeven: Strike price of long ITM Call + Premium of ITM Call – Premium of OTM Call

- Maximum profit: Limited equivalent to (Strike price of OTM Call – Strike price of ITM Call) – (Premium of ITM Call – Premium of OTM Call)

- Maximum risk: Limited, net premium paid i.e. (Premium of ITM Call – Premium of OTM Call)

Additional Read: What are Options? How do they work? Types and Features of Options

So, if you are a cautious investor who doesn’t mind low-risk trades, the Bull Call Spread is an Option you can consider. However, there are Options strategies for different market scenarios, so turn the pages to see which strategy will bring in the bucks for you.

Track your application

COMMENT (0)