Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 2: Introduction to Options

Let’s revisit Seema and Anant’s situation that we have covered in the Future Trading module. If you recollect, Seema is a tomato sauce manufacturer who entered into a Futures contract with Anant, a tomato farmer, to buy tomatoes at Rs. 10/kg. Now, if the price of tomatoes is lower at the time of expiry, then Seema would be at a loss. What if there was a way to avoid this?

Options are a derivative instrument that gives one party, the buyer, an option rather than an obligation to honour the contract.

Introduction to Options

In the Futures, we understood how both transacting parties must honour the contract. That means that parties have to shoulder the possibility of unlimited losses on Futures positions. They can also make more profits.

However, to manage losses, an Options contract is a better product.

|

Did you know? Apart from Call and Put, few Exotic Options are also available in the market. These options are Bermuda Options, Barrier Options, Binary Options, to name a few. |

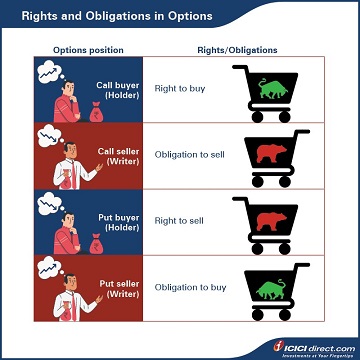

Options contracts are different from Futures contracts because one party has the right to buy or sell an underlying while another party has an obligation. The right to buy is a Call Option while the right to sell is a Put Option.

Options contracts provide the buyer with the Option to exercise their right. The buyer may choose to exercise his right only if it is favourable. If a transaction is not in the buyer’s favour, they are not required to go through with it.

On the other hand, the seller doesn’t have any right but has an obligation. If a buyer wants to exercise his right, the seller must compulsorily oblige and honour the contract.

- The buyer of an Option is also known as the holder.

- The seller of an Option is also known as the writer.

The obliged party has to compensate the party with the obligation. When a buyer purchases a right, he needs to pay the cost of that right, known as a premium, upfront to the seller. In other words, a buyer needs to make an upfront compensation to the seller for taking on a risk.

For instance, if Seema purchased an Option to buy tomatoes from Anant at Rs. 10/kg, she may choose not to exercise this Option if the current market price is Rs. 8/kg for tomatoes. That puts Anant in a spot. That is why Seema will have to make an upfront payment to Anant, say of 10% of the contract value, to compensate for the risk Anant is taking, which is non-refundable.

Please note that Call and Put are different types of Options - selling a Call Option is not equivalent to buying a Put Option.

There are four distinct parties in Options contracts. We can summarize the rights and obligations as under:

Example: Call Option

Options contracts are not new to us. We often use them in day-to-day life. For example, let us assume that you decide to purchase a property for Rs 50 lakh and plan to complete the transaction in 2 months and proceed with legal formalities. As a buyer, you need to pay some non-refundable token amount, let’s say Rs. 1 lakh, to the seller to secure the deal. Now let’s assume two scenarios:

Scenario 1:

Next month, you realize that litigation has come up in that area, and the same property is now available at Rs. 40 lakh. As a buyer, you don’t have any obligation to purchase that property now, and you can forgo the token amount of Rs. 1 lakh. This way, you safeguard yourself from a more significant loss. You still save yourself Rs. 9 lakh on the transaction. The seller can choose to sell the property to someone else at Rs. 40 lakh. However, the seller will earn Rs. 1 lakh extra since you did not purchase.

Scenario 2:

In the next month, you realize that the government had sanctioned a significant project nearby and consequently, the same property is now available at Rs. 60 lakh. As a buyer, you will exercise your right and purchase the property as per the already agreed price of Rs. 50 lakh. A seller needs to honour the contract and can’t refuse now. You earn an immediate profit of Rs. 9 lakh, and the seller loses the same amount.

Note: Options are always a zero-sum game, i.e. profit for one party is equivalent to a loss for the counterparty. That means that Call Options will be exercised by the buyer when prices of the underlying increase.

Detailing with a Nifty example

Let’s now understand this with an example of the Nifty Call Option. Assume that you have purchased the Nifty 15,500 Call Option with an expiry of July 29, 2021, at Rs. 100. That means that you have purchased the right to buy Nifty at 15,500 on expiry. You don't need to exercise your right. You can exercise your right only if it is favourable to you. For instance, if you find that the Nifty market price is more than 15,500, you can choose to exercise your Call Option.

- The amount you paid to purchase the right is known as premium.

- The rate at which you enter the contract is known as the strike price or the exercise price.

If you don’t exercise your right, you will lose the premium to the seller who will earn it.

Example: Put Option

Let us discuss a typical example of Put Options.

Assume that you own a house. You want to sell it for Rs. 50 Lakh and feel that prices may fall in the next three months (90 days). You are ready to pay a non-refundable small sum of money as a confirmation of the transaction so that buyer will be obliged to buy the house. You meet a potential buyer, Sanjay, and pay Rs. 50,000 to enter into a contract. Accordingly, you have 'Right but no obligation to sell' house at Rs. 50 Lakh to Sanjay after three months (90 days).

Scenario 1:

As expected, the market price of the house has gone down to Rs. 45 lakh.

You have the 'Right' to sell the house at Rs. 50 Lakh and have paid Rs. 50,000 to acquire that right. So you will earn a profit of Rs.4,50,000(50,00,000 - 45,00,000 - 50,000).

Scenario 2:

Prices of 'dream homes' have gone up to Rs. 60 Lakh since a new airport project is announced in the neighbourhood. If you sell the house to Sanjay at Rs 50 Lakh, you stand to lose Rs. 10 Lakh since the current price has gone up to Rs 60 Lakh. So, you decide to forego Rs 50,000 and choose not to sell the house.

Detailing with a Nifty example

Let’s understand this with the example of the Nifty Put Option. Assume that you have purchased the Nifty 15,500 Put Option with an expiry of July 29, 2021, at Rs. 80. That means you have purchased a right to sell Nifty at 15,500 on expiry. You don't need to exercise your right if it is not in your favour. You may exercise your right only if you find that the Nifty market price is less than 15,500.

In case you don’t exercise your right, you will lose the premium to the seller who will earn it.

Difference between Futures and Options contracts

In the case of Futures contracts, both long and short, must buy and sell the underlying as per contract specifications even though the market price at expiry might not favour either.

For example, suppose a trader short (agrees to sell) 1-month Futures of XYZ Ltd. at Rs. 70 and at expiry, XYZ’s stock move up to Rs. 75, then he would have ideally wanted to move out of the contract since he is incurring a loss in this position. He cannot back out from his commitment in a Futures contract, but he can do so in an Options contract by going long on Put Options.

Therefore, in Futures, losses and gains are linear, but in Options buying, losses are limited to the premium, and gains can be unlimited.

For those who want to hedge against unlimited losses, entering into an Options contract is more sensible than a Futures contract.

Summary

- Options are a derivative instrument that gives one party, the buyer, an option rather than an obligation to honour the contract.

- The buyer may choose to exercise his right only if it’s favourable. If a transaction is not in the buyer’s favour, they are not required to go through with it.

- The buyer of an Option is known as the holder. The seller of an Option is known as the writer.

- The right to buy is known as a Call Option and the right to sell is known as a Put Option.

- Options are always a zero-sum game, i.e. profit for one party is equivalent to the loss for the counterparty.

- The amount you paid to purchase the right is known as premium. The rate at which you enter the contract is known as the strike price.

- Options are different from Futures because they provide a right, not an obligation, to honour the contract.

- Options buying can be an excellent way to hedge from unlimited loss.

With that introduction to Options, you can now dive into other Options-related terminology you must know. We’ll get into that in the next chapter.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)