Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 3: An Options Trading Course for Option Trading Terminology

Your learning is usually linear. You start as a trainee at your workplace, learn the ropes and then move up the ladder. For example, even a lion does not hunt as a newborn. It takes months or a few years of observation and training before it can go on a prowl. Similarly, before executing any Options trades, you need to understand Options terminology first.

Options are derivative contracts that can be tricky to comprehend if you don’t know the right terms. So let’s break down the jargon to make Options more straightforward for you.

Options terminology

Lot size

Lot size in Options contract is the same as that in Futures contracts. For example, TCS Options contract lot size is 300. It refers to the total number of units in a single contract.

Expiry date

|

Did you know? Options contracts with expiration dates longer than one year are called LEAPS or long-term equity anticipation securities. They can have expirations of up to 3 years. |

Just like Futures contracts, Options contracts also expire on the last Thursday of the month. Weekly expiry contracts on the Index Option are also available in the market and expire on the Thursday of the week.

Number of available contracts

If you remember, there are only 3 Futures contracts available to investors at a time. However, in Options, there are more.

- For Index weekly Options, 7 weekly expiry contracts excluding the expiry week of monthly contract are available for trading.

- A new serial weekly Options contract is introduced after the expiry of the respective week's contract.

- Long-term Index Options of Nifty are also available with three quarterly expiries (March, June, September and December cycles) and the next 8 half-yearly expiries (June and December cycles).

|

Did you know? Similar to Futures contracts, Options contracts are also available in 3 indices and 156 securities as of April 2021. |

Strike price

The strike price refers to the rate at which an investor has entered into the Options contract. Various strike prices are available in the market. They can be available at prices lower than the spot price and or higher than the spot price.

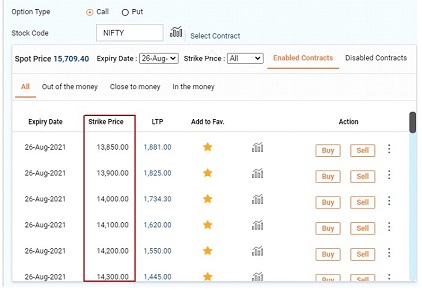

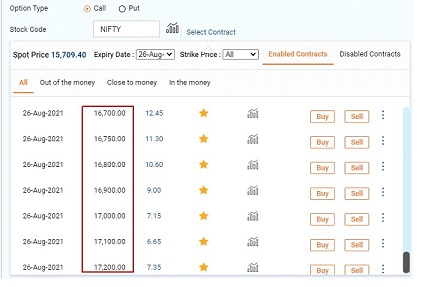

Take a look at the image below. For instance, if you are trading in the Nifty 15,700 contract, the strike price, in this case, is 15,700. You will also see that Spot Nifty is at 15,709 on July 28, 2021 and strike prices are available from 13,850 to 17,200 for contracts with an August expiry.

Options premium

Premium is the price that the party going long (or the buyer) pays above the spot price to acquire an Options contract. It is the cost the Option buyer/holder pays to acquire the right, but not the obligation, to either buy or sell the underlying asset.

Options premiums are traded for a single unit of the underlying asset which is then multiplied with the lot size to get the total premium for the contract.

For example, assume that an Options price for the Call Option on Stock A is Rs. 150 and lot size is 100.

Total premium = Rs. 150*100 = Rs. 15,000

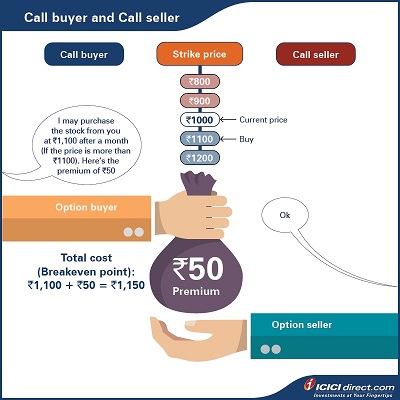

In the case of a Call Option buyer, you are purchasing a right to buy an underlying asset and paying a premium to the seller. So, we will add the premium cost to the strike price to calculate the breakeven point. Thus, Call Option buyers will earn a profit if the spot price moves above the breakeven point.

The breakeven point for the Call Option = Strike Price + Premium

For Put Options, the premium will be deducted from the strike price to calculate the breakeven point. Thus, Put Option buyers will earn a profit if the spot price falls below the breakeven point.

The breakeven point for Put Option = Strike Price – Premium

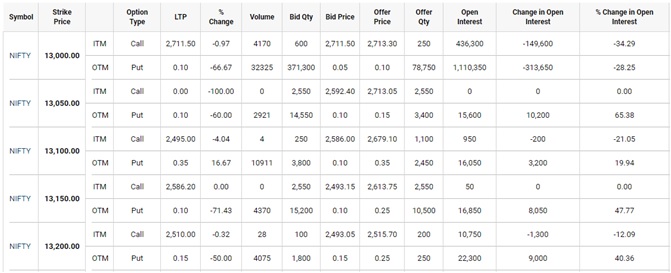

All the information related to different Options can be seen from the Options chain as shown below in the table. You will see different Option strike prices, Call Option and Put Option premium, Open Interest and other useful data in a single screen.

Margin concept in Options contract

Unlike Futures, an Option buyer is not required to pay any margin amount. This is because the buyer is exposed to limited risk, which is already compensated for with the premium paid. All one must do is pay the Option premium to get the right (but remember, not the obligation) to buy or sell the underlying asset. The amount of Option premium depends on factors like:

- Strike price

- Price of the underlying asset

- Volatility of prices

- Time to expiration.

On the other hand, the Option seller is exposed to unlimited risk. The seller must oblige to either buy or sell the underlying whenever the Option is exercised by the buyer. Therefore, a seller needs to deposit a margin with the broker. This margin amount is usually in the range of 15% to 50%. This is similar to the Futures contract margins and depends upon the contract value and volatility of the underlying asset.

For example, let’s assume a trader receives Rs. 10*500 = Rs. 5,000 as premium on selling a Call Option of Stock A. This Option has:

- A strike price of 1,000

- A contract size of 500

- A margin of 20%

The seller will have to deposit (20% of 1000 x 500), i.e. Rs. 100,000, on the overall position of Rs 500,000.

Intrinsic value and time value

When it comes to Option premiums, there are two concepts you need to know, namely intrinsic value and time value.

Option premium = Intrinsic value + Time value

The intrinsic value of Call Options is calculated by subtracting the strike price from the current market price. Intrinsic value is the amount of benefit that an Option buyer receives if they exercise the Option. In case of a Put Option, intrinsic value can be determined by subtracting the spot price from the strike price. All Options expire at the intrinsic value on expiry.

The formulae for determining intrinsic value are stated below:

Intrinsic value of a Call Option = Max {0, (Spot price – Strike price)}

Intrinsic value of a Put Option = Max {0, (Strike price – Spot price)}

Note: The intrinsic value of a Call or Put Option can never be below zero because the Option buyer will not exercise the Option if it does not result in positive cash flow. If it is negative on calculation using the formula, we will consider it as zero.

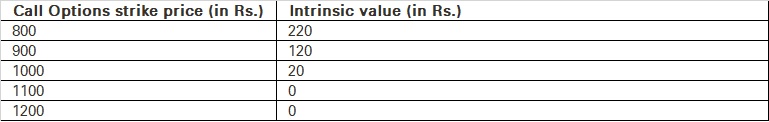

Let’s understand the intrinsic value of a Call Option with an example.

Assume ABC Ltd.’s Rs. 1,000 strike price Call is available in the market at Rs. 50. If the current market price of ABC is Rs. 1020, its intrinsic value can be calculated as under:

Spot price = Rs. 1,020

Strike price = Rs. 1,000

Intrinsic value = Max {0, (Spot price – Strike price)} = Max {0, (1020 –1000)} = Rs. 20

The intrinsic values of various strike prices of Call Options are listed in the following table:

Let’s understand the intrinsic value of a Put Option with an example:

Assume that ABC Ltd.’s Put is available in the market at Rs. 40.

Spot price = Rs. 980

Strike price = Rs. 1,000

Intrinsic value = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 980)} = Rs. 20

The intrinsic values of various strike prices of Put Options are listed in the following table:

Time value is the reducing value of an Options contract over a period of time, until it becomes zero on expiry. As the time value of an Option becomes zero, pay off from an Option on expiry is equivalent to its intrinsic value.Time value

Time value of an Option = Option premium – Intrinsic value

The difference between the Options premium and the intrinsic value of an Option is called the time value of an Option. The greater the volatility and time of the Option, the higher would be its time value.

Note:

At the time of expiry of an Options contract, there is no time value and the worth of the Option is equal to its intrinsic value. Therefore, the Option premium begins to lose value only after the contract starts and continues to expiry. This concept is called time value decay.

Let’s understand the time value of a Call Option with an example:

Assume that ABC Ltd.’s Rs. 1,000 strike price Call is available in the market at Rs. 50. If the current market price of ABC is Rs. 1020, its intrinsic value can be calculated as under:

Spot price = Rs. 1,020

Strike price = Rs. 1,000

Intrinsic value = Max {0, (Spot price – Strike price)} = Max {0, (1020 – 1000)} = Rs. 20

Time value = Premium – Intrinsic value = 50 – 20 = Rs. 30

Summary

- Lot size refers to the total number of units that is contained in a single Options contract.

- Expiry date is the date on which an Options contract expires or ends. Just like Futures, it is usually on Thursdays.

- The strike price refers to the rate at which an investor has entered into the Options contract.

- Premium is the price that the party going long (or the buyer) pays above the spot price to acquire an Options contract. It is a compensation to the seller for the risk that he/she assumes.

- Option premium = Intrinsic value + Time value

- Unlike Futures, an Option buyer is not required to pay any margin amount. A seller, however, must deposit a margin with the exchange.

- Intrinsic value is the amount of benefit that an Option buyer receives if they exercise the Option.

- Intrinsic value of a Call Option = Max {0, (Spot price – Strike price)}

- Intrinsic value of a Put Option = Max {0, (Strike price – Spot price)}

- Time value is the reducing value of an Options contract over a period of time, until it becomes zero on expiry.

- Time value of an Option = Option premium – Intrinsic value

In the following chapters, we will get into details about trading in the Call and Put Options.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)