Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 4: A Complete Guide to Futures Trading

Do you remember Anant from Chapter 2? The tomato producer needed a steady price for his tomatoes. With a Futures contract, Anant could have agreed to sell his produce to Seema’s tomato sauce factory at a predetermined price. This way, Anant would get a certain amount of money for his produce, irrespective of the market price at the time.

Futures are a type of derivative contract that obliges two parties to transact on an asset at a predetermined rate on a particular date. If Seema entered into a Futures contract with Anant to purchase a kilo of tomatoes at Rs. 10/kg, even if the market rate was Rs. 8.5/kg, the Futures contract would require Seema to honour the contract.

In short, a Futures contract is a standardized contract that oblige parties to buy or sell an asset at a particular rate, regardless of the current market price at the expiration date.

Unlike Forward contracts, Futures don’t have liquidity risk, default risk, lack of flexibility, etc. In a Futures contract, the buyer and seller agree to buy and sell a specific amount of underlying asset on a future date at a particular price. All contract specifications are standardized as per the exchange on which it is tradable and the exchange guarantees trade settlement of the contract as well.

So how does it work?

- All Futures contracts come with a settlement guarantee from the clearing corporation of the stock exchange. It is an agency designated to settle trades on the stock exchanges. That removes any default risk.

- All Futures contracts have a pre-defined expiry but anyone can exit from these contracts at any point of time before the expiry by trading on the exchange, therefore provide enough flexibility.

- Futures are freely traded on stock exchanges and anyone can participate in these contracts. Therefore, they are extremely liquid.

Every Futures contract has some underlying asset and the contract derives its value from that underlying asset. The underlying asset could be shares, an index, currency, commodity and interest rates.

Interest rate, commodity and currency derivatives are also available in the market on various exchanges. If you buy a Futures contract of Reliance Industries, then Reliance shares are the underlying asset. Similarly, if you buy a Nifty Futures contract, then the underlying asset would be the value of the Nifty index. If the Nifty value goes up, the price of Nifty Futures contracts will also move in the same direction. So, if Nifty moves up by 100 points, we can also expect a similar movement in the price of Nifty Futures.

Pricing of Futures contracts

Futures prices normally exceed spot or cash prices due to the cost of carry and converge to the spot price on expiry.

- Futures price is the price which has been agreed upon for the future delivery of the asset at the time of entering into the contract.

- Spot price or cash price is the current market price of the underlying asset.

Cost of Carry or CoC is the cost that an investor incurs for holding a certain Futures contract until it expires.

Futures price = Spot price + Cost of carry

Therefore,

Cost of carry = Futures price – Spot price

Let’s understand this with an example.

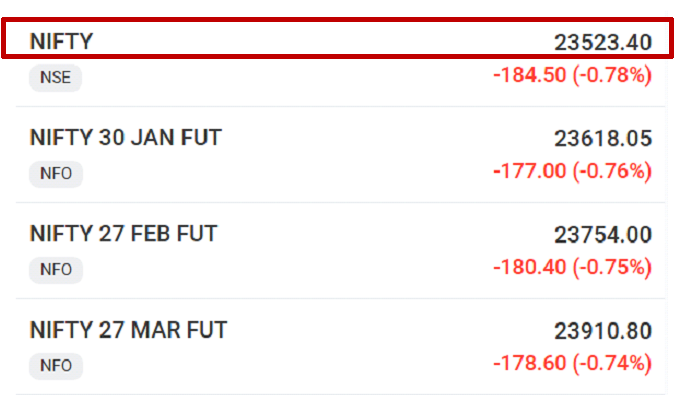

This is the example of Nifty Futures. As on Jan 8, 2025, Nifty is trading at 23,523.40, i.e. the spot price, and a near month Futures contract of Jan 30, 2025 is available at 23,618.05. Here, the Futures price exceeds spot price by ~95 points. If the Futures price exceeds spot price, we can say that a Futures contract is trading at a premium. In this example, this Futures contract is trading at a premium of 3 points.

The longer the expiry period, higher is the cost of carry. This is also true for the difference between the Futures price and cash price. On expiry, the cost of carry becomes zero and the Futures price converges with the spot price.

If the Futures price is lower than the spot price, it is said to be at a discount. The major reason for the discount is excessive selling of the Futures contract in the market resulting in it being oversold. The cost of the carry depends on the time to expiry.

Can you see from the example above that the Mar contract is trading at a higher premium in comparison to the Jan and Feb contracts?

Calculating the fair value

The fair value of a Futures contract is the theoretical value of a Future contract that it should be traded on. However, the Futures price may differ from the fair value because of short-term fluctuations in the market that are influence by demand and supply. A large deviation could result in an arbitrage opportunity, assuming that the Futures price will eventually revert back to the fair value. We will look at this more in detail in the upcoming chapters.

Calculate the fair value of a Futures contract using this formula:

Futures Price = Spot Price *(1+r*t) – Dividends

Where

r = Risk-free interest rate (91-day Treasury-bill or T-bill return is considered as a risk-free rate)

t = time in years

The market price of the Futures contract may be different from calculated fair value.

Let’s understand better with an example. Let’s calculate the fair value of all 3 Nifty Futures contracts from the example above, assuming there is no dividend payment during the period.

- Fair value of the January contract = 23,523.4*(1+22*0.065/365) = 23615.56

(The 91-day T-bill yield considered here is 6.5%, t =22/365 as there are 22 days left in the expiry of the contract which is divided by 365 to convert the time in years)

- Similarly, the fair value of the February contract = 23,523.4*(1+50*0.065/365) = 23,732.85

- The Fair value of March contract = 23,523.4*(1+78*0.065/365) = 23,850.15

However, the market value of contracts can be different from fair value.

Summary

- Futures contracts are standardized contracts that oblige parties to buy or sell an asset at a particular rate, regardless of the current market price at the expiration date

- The underlying asset for Futures can be shares, an index, currency, commodity, interest rate, etc.

- All Futures contracts come with lower default risk, more flexibility and more liquidity than Forwards contracts.

- Cost of Carry is the cost that an investor incurs for holding a certain Futures contract until it expires.

- If Futures price > spot price, then the contract is trading at a premium.

- If spot price > Futures price, then the contract is trading at a discount.

- The fair value of a Futures contract is the theoretical value of the Futures contract based on spot price, number of days left in expiry and risk-free interest rate.

In the next chapter, we will demystify what some could call ‘jargon’ related to Futures contracts. But these are some important terms to know.

Track your application

COMMENT (0)