Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

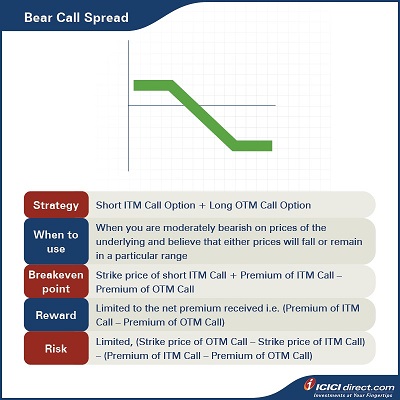

Chapter 5: Bear Call Spread

Abhinav’s manager goes on to explain the Bear Call Spread to him, saying that it is a strategy that can be deployed when the investor is moderately bearish. It is also suitable for earning premium income during volatile times.

Looking at the Bear Call Spread

In a Bear Call Spread strategy, you buy an OTM Call Option and simultaneously sell an ITM Call Option with the same expiry, on the same underlying asset and involving the same number of options. You will receive net cash inflow at the start of trade. Do note that the premium paid is less than the premium received

|

Did you know? TBear Call Spread is also known as Short Call Spread or Credit Call Spread. |

This strategy can be used when you are moderately bearish on the prices of the underlying and believe that prices will either fall or remain rangebound. You protect the downside risk of the Call sold (obligation to sell the asset) by purchasing a Call of a higher strike price (right to buy the asset).

- The maximum profit that can be made will be limited to the net premium received at the start of trade,

- The maximum loss that can be incurred will be equal to the difference between the two strike prices and the net premium received at the start.

- Maximum risk: Limited, (Strike price of OTM Call – Strike price of ITM Call) – (Premium of ITM Call – Premium of OTM Call).

Strategy: Short ITM Call Option (Leg 1) + Long OTM Call Option (Leg 2)

When to use: When you are moderately bearish on prices of the underlying and believe that prices will either fall or remain rangebound

Breakeven: Strike price of short ITM Call + Premium of ITM Call – Premium of OTM Call

Maximum profit: Limited to the net premium received i.e. (Premium of ITM Call – Premium of OTM Call)

Maximum risk: Limited, (Strike price of OTM Call – Strike price of ITM Call) – (Premium of ITM Call – Premium of OTM Call)

Let’s understand the Bear Call Spread strategy with an example:

Assume that the spot price of ABC Ltd. is Rs. 1,000. Abhinav sold an ABC Ltd. ITM Call of strike price Rs. 900 at Rs. 140 and bought an OTM Call Option of strike price Rs. 1,200 at Rs. 30. He received a total premium of Rs. 140 – Rs. 30 = Rs. 110, and this will be the maximum profit. He will start losing maximum amount if the stock moves beyond the higher strike price i.e., Rs. 1,200.

Let’s take a look at the cash flow in various scenarios:

|

Closing price of stock on expiry (Rs.) |

Payoff from ITM Call Option (A) (Rs.) |

Payoff from OTM Call Option (B) (Rs.) |

Net payoff (A+B) (Rs.) |

|

700 |

140 |

– 30 |

110 |

|

800 |

140 |

– 30 |

110 |

|

900 |

140 |

– 30 |

110 |

|

1000 |

40 |

– 30 |

10 |

|

1010 |

30 |

– 30 |

0 |

|

1100 |

– 60 |

– 30 |

– 90 |

|

1200 |

– 160 |

– 30 |

– 190 |

|

1300 |

– 260 |

70 |

– 190 |

|

1400 |

– 360 |

170 |

– 190 |

Let us understand the payoff in various scenarios. It will give you a fair idea of how we have arrived at the above values.

If the stock closes at Rs. 800 on expiry: Both legs expire OTM

Leg 1: Premium received on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium paid on ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (800 – 900)} = Max (0, – 100) = 0

So, payoff from the ITM Call Option = Premium received – Premium paid = 140 – 0 = Rs. 140

Leg 2: Premium paid on the OTM Call Option of strike price Rs. 1200 = Rs. 30

Premium received on OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (800 – 1200)} = Max (0, – 400) = 0

So, the payoff from the OTM Call Option = Premium received – Premium paid = 0 – 30 = – Rs. 30

Net payoff = Payoff from ITM Call Option + Payoff from OTM Call Option = 140 – 30 = Rs. 110

If the stock closes at Rs. 1010 on expiry: Leg 1 expires ITM while leg 2 expires OTM

Leg 1: Premium received on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium paid on ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1010 – 900)} = Max (0, 110) = Rs. 110

So, the payoff from the ITM Call Option = Premium received – Premium paid = 140 – 110 = Rs. 30

Leg 2: Premium paid on the OTM Call Option of strike price Rs.1200 = Rs. 30

Premium received on the OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1010 – 1200)} = Max (0, – 190) = 0

So, the payoff from the OTM Call Option = Premium received – Premium paid = 0 – 30 = – Rs. 30

Net payoff = Payoff from ITM Call Option + Payoff from OTM Call Option = 30 + (– 30) = 0

lf the stock closes at Rs. 1300 on expiry: Both legs expire ITM

Leg 1: Premium received on the ITM Call Option of strike price Rs. 900 = Rs. 140

Premium paid on the ITM Call Option of strike price Rs. 900 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1300 – 900)} = Max (0, 400) = Rs. 400

So, the payoff from the ITM Call Option = Premium received – Premium paid = 140 – 400 = – Rs. 260

Leg 2: Premium paid on the OTM Call Option of strike price Rs.1200 = Rs. 30

Premium received on OTM Call Option of strike price Rs. 1200 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1300 – 1200)} = Max (0, 100) = Rs.100

So, the payoff from the OTM Call Option = Premium received – Premium paid = 100 – 30 = Rs. 70

Net payoff = Payoff from ITM Call Option + Payoff from OTM Call Option = (– 260) + 70 = – Rs. 190

Summary

Additional Read: Understanding Put and Call Parity and How They Work

- In a Bear Call Spread strategy, you buy an OTM Call Option and simultaneously sell an ITM Call Option with the same expiry, same underlying asset and involving the same number of options.

- This strategy can be used when you are moderately bearish on the prices of the underlying, and believe that either prices will fall or remain in a particular range.

- Breakeven: Strike price of short ITM Call + Premium of ITM Call – Premium of OTM Call

- Maximum profit: Limited to the net premium received i.e. (Premium of ITM Call – Premium of OTM Call)

- Maximum risk: Limited, (Strike price of OTM Call – Strike price of ITM Call) – (Premium of ITM Call – Premium of OTM Call)

You must have now understood the workings of the Bear Call Spread. Now let’s move on to another equally interesting strategy – the Bear Put Spread.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)