Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 6 – Futures Trading – Part 1

You go to the market to buy vegetables. There needs to be a vegetable vendor who sells you vegetables. Here, you are the buyer and the vendor is the seller.

Any kind of trade requires two parties – a buyer and a seller. Just like that, Futures trading also needs two transacting parties who speculate on how the price of an underlying asset will move. Here’s what you need to understand about Futures trading:

Long and short position in Futures

You can go long or short on a Futures contract. Going long means agreeing to buy an underlying security at a particular price in the future. Going short means agreeing to sell an underlying security.

If you expect the price of a stock to move up, i.e. you are bullish about a stock, you can buy a Futures contract. For instance, let’s say the Union Budget announcement is around the corner and you are positive about it. You expect the market to move up. In this case, you can go long on the Nifty Futures at the current market price. Then, when the prices go up, you can sell the Nifty index you bought at a higher price on that date.

Let’s understand this with numbers. If the Nifty Futures are currently trading at 14,500 and you purchase one lot (75 nos.) of it. If the price of the Nifty Futures moves up by 200 points to 14,700, you can sell your open position and book a profit of Rs. 200*75 = Rs. 15,000 on your position (14,700 – 14,500). This is an example of a long position. (Current Nifty lot size is 75 but that can change)

On the contrary, if you expect a high interest rate scenario, say through an announcement in the Reserve Bank of India (RBI) monetary policy review meet, and the market to go down, you can go short on the Nifty Futures. When the prices go down in future, you can buy Nifty units at a lower price and sell it at the higher price agreed upon.

For example, if you sell it at the current market price of Rs. 14,500 and later buy it back at Rs. 14,300 after few days, you book a profit of Rs. 200*75 = Rs.15,000 on this transaction. This is an example of a short position.

Choosing the right Futures contract from available contracts with different expiry dates

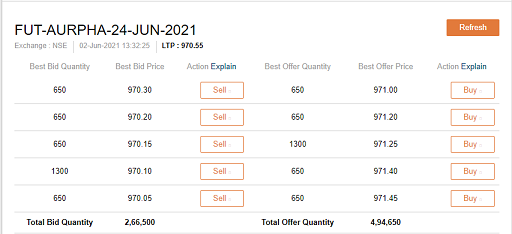

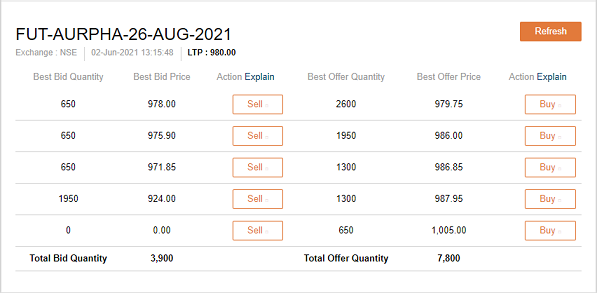

A trader, Ram, wants to enter into a Futures contract on Aurobindo Pharma Ltd. He considers two different contracts, one expiring on June 24, 2021 and another on 29 July, 2021. The Futures price on each of these contracts is Rs. 1037.15 and Rs. 1042.80. Why the difference?

This is because of the different expiry dates of these contracts. The choice of any contract can be finalized after considering the following factors:

Liquidity of the contract

The ease with which you can square off your position in a Futures contract determines its liquidity. This depends on the number of buyers and sellers operating in the market.

- The term squaring off means taking an offsetting position to your earlier position. An offset happens when you take an opposite position in comparison to the original trade that you enter into. For instance, if you go long on one lot of Aurobindo Pharma, then selling one lot of the same company would be squaring it off.

This liquidity can be determined by bid-ask spread on any contract - the lower the bid-ask spread, the higher would be the liquidity.

- A bid-ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. In the given example bid price for a Jun month contract is Rs. 970.3 and the ask price is Rs. 971, then the bid-ask spread would be Rs.0.70, i.e. the difference between the bid and the ask price.

In the same stock for an Aug month contract, the bid-ask spread increased to Rs. 979.75-978 = Rs. 1.75

You will find high liquidity in current month contracts, liquidity starts increasing in next month contracts when current month contracts near expiry.

Size of the contract

As an investor, you should always choose a contract that has a quantity of underlying assets that line up with your risk tolerance. For instance, if a Futures contract on Stock A has a contract size of 300 and price of Rs. 3000, then the investor needs to be sure if they want this kind of exposure.

What would the lot value be in the above example? (Hint: Multiply the contract size with the price.)

Time to expiration

The period of the contract (1 month, 2 months or 3 months) should also match the corresponding time for which you are willing to stay exposed to that lot value. The later the expiry date, the longer the exposure. This increases the risk factor.

|

Did you know? Longer expiry contracts are available at higher prices in comparison to contracts with shorter expiry due to the higher cost of carry. |

Summary

- A party can go long or short on a Futures contract.

- Going long means agreeing to buy an underlying at a particular price while going short means agreeing to sell.

- If you expect the price of a share to move up, i.e. you are bullish about a share, you can buy a Futures contract.

- If you expect the price of a share to go down, i.e. you are bearish about a share, you can go short or sell a Futures contract.

- Choosing the right Futures contract:

- Check liquidity

- Check size

- Check time to expiration

There is a lot more to know before you begin. You will learn more about Futures trading in the next chapter.

Disclaimer:

ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100.I-Sec acts as a Composite Corporate agent having registration number –CA0113. PFRDA registration numbers: POP no -05092018. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds and National Pension Scheme (NPS). Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund and NPS related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)