Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 8: Understand Advanced Concepts in Futures

Aisha is a stock market trader who is exploring the world of Futures for the first time. She enters into a contract to sell a lot of Nifty Futures contracts. The price is slightly higher for the near month contracts than the underlying index and even higher for subsequent two months. She hears that the Open Interest is higher for the near-month contract and lower for farther months. She also comes across terms like Rollover and Spread.

Since Aisha is new to these terms, she wants to understand what they mean. Let’s break these down for her, shall we?

Open Interest in Futures contracts

Open Interest is a term that is often used in the world of derivatives. It indicates the number of contracts that are due or active in the market and are yet to be settled.

Note: A single contract accounts for both parties, a buyer and a seller, involved in the transaction. The number of Open Interest, therefore, refer to the number of active contracts rather than the number of active parties in the market.

The higher number of open positions of a particular Futures contract denotes that the contract is highly active and has even higher participation.

Now, you might be wondering how Open Interest rises and falls. Aisha has this doubt too. Let’s understand this with an example:

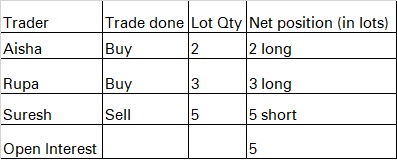

Let’s suppose the following transactions happen on day 1:

- Aisha buys 2 lots of Nifty Futures contracts and his net outstanding position is 2 lots long.

- Rupa buys 3 lots of Nifty Futures contracts and his net outstanding position is 3 lots long.

- Suresh has sold 5 lots of Nifty and his net outstanding position is 5 lots short

- So the total no. of outstanding contracts is 5, so Open Interest is 5.

Let’s suppose the following transactions happen on day 2:

- Aisha sold her 1 lot of Nifty and his net outstanding position is 1 lot long.

- Rupa sold her 3 lots of Nifty Futures contract and his net outstanding position is zero.

- Suresh has bought 2 lots of Nifty and his net outstanding position is 3 lots short.

- Charles has purchased 2 lots of Nifty and his net outstanding position is 2 lots long.

- So the total no. of outstanding contracts is 3 and so Open Interest is 3.

Question: Which parties remain in the Open Interest Futures contract now in the example above? Aisha, Suresh and Charles remain in the Open Interest on day 2.

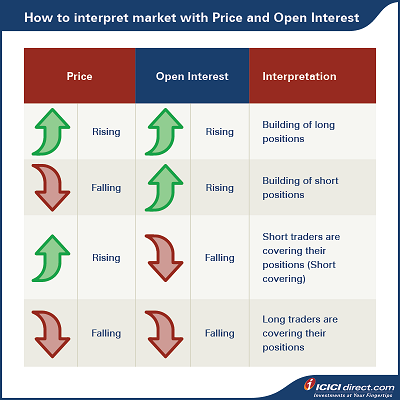

- Open Interest can also be used to understand market movement but not give any sense of whether the market will move up or down.

- Rising Open Interest supported by rising prices is an indication of a building of long positions. Conversely, increasing Open Interest and falling prices are a sign of a building short positions.

- Falling Open Interest along with rising or falling stocks is a sign of position covering. Rising prices with falling Open Interest signify that short traders are covering their positions, also known as short covering. Falling prices with falling Open Interest is a sign that long traders are covering their position.

Rollover and Rollover percentage

Now, on the day of derivatives expiry on the last Thursday of a month, Aisha chooses to Rollover or carry forward her position.

At the expiry of one Futures position, the participants may square off their current contract position and shift onto the next series with the same original position. When you Rollover a Futures contract, the price difference between both the series at the time of Rollover must be settled.

E.g., Rupa has a long position in one lot (75 Qty) of Futures of Nifty for the current month. She sees some more upside left in the near Future. She decides to Rollover the position to the next month and pays the difference in the prices of both contracts. If a current month's nifty contract price is Rs. 14110 and next month's price is Rs. 14,150. She needs to pay the difference in the price, i.e. (14150-14110) *75 = Rs. 3,000

Rollover percentage, on the other hand, is calculated by dividing the next month and the far month contracts from the total Futures contracts available in the underlying asset and then multiplied by 100. High Rollover percentage indicates that current momentum will continue.

Rollover percentage = {(Next month Open Interest + Far month Open Interest) / (Near month Open Interest + Next month Open Interest + Far month Open Interest)} *100

Spread position

A Spread position in a Futures contract involves taking simultaneous opposite positions in two contracts to benefit from the price discrepancy of the two. The underlying asset in the two contracts is the same.

For example, let’s take Aisha’s contract. The current price of Nifty Futures for July 2021 expiry Rs 15670 per unit. Rupa believes the price might increase to 15800 but not beyond 15900. Rupa takes a long position in the 1-month Futures contract and a short position in the 3-month Futures contract. This strategy is called Calendar Spread.

- There may be a large difference in the Futures prices in two consecutive months. When that deviation in Future prices happens from the fair value is large, a Spread position can be taken. The contract which is overvalued must be sold and simultaneously the contract of the adjacent month should be bought.

- In a Spread position, both the positions need to be closed simultaneously, otherwise the single position will be considered a naked position and require a higher margin in comparison to the Spread position.

Margin and risk involved in a Spread position in Futures contract

The Spread position value is calculated by multiplying the weighted average price of the position in a far month contract and Spread position quantity.

Spread margin percentage is then applied to the Spread position value to arrive at the Spread margin. The only risk the trader is exposed to is basis risk. In simple terms, the basis is the difference between the prices of two positions. In the Calendar Spread example, the basis risk can be calculated as below:

Basis = Futures price of two months - Futures price of one month

The risk for the Calendar Spread is that the basis amount might not remain constant, which means that the price of two months or one month might change unexpectedly, leading to a change in the basis.

Is it better to take a Spread Futures position in comparison to a single Futures contract?

Yes, trading through Spread positions can hedge the risk when compared to taking a position in a single Futures contract. Every Spread position is a hedge position as simultaneous buying and selling is done in two different Futures contracts (of the same underlying) of two maturities. You hedge your buy position by a sell position in a subsequent month or vice versa.

Secondly, margin requirements will also reduce when a trader opts for Spread trading strategies. However, do note that as Spread positions have less risk, the probability of profit is also less.

Summary

- Open Interest is the number of contracts that are due or active in the market and are yet to be settled.

- A single contract, with a buyer and a seller, is accounted for as one Open Interest contract.

- Rising Open Interest supported by rising prices is an indication of a building of long positions. Conversely, increasing Open Interest and falling prices are a sign of a building short positions.

- The process of extending or carrying forward a Futures position to another position with a new expiry date is called Rollover.

- When you Rollover a Futures contract, the price difference between both the series at the time of Rollover has to be settled.

- Rollover percentage is calculated by dividing the next month and the far month contracts from the total Futures contracts available in the underlying asset and then multiplied by 100.

- A Spread position in a Futures contract involves taking simultaneous opposite positions in two contracts to benefit from the price discrepancy of the two. The underlying asset in the two contracts is the same.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)