Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 8: Options Summary

Options are derivative instruments that gives one party, the buyer, an Option, rather than an obligation to honour the contract.

- The buyer of an Option is known as the holder.

- The seller of an Option is known as the writer.

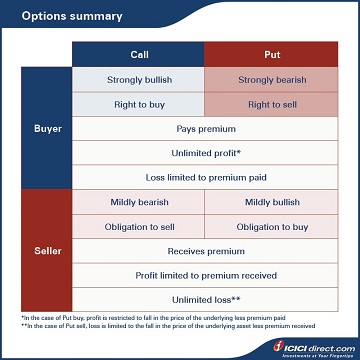

A Call Option is the right, not the obligation, to buy an underlying asset at an agreed price on or before a particular date. On the other hand, a Put Option is the right, not the obligation, to sell an underlying asset at an agreed price on or before a particular date.

Some important terms to recollect

- The strike price refers to the rate at which an investor has entered into the Options contract. Various strike prices are available in the market. They can be available at prices lower than the spot price and or higher than the spot price.

- Options premium is the price that the party going long (or the buyer) pays to the seller of an Option to acquire a right.

- Time value is the reducing value of an Options contract over a period of time, until it becomes zero on expiry. As the time value of an Option becomes zero, pay off from an Option on expiry is equivalent to its intrinsic value.

Risks in Options contract

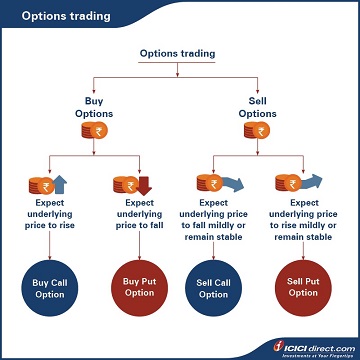

Risk in an Option contract depends upon the position held by the buyer or seller. In case the participant is going long (buyer) on the Option, then their risk is limited to the extent of the premium paid. The maximum risk they bear is not to exercise the Option and let it expire. The loss will be equal to the premium paid.

On the other hand, the risk for the Option writer is unlimited. This is because the Option writer has no choice but to fulfill the obligation that will arise after the Option is exercised by the Option holder. The price can fluctuate drastically and cause a steep loss.

Call Holders – When an individual buys a Call Option, they are buying the right to purchase the stock at a specific price. Here, the possibility of profit is unlimited, but the loss is limited to the Options premium.

Call Writers – If one is to write or sell a Call Option, they have an obligation to sell the underlying asset to another party. The profit potential is the Options premium they receive; the loss potential is unlimited since the price of the underlying asset could go up indefinitely.

Put Holders – If an individual buys a Put Option, they are buying the right to sell an underlying asset at a predetermined price. The upside potential or profit possibility is the difference between the spot price and the strike price. The loss is limited to the premium amount.

Put Writers – When an individual sells a Put Option, they have an obligation to buy the underlying asset from a third party. The profit potential is limited to the Options premium, while the downside or loss risk is limited to the underlying asset’s worth.

Settlement of Options contract

In India, Options contracts are settled on a cash basis before expiry which means that the Option buyer will receive the payoff accrued to the Option from the Option seller (writer) on expiry.

If you don’t square off your derivatives positions in stocks before the close of trading hours on the day of expiry, you will either have to take delivery (for long Futures, long Calls, short Puts) or give delivery of the underlying stock (short Futures, long Puts, short Calls) for the contract.

For example, a 3-month Call on Stock A at a contract price of Rs. 500 has a lot size of 1,000 shares. At expiry, the price becomes Rs. 520 and then long will exercise his right to buy the shares and pay Rs. 5 lakh to the short who in turn will deliver 1,000 shares of A.

Summary

- Risk in an Option contract depends upon the position held by the buyer or seller.

- For Call holders, the possibility of profit is unlimited, but the loss is limited to the Options premium.

- For Call writers, the profit potential is the Options premium they receive while the loss potential is unlimited.

- For a Put holder, the upside potential or profit possibility is the difference between the spot price and the strike price. The loss is limited to the premium amount.

- For Put writers, the profit potential is limited to the Options premium, while the downside or loss risk is limited to the underlying assets’ worth.

- In India, Options contracts are settled on a cash basis before expiry which means that the Option buyer will receive the payoff accrued to the Option from the Option seller (writer) on expiry.

This brings us to the end of the Options basics. In the next chapter, you will learn about how to choose the right Options contract. Do not miss it.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)