Learning Modules Hide

Hide

- Chapter 1: Basics of Derivatives

- Chapter 2: Futures and Forwards: Know the basics – Part 1

- Chapter 3: Futures and Forwards: Know the basics – Part 2

- Chapter 4: A Complete Guide to Futures Trading

- Chapter 5: Futures Terminology

- Chapter 6 – Futures Trading – Part 1

- Chapter 7 – Futures Trading – Part 2

- Chapter 8: Understand Advanced Concepts in Futures

- Chapter 9: Participants in the Futures Market

- Chapter 1: Introduction to Derivatives

- Chapter 2: Introduction to Options

- Chapter 3: An Options Trading Course for Option Trading Terminology

- Chapter 4: All About Options Trading Call Buyer

- Chapter 5: All About Short Call in Options Trading

- Chapter 6: Learn Options Trading: Long Put (Put Buyer)

- Chapter 7: Learn Options Trading: Short Put (Put Seller)

- Chapter 8: Options Summary

- Chapter 9: Learn Advanced Concepts in Options Trading – Part 1

- Chapter 10: Learn Advanced Concepts in Options – Part 2

- Chapter 11: Learn Option Greeks – Part 1

- Chapter 12: Option Greeks – Part 2

- Chapter 13: Option Greeks – Part 3

- Chapter 1: Learn Types of Option Strategies

- Chapter 2: All About Bull Call Spread

- Chapter 3: All About Bull Put Spread

- Chapter 4: Covered Call

- Chapter 5: Bear Call Spread

- Chapter 6: Understand Bear Put Spread Option Strategy

- Chapter 7: Learn about Covered Put

- Chapter 8: Understand Long Call Butterfly in Detail

- Chapter 9: Understand Short Straddle Strategy in Detail

- Chapter 10: Understand Short Strangle Option Strategy in Detail

- Chapter 11: Understand Iron Condor Options Trading Strategy

- Chapter 12: A Comprehensive Guide to Long Straddle

- Chapter 13: Understand Long Strangle Option Strategy in Detail

- Chapter 14: Understand Short Call Butterfly Option Trading Strategy

- Chapter 15: Understanding Protective Put Strategy

- Chapter 16: Protective Call

- Chapter 17: Delta Hedging Strategy: A Complete Guide for Beginners

Chapter 9: Understand Short Straddle Strategy in Detail

Abhinav’s manager, Simran, tells him that her market outlook for stock ABC Ltd is rangebound in the near term. Accordingly, she asks Abhinav to suggest an Options strategy for ABC Ltd. Abhinav, after careful consideration, suggests the Short Straddle strategy. Let’s take a look at the details of this strategy.

What is Short Straddle

In a Short Straddle, the trader sells a Call and a Put on the same underlying for the same expiry and strike price. The Options sold are normally ATM Options. The risk in the Short Straddle is unlimited. However, returns are capped to the extent of premium received.

Strategy: Short ATM Call Option (Leg 1) + Short ATM Put Option (Leg 2)

When to use: When you believe that the price of the underlying will not exhibit significant volatility in the near term, and will remain in a particular range

Breakeven: There are two breakeven points:

1. Upper breakeven point: Strike price of short Call Option + Total premium received

2. Lower breakeven point: Strike price of a short Put Option – Total premium received

However, the strike price of the Call and Put Options is the same in this strategy.

Maximum profit: Limited to the premium received

Maximum risk: Unlimited

Let’s understand this strategy with an example:

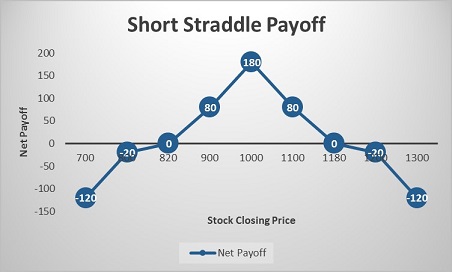

Abhinav sells ABC Ltd. ATM Call and Put Options at a strike price of Rs. 1,000, with premiums of Rs. 100 and Rs. 80 respectively. Abhinav receives a total premium of Rs. 100 + Rs. 80 = Rs. 180, and this will be the maximum profit. He will lose money if the stock moves more than 180 points in any direction i.e., above Rs. 1,180 or below Rs. 820.

Let’s look at the cash flow in various scenarios:

|

Closing price of ABC Ltd. on expiry (Rs.) |

Payoff from ATM Call Option (A) (Rs.) |

Payoff from ATM Put Option (B) (Rs.) |

Net payoff (A+B) (Rs.) |

|

700 |

100 |

– 220 |

– 120 |

|

800 |

100 |

– 120 |

– 20 |

|

820 |

100 |

– 100 |

0 |

|

900 |

100 |

– 20 |

80 |

|

1000 |

100 |

80 |

180 |

|

1100 |

0 |

80 |

80 |

|

1180 |

–80 |

80 |

0 |

|

1200 |

–100 |

80 |

– 20 |

|

1300 |

–200 |

80 |

– 120 |

Let us understand the payoff in various scenarios. It will give you a fair idea of how we have arrived at the above values.

If the stock closes at Rs. 800 on expiry: Leg 1 expires OTM while leg 2 expires ITM

Leg 1: Premium received on the ATM Call Option of strike price Rs. 1000 = Rs. 100

Premium paid on ATM Call Option of strike price Rs. 1000 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (800 – 1000)} = Max (0, – 200) = 0

So, the payoff from the ITM Call Option = Premium received – Premium paid = 100 – 0 = Rs. 100

Leg 2: Premium received on the ATM Put Option of strike price Rs.1000 = Rs. 80

Premium paid on ATM Put Option of strike price Rs. 1000 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 800)} = Max (0, 200) = Rs. 200

So, the Payoff from the ATM Put Option = Premium received – Premium paid = 80 – 200 = – Rs. 120

Net payoff = Payoff from ATM Call Option + Payoff from ATM Put Option = 100 + (– 120) = – Rs. 20

If the stock closes at Rs. 1000 on expiry: Both the legs expire ATM

Leg 1: Premium received on the ATM Call Option of strike price Rs. 1000 = Rs. 100

Premium paid on ATM Call Option of strike price Rs. 1000 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1000 – 1000)} = Max (0, 0) = 0

So, the payoff from the ITM Call Option = Premium received – Premium paid = 100 – 0 = Rs. 100

Leg 2: Premium received on the ATM Put Option of strike price Rs.1000 = Rs. 80

Premium paid on the ATM Put Option of strike price Rs. 1000 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 1000)} = Max (0, 0) = 0

So, the Payoff from the ATM Put Option = Premium received – Premium paid = 80 – 0 = Rs. 80

Net payoff = Payoff from ATM Call Option + Payoff from ATM Put Option = 100 + 80 = Rs. 180

If the stock closes at Rs. 1200 on expiry: Leg 1 expires ITM while leg 2 expires OTM

Leg 1: Premium received on the ATM Call Option of strike price Rs. 1000 = Rs. 100

Premium paid on ATM Call Option of strike price Rs. 1000 at expiry = Max {0, (Spot price – Strike price)} = Max {0, (1200 – 1000)} = Max (0, 200) = Rs. 200

So, the payoff from the ITM Call Option = Premium received – Premium paid = 100 – 200 = – Rs. 100

Leg 2: Premium received on the ATM Put Option of strike price Rs.1000 = Rs. 80

Premium paid on ATM Put Option of strike price Rs. 1000 at expiry = Max {0, (Strike price – Spot price)} = Max {0, (1000 – 1200)} = Max (0, – 200) = 0

So, the payoff from the ATM Put Option = Premium received – Premium paid = 80 – 0 = Rs. 80

Net payoff = Payoff from ATM Call Option + Payoff from ATM Put Option = (– 100) + 80 = – Rs. 20

Additional Read: ATM Straddle writing suggesting consolidation in expiry week

Summary

- In a Short Straddle, the trader sells a Call together with a Put on the same underlying for the same expiry and strike price. The Options sold are normally ATM Options.

- The strategy is used when the trader believes that the price of the underlying will not exhibit significant volatility in the near term, and will remain in a particular range.

- Breakeven: There are two breakeven points:

- Upper breakeven point: Strike price of short Call Option + Total premium received

- Lower breakeven point: Strike price of a short Put Option – Total premium received

- Maximum profit: Limited to the premium received

- Maximum risk: Unlimited

In the next chapter, we will look at one more neutral-view Options strategy: A Short Strangle.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)