XIRR in Mutual Funds: What is XIRR, Calculation & Benefits

Conclusion

Mutual funds have become a popular means of investing for the masses because of ease of investing, low ticket size, and relatively lower costs. The investment tool has become ‘go to’ avenue for those that want to get decent returns on equities but do not have time or expertise to manage their own portfolio.

If you are invested in a mutual fund, you can know what return your fund has deliveredFor calculating the returns, you should know three kinds of interest rate calculations while investing in mutual funds – Absolute returns, Compounded Annual Growth Rate (CAGR) and Extended Internal Rate of Return (XIRR).

What is XIRR?

XIRR or extended internal rate of returnis a variation of the Internal Rate of Return (IRR), a metric used in financial analysis to estimate the profitability of potential investments. Since it is a variation, there are slight differences. IRR aggregates the cash flow into annual periods without taking into account the timing of the actual cash flow. At the same time, it is also assumed that cash flow is periodic, meaning it is happening at a set interval. Whereas, XIRR is more flexible and allows a person to accommodate variations. It not just calculates the returns on SIP investments but also accommodates lump sum investment made in the same fund during the period you were invested in.

XIRR Formula

The formula of XIRR is as follows:

XIRR = (NPV (Cash Flow, r)/Initial Investment) *100

Understand XIRR With an Example

Say you invest in a mutual fund of ₹10,000 every month. XIRR considers it whenever the investment of an amount is made. The money put in earlier worked harder for you than the recent contributions. A simple average return is therefore not sufficient. That said, an XIRR overcomes this by calculating an annualized return considering these differences in time.

Take an example: suppose you invest ₹10,000 every month for one year and your total grows to ₹1,20,000. XIRR will consider the ₹10,000 invested in January and will work for 12 months, whereas the contribution in December will work for 1 month only. It will thus give you a better idea of how your investment returned during the one year.

How XIRR Works in Mutual Funds?

The Extended Internal Rate of Return or XIRR is a financial metric that calculates the annualized return on mutual fund investments. It considers the timing and amount of cash flows. It is particularly useful in cases where the calculation of the rate of return is for an investment with irregular cash flows, such as a Systematic Investment Plan. Therefore, XIRR takes into account both the date and amount of each transaction to give a fair return rate where simple IRR cannot. It is calculated using a financial calculator or spreadsheet software, and is an indicator that alerts investors about their investment performance in a more descriptive manner.

How to calculate XIRR?

XIRR is calculated using Microsoft Excel or any similar application. It is tedious to calculate XIRR using pen and paper. However, you do not need to be an expert at MS Excel to calculate the XIRR of a mutual fund. Neither you need to know the net asset value (NAV) of the mutual fund you had invested in. All you need to know is your SIP amount, SIP dates and maturity amount and maturity date. The software will take care of the rest.

The sequence to calculate XIRR is as follows:

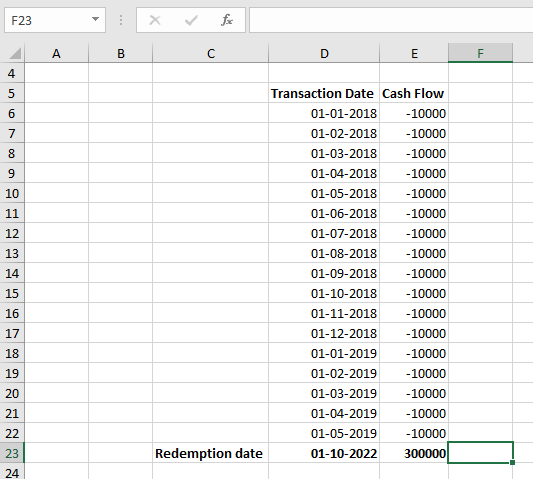

Step 1: Open a blank workbook on MS Excel

Step 2: In one column, write a header ‘Transaction Date’ and start entering the transaction date right below it. The transaction date here is when your mutual fund house credits units in lieu of your investments.

Step 3: In the adjoining column on the right, write the header ‘Cash Flow’. Now start adding the SIP amount against the respective dates. Keep in mind to use negative values for them, not positive ones. This is just to denote that cash is flowing out of your account, not coming in.

Step 4: Now, in the first column, write the date of redemption at the bottom, that is, in the cell just below the last transaction date. The date of redemption refers to the date on which you sold your investment. Now add the redemption amount that you received in the column against it. This should be a positive value as the money is flowing into your account.

Note that if you have not sold the investment but want to calculate the returns, you can simply add today’s date. In such a case, you need to know the total value of your investment as of this date. The total value can be calculated very simply by multiplying the latest NAV by the number of units of mutual funds you hold.

You can see the entire process in the example below:

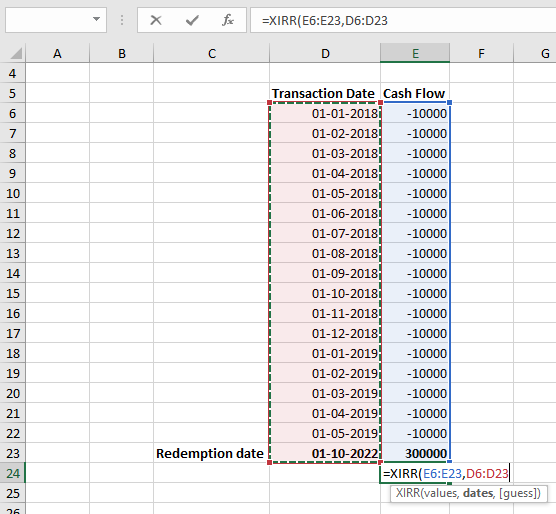

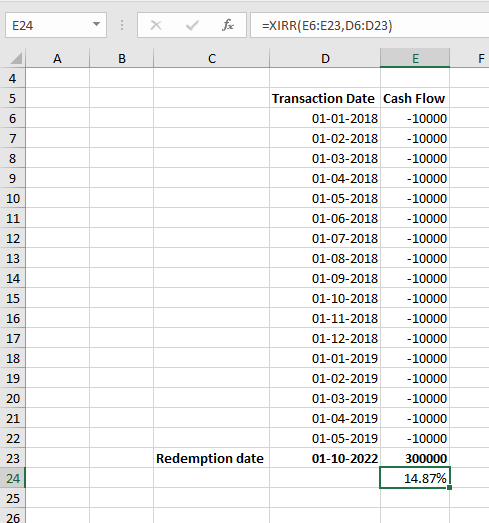

Step 5: Now, in any cell, type ‘=’. This will invoke the formula function. Following this, type XIRR. Select the formula that appears by either pressing Tab on the keyboard or left clicking on the mouse. When the formula asks you to enter values, select all values in the Cash Flow column from top to bottom. Now, type a comma and select all dates as shown below.

Step 6: Close the bracket, and press Enter. Keep the cell you entered the formula in selected and click on per cent (%) button in the Number section under the Home ribbon. This will convert the result into a percentage. This is the XIRR, you are seeking.

In our example, the fund returned 14.87 per cent in the indicated period.

The formula of XIRR is as follows:

XIRR = (NPV (Cash Flow, r)/Initial Investment) *100

What are the benefits of calculating XIRR in a mutual fund?

- Accurate performance measurement: XIRR gives a more accurate measure in regard to investment performance since it considers both the date and the amount of each cash flow. Consequently, XIRR may be considered the closest value of the real rate of return instead of the simple IRR.

- Comparative Analysis: Using XIRR, investors are able to compare the performance between different mutual funds or any other investment avenues with irregular cash flows before investing in a particular fund.

- SIP Investment: XIRR can be helpful in calculating the actually realized yields on the periodical investments for the investors under Systematic Investment Plans.

- Easy to Calculate: XIRR can be very easily calculated using Microsoft Excel and similar software without requiring high financial knowledge or the Net Asset Value (NAV) of the mutual fund.

- Informed Decision Making: An understanding of XIRR will help investors in decision making with respect to investments, for instance, between a lump sum investment and a SIP or the time when an investor must redeem their investments.

What is the Difference between XIRR and CAGR?

|

Feature |

XIRR |

CAGR |

|

What it measures |

Internal Rate of Return (IRR) considering irregular cash flows. |

Compound Annual Growth Rate (CAGR) assuming a steady growth rate. |

|

Suitable for |

Investments with multiple deposits/withdrawals (SIPs, dividends). |

Lump sum investments with no additional deposits/withdrawals. |

|

Calculation |

Considers timing and amount of each cash flow. |

Uses only starting and ending investment values. |

|

Accuracy for SIPs |

More accurate, reflects reinvestment of returns. |

Less accurate, may underestimate returns. |

Conclusion

The XIRR is a powerful tool to measure the performance of mutual funds or even any other investment with irregular cash flows. Compared to simple average returns, it takes the timing of each cash flow into account for a more accurate amount of annualized returns. On Excel, the calculation of XIRR from a series of cash flows is relatively simple and requires only some easy steps on your part to be in the know about the return the investment is giving you. XIRR aids the investor in understanding, applying, and comparing investments for informed decisions, finally cumulating into better financial outcomes. Thus, it makes XIRR one of the most cardinal numbers that one can possibly have in assessing one's investment returns.

XIRR FAQs

What is a good XIRR in mutual funds?

A "good" XIRR with regards to mutual funds will depend on market conditions, the performance of the specific fund, and your own goals. By general standards, XIRR above the average market-returned rate or above inflation is good. For instance, if the average market returns amount to 8%, then 12% XIRR indicates good performance. In simple terms, an XIRR more than 12% is good for Equity Mutual Funds and over 7.5% is acceptable for Debt Mutual Funds. So, keep an eye on your XIRR to assess how your investments are doing!

How XIRR is different from absolute return?

Absolute return is just the total gain or loss, like a basic percentage. XIRR is more precise for investments like mutual funds where you add money over time. It considers when you invested each amount, giving a more accurate picture of your overall return.

How much XIRR is good for mutual funds?

Determining a "good" XIRR for mutual funds depends on various factors, including the type of fund, market conditions, and investment duration. Generally, an XIRR that exceeds the fund's benchmark index and inflation rate is considered favourable. However, it's essential to evaluate XIRR in the context of your investment goals, risk tolerance, and the fund's historical performance.

Is XIRR better than CAGR?

XIRR is better than CAGR for assessing investments with irregular cash flows like those in mutual funds.

Is XIRR compounded annually?

No, XIRR actually helps you assess returns considering compounding that happens more frequently, throughout the year. This gives a more accurate idea of your mutual fund's performance compared to annual compounding.

What are the limitations of XIRR?

XIRR assumes your returns are reinvested at the XIRR rate, which might not be realistic. It also doesn't consider risk. While great for SIPs, it may not be perfect for complex situations.

Can we convert XIRR to CAGR?

No, directly converting XIRR to CAGR isn't recommended. XIRR considers irregular investments, while CAGR assumes a steady growth rate. They measure performance differently. However, both can be helpful!

Is 100% XIRR good?

An XIRR of 100% is very high and uncommon for mutual funds. It likely means your investment doubled in a year, which can be great! But remember, XIRR assumes returns are reinvested at that rate, which might not be realistic. It's best to compare your XIRR to typical returns for the fund type.

What does XIRR of 10% mean?

An XIRR of 10% means that if you had invested a lump sum at the beginning and reinvested all earnings at 10% annually, you would have achieved the same overall return you got with your actual contributions throughout the year. It's a good estimate of your investment's performance

Top Mutual Funds

Top Mutual Funds

COMMENT (0)