Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

Your ability to take any risk is a function of your confidence in your future income. If you are on a high-income path, you may be in a better position to take risks. But before making investments, you may want to perform a few tests on shortlisted mutual fund schemes. At the end of this chapter, we hope you are able to choose your mutual fund scheme wisely to deploy your hard-earned savings.

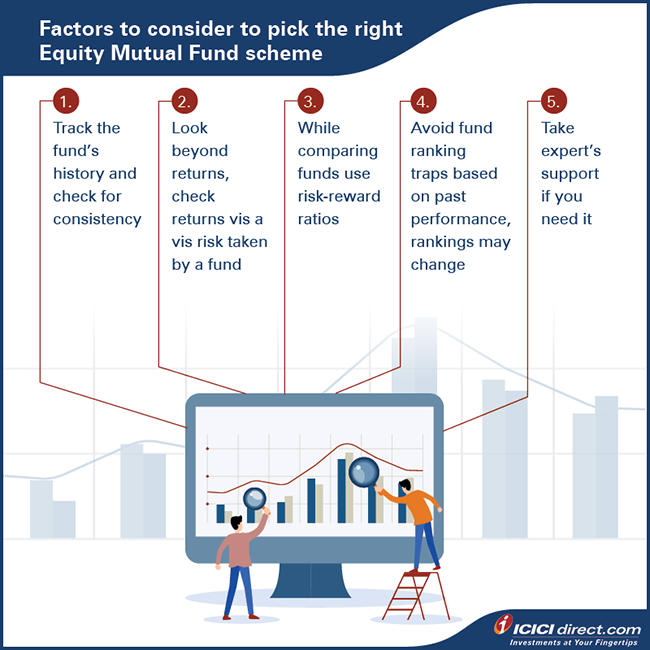

How to choose the right Equity Mutual Fund scheme?

Are you ready to select an equity mutual fund scheme? These basic principles will help you make the right choice:

1. Track the fund’s history: Has the fund been a top performer in recent months? Wonderful! But you, as an investor, should not be swayed by recent good performance. Look into the fund’s history over a longer period instead. Study its performance, say over the last five years, and take note of its ups and downs.

2. Look beyond returns: Shortlisted a fund that brings good returns? Before you commit to the scheme, however, check up on its risk-reward parameters. Use the Sharpe, Treynor, and Sortino ratios (among others) to make your decision.

3. Don’t rely only on past performance: A fund with a good track record is a good thing. Just remember that the past performance of the fund does not necessarily guarantee good performance in the future. It is better to choose a fund wisely based on the evaluation ratio.

4. Avoid fund ranking traps: If you have shortlisted only the top-performing funds, wait a moment before investing. The fund rankings will keep on changing. So, if a top performer today slips down the ranks a year later, it doesn't mean that you should also change your portfolio. Stay invested in good funds for a long period.

5. Get support if you need it: If you are new to mutual fund investment, you could approach an expert for support. It may help to choose a fund with the help of a trusted and qualified adviser. Just ensure that they understand your needs while suggesting funds for you to invest in.

Risk with Equity Mutual Funds

All investments are subject to some risk. And that holds for equity mutual funds as well. The risk is lower than if you were directly investing in stocks. But the risk is higher than if you were to invest in debt instruments or fixed deposits.

Remember! Equity mutual funds invest in the stocks of individual companies. The performance of the fund depends on how the companies in which the fund invests perform.

What kinds of risks could your equity mutual fund investment face? Take a look!

- Volatility: Equity mutual fund returns are volatile. That’s because the Net Asset Value (NAV) fluctuates as per market movements.

Here’s a tip! Go with periodic investments in equity funds instead of lump-sum investments. Systematic Investment Plans (SIPs) in these funds can reduce the impact of volatility in the long term. - Market-based return: Equity funds don't provide guaranteed returns. The returns that you eventually receive will depend on various factors. These include:

- market risks like interest rate, inflation, and the political environment

- company-specific risks like financial risk

- Fund management risk: The fund returns depend, to a great extent, on the stock-picking and decision-making abilities of the fund manager.

Here’s a tip! Invest in funds that are managed by fund managers who have a proven track record.

- Concentration risk: Sometimes equity mutual funds may have major exposure to a single stock or sector. If this stock or sector performs badly, it would impact the fund returns due to the concentration risk. Thematic and sectoral mutual funds usually have high concentration risks.

- Here’s a tip! Be careful while investing in funds that have a high concentration in a single stock or sector. Such a fund may not remain fully diversified and this would increase the unsystematic risk. Such mutual funds may not be suitable for everyone and should be chosen only after taking individual risk tolerance into consideration.

Before investing in an equity mutual fund, get a clear understanding of your risk appetite. Are you comfortable with a riskier scheme? Or, would you prefer a fund that is low-risk and brings moderate returns?

Points to remember

- Beta measures the market risk of an equity mutual fund.

- Use standard deviation to measure total risk.

- Alpha is used to assess a fund manager’s performance.

Is it better to invest directly in shares instead of Mutual Funds?

Stock selection is the key to generating returns on an equity portfolio. So, how can a mutual fund help?

When you invest in a mutual fund, you outsource the stock selection to a professional fund manager. The fund manager is qualified to select stocks efficiently in order to maximise the returns of investors.

If you compare the return of an individual stock with a mutual fund, then the former may provide better returns. But note the disadvantages as well!

- You would need to diversify your portfolio by holding 10 to 15 different securities.

- It is unlikely that all the chosen securities will perform well consistently.

- If you invest in individual stocks, you will need to continuously track and review their performance. That is time-consuming and requires market knowledge.

All of this would be taken care of by fund manager in case of a mutual fund.

Let’s summarise the risks and rewards of direct stock and mutual fund investments. Assuming similar market conditions for both investments, here’s how the two compare:

|

Direct Stock |

Equity Mutual Fund |

|

|

Risk |

High |

Low in comparison to direct stock |

|

Reward |

High |

Low in comparison to direct stock |

Summary

- The basic aspects to look at before investing in a mutual fund are:

- Fund history

- Past performance

- Risk factors

- Risk-reward ratio

- Avoid ranking traps

- Reach out to an expert if you need the advice

- The risks with investing in equity mutual funds are:

- Volatility

- Market-based returns

- Fund-management risk

- Concentration risk

- Before investing in equity mutual funds, have a clear understanding of your goals, risk appetite and the kind of mutual fund you want to invest in.

Now that we’ve covered what goes into evaluating equity mutual funds, the next chapter will look at similar metrics for debt mutual funds.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)