Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

After learning about the regulations, Ritika is now confused about what kind of fund she should invest in. Should she go with an open-ended fund or a close-ended fund? What is an interval fund? Should she look at a growth fund or a dividend fund?

Let’s dive into some of these concepts and clear it up for her.

Open-Ended, Close-Ended, And Interval Funds

How flexible is a mutual fund? To find out, you will need to check if it is an open-ended, close-ended, or an interval fund.

Open-ended mutual fund:

Open-ended funds are very flexible and the most common type of mutual fund. There are no time restrictions on entering and exiting the investment. You can buy and redeem mutual fund units at any time.

Close-ended mutual fund:

These funds are open for investment only during the New Fund Offer (NFO) period. That restricts when you can buy mutual fund units. Moreover, you can redeem the units only after completion of the fund tenure, i.e. on maturity, unless the fund is converted into an open-ended fund or the tenure rolls over.

Read more at: Open Ended Vs Close Ended

Can you exit the investment prematurely? Yes, you can trade the fund units on the stock exchange. SEBI mandates close-ended funds to be listed on the stock exchange to provide liquidity to investors.

Interval fund:

Interval funds are a blend of open-ended and close-ended funds. They allow investors to buy or redeem units only during specific pre-specified points of time.

|

Open-Ended Mutual Funds |

Close-Ended Mutual Funds |

|

Can be bought at any time |

Can be bought only during the NFO period |

|

Can be redeemed (sold) at any time |

Have a lock-in period and can be redeemed (sold) only on completion of fund term |

|

Don’t have to be listed on a stock exchange |

Have to be listed on an exchange to provide liquidity to investors before maturity |

|

Number of outstanding units can fluctuate |

Fixed outstanding units |

Mutual Fund units and Net Asset Value (NAV)

Before investing in mutual funds, one should be familiar with two concepts—mutual fund units and Net Asset Value (NAV).

Here’s an example to illustrate how mutual fund units and NAV are related:

Shashi is investing in an open-ended mutual fund scheme. Let’s look at the basics:

- Shashi’s fund value will depend on the number of mutual fund units he buys.

- How many units can he buy? That will depend on the fund’s Net Asset Value (NAV) on the day of mutual fund investment.

- Any returns will be distributed to Shashi in proportion to the number of units he holds.

- What if Shashi wants to exit the investment? The redemption value of each unit will depend on the NAV prevailing on that day.

NAV represents the value of one mutual fund unit. To calculate it, divide the fund's net worth by the total number of units issued. Here's the basic formula:

NAV = (Total Assets – Total Liabilities)/Total No. of Units Issued

Did you know?

At the time of a New Fund Offer (NFO), the NAV of each unit is Rs 10. After that, the NAV fluctuates daily based on the prevailing value of the fund’s portfolio.

Here’s an example to show how NAV affects your investment:

Meet Anil, Binita, and Chirag. They invested Rs 10,000, Rs 20,000, and Rs 50,000 respectively in Mutual Fund X on the same day. The fund had a NAV of Rs 20 at the time.

How many units did each investor get?

|

Amount Invested in Mutual Fund X |

Units Received (= Amount Invested/Prevailing NAV of Rs 20) |

|

Anil invested Rs 10,000. |

That fetched him 500 mutual fund units. |

|

Binita invested Rs 20,000. |

That fetched her 1,000 mutual fund units. |

|

Chirag invested Rs 50,000. |

That fetched him 2,500 mutual fund units. |

Fast-forward to a year later. The NAV of Mutual Fund X has risen to Rs 24.

Here are the current fund values of our three investors:

|

No. of Units in Mutual Fund X |

Current Fund Value of Investor (= No. of Units x Prevailing NAV of Rs 24) |

|

Anil holds 500 mutual fund units. |

His current fund value is Rs 12,000. |

|

Binita holds 1,000 mutual fund units. |

Her current fund value is Rs 24,000. |

|

Chirag holds 2,500 mutual fund units. |

His current fund value is Rs 60,000. |

Should they exit their investments at this stage, they will each receive their current fund value.

How much will they earn if they exit?

|

Profit on Investment in Mutual Fund X (= Current Fund Value – Original Investment) |

Profit Percentage ( = [Profit/Original Investment] x 100) |

|

Anil earns a profit of Rs 2,000. |

20% |

|

Binita earns a profit of Rs 4,000. |

20% |

|

Chirag earns a profit of Rs 10,000. |

20% |

The profit percentage for all three investors is 20%. That’s because the NAV has increased by 20%. The returns are distributed based on the number of units that each investor holds.

Low NAV vs high NAV

Investors often feel that a fund with a low NAV is likely to perform better. That’s a common misconception. Fund returns depend on two things: (1) the market and (2) the fund manager’s capability. So, don’t just focus on the net rupee gain from a low NAV fund. Make sure to assess the fund’s performance in percentage terms.

Also Read: High NAV Mutual Funds or Low NAV Mutual Fund - What is Better?

Remember: If a mutual fund has a high NAV, it could indicate a well-managed fund. A mutual fund that performs well consistently may see a continued uptick in its NAV. Over time, the continuous gains result in a high NAV. However, be wary of funds that have attracted considerable assets under management. When the corpus is too large, managing effectively can get complicated.

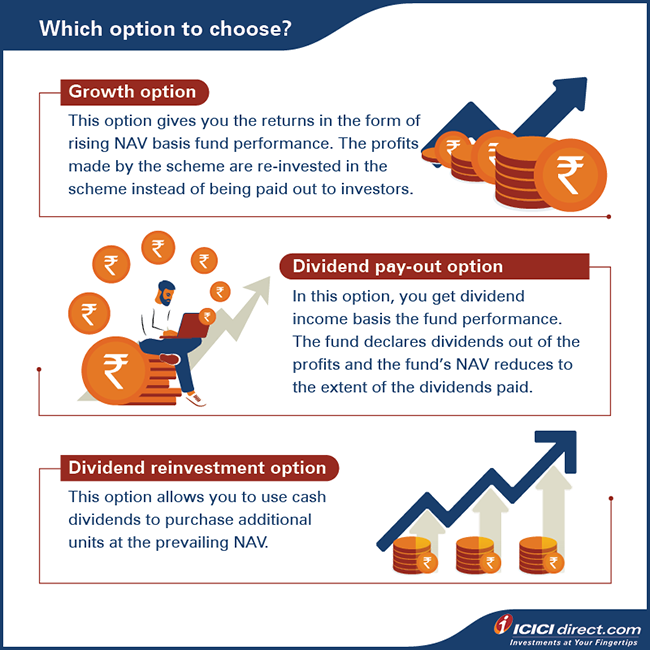

Growth and Dividend options

Most mutual funds offer two investment options at the time of investment: (1) growth option and (2) dividend option.

-

Growth option:

The AMC does not declare any dividend on the scheme. If the fund generates returns, the NAV increases. Consequently, the market value of the mutual fund units rises as well. -

Dividend option:

If the fund generates returns, the AMC declares a dividend. That is deducted from the NAV. If you choose the dividend option, you have two other choices: -

Dividend pay-out:

The declared dividend amount is paid to investors. Once again, the payment is in proportion to the number of units held by each investor. -

Dividend reinvestment:

The declared dividend amount is invested in the same fund at the revised NAV (also known as ‘ex-dividend NAV). The additional units are then allocated to the investor.

Here’s an example to show you how the growth and dividend options work:

Sharmila invests Rs 1 lakh in a mutual fund when its NAV is Rs 20. That brings her 5,000 mutual fund units (i.e. Rs 1 lakh/Rs 20).

A year later, the NAV rises to Rs 25, and the AMC declares a dividend of Rs 2 per unit. What are the possible scenarios for growth and dividend options? Let’s take a look:

-

Growth option:

The NAV remains at Rs 25. Sharmila’s fund value grows to Rs 1.25 lakh (i.e. 5,000 units x Rs 25). -

Dividend option:

The declared dividend is subtracted from the NAV. So, the ex-dividend NAV stands at Rs 23* (i.e. Rs 25 – Rs 2). Sharmila’s fund value is now Rs 1.15 lakh (i.e. 5,000 units x Rs 23). -

Dividend pay-out:

Sharmila receives a dividend pay-out of Rs 10,000 (i.e. 5,000 units x Rs 2). -

Dividend reinvestment:

Sharmila earns a dividend of Rs 10,000 (i.e. 5,000 units x Rs 2). This amount is reinvested in the scheme at the current NAV. Sharmila receives 434.7826 units with the Rs 10,000 dividend (i.e. Rs 10,000/Rs 23). She now holds a total of 5,434.7826 units (i.e. 5,000 units + 434.7826 units). This pushes up her fund value to nearly Rs 1.25 lakh (i.e. Rs 1.15 lakh + [434.7826 x Rs 23]).

On the NAV, Dividend Distribution Tax (DDT) will be applicable. DDT rate depends on the type of the fund. This will reduce the NAV. However, the same has not been accounted for in the example to keep calculations simple. Dividends are taxable in the hands of the investors.

Summary

- Mutual funds are either open-ended, close-ended, or interval funds.

- Open-ended funds have no time restrictions on entering and exiting the investment. You can buy and redeem mutual fund units at any time.

- Close-ended funds can only be invested in during the New Fund Offer (NFO) period. They are not as flexible as open-ended funds.

- Interval funds are a blend of open-ended and close-ended funds. They allow investors to buy or redeem units only during specific pre-specified points of time.

- It can be helpful to know more about mutual fund units and Net Asset Value (NAV), before you invest.

- NAV represents the value of one mutual fund unit.

- Typically, mutual funds offer growth or dividend investment options.

- When the AMC does not declare any dividend and reinvests profits, it is a growth option. This is ideal for investors who want to generate wealth in the long term.

- If the fund generates returns, and the AMC distributes this as dividend among investors, it is a dividend option. This is ideal for investors seeking regular income.

We now continue to the second part of decoding mutual funds jargon and how they work in the next part of the same chapter.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)