Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 5: Learn How to Choose the Right Debt Mutual Fund

Nothing in life is risk-free. With investments, you can reduce your risk exposure, but eliminating it completely is not really a possibility.

A smart investor always makes an informed decision. If you know you want to minimize risk but still take advantage of mutual funds, you may have decided that debt mutual funds are the way to go. But, you need to know the risks that come with debt mutual funds.

Risk in Debt Mutual Funds

With debt securities, there are two major risks:

- Interest rate risk

- Default risk or credit risk

Do you remember?

- Interest rate risk is the risk that a rise in economic interest rates will reduce the price of a fixed-income security.

- Credit risk is the risk that a debt security issuer may default or fail to make a payment.

Some of the other common risks in debt mutual funds are:

- Purchasing power risk

- Call risk

- Reinvestment risk

Let’s look at these in a little more detail.

Interest rate risk

The interest rates in an economy fluctuate over time. This will change the borrowing cost. If you remember, fixed income securities prices are inversely related to interest rates. For instance, when the interest rate rises, the price of an existing bond will fall.

- To manage the interest rate risk, you need to check the duration of the bond fund. Higher the duration, more is the volatility in the price of a bond.

Default risk

Default risk or credit risk is related to the possibility of non-payment or a delayed payment of interest or principal from the fixed income security issuer or both.

- If you want to avoid this risk, you need to assess the quality of the fund portfolio. You can check the fund portfolio and objective before making any investment decisions.

- You can also check the credit rating of the securities in the fund.

For instance, lower the credit rating of a bond, higher the chances of default. For instance, a BBB rated bond carries a higher risk of default when compared to a AAA rated bond.

Purchasing power risk

Inflation makes things more expensive. For instance, a packet of Maggi noodles cost Rs. 10 in the past. Today, the same packet costs Rs. 12. This is because of inflation. Bonds pay steady returns. Purchasing power risk is the risk that the steady returns that debt securities provide may not be able to beat inflation rate if there is a steep rise.

- Compare inflation and fund returns frequently to see if the fund you are invested in meets your return expectations.

Call risk

Call risk is associated with bonds that have an embedded call option.

- Some bonds, called callable bonds, provide the issuer with the option

If an issuer calls back the bond before maturity, investors will receive their money back. If the interest rates at that time are low, then as an investor, you may be forced to reinvest that money at a lower interest rate. This will reduce you return on the investment vis-à-vis the returns you would have gotten if the bond was not called back.

Reinvestment risk

Reinvestment risk is the inability to invest periodic interest amounts received from bonds at the bond's YTM. This risk is especially prominent in a falling interest rate scenario.

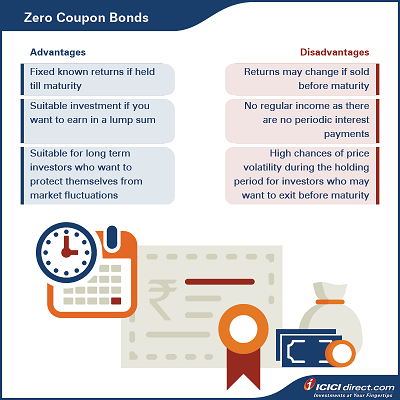

- If you want protection from reinvestment risk, it is better to invest in zero-coupon bonds.

Zero coupon bonds are bonds that do not pay any interest. Instead, you buy these bonds at a deep discount on their face value. The gain is the amount you receive when the bond matures.

The best way to manage debt fund risks is to understand the various types of risks associated with debt securities. Once you know the risk, you can then choose a fund that matches your risk appetite.

How to choose the right Debt Mutual Fund?

Choosing the right debt fund is important to balance your portfolio. Here are some tips to help you make the right decision:

1. Identify your needs

The first thing to do is to identify your investment goals, risk appetite and time horizon. Many investors think debt funds are a safe bet and there are no chances of losing money. However, as you have already seen, there are some risks associated with debt funds.

2. Evaluate the risks

While debt funds have comparatively lower risk than equity funds, they still carry some amount of risk. Understand the different risks and how they will impact your returns.

3. Check the liquidity of the securities in the fund

Sometimes, corporate debt securities are not very liquid in the short term. If the fund suddenly faces a lot of redemption pressure, it may be forced to sell some securities at a discount. This could impact your returns.

4. Look at the rating

Considering the credit rating of the securities in a fund is a good way to evaluate default risk. While it may not be foolproof, it is a fair indicator of how creditworthy the fund as well as the securities in the fund are.

5. Don’t rely only on past performance

While historical performance is something to look at, don’t blindly rely on it. Dig deeper. Look at the duration risk, credit risk as well as fund manager reviews.

|

Did you know? Debt funds are also called income or fixed-income funds because they provide relatively predictable returns if the securities in a fund are held till maturity. |

Tips on how to choose Debt Funds

High-risk appetite

- If you have a high-risk appetite, a long duration fund could be a good option. Long duration debt funds invest in securities that typically have a duration of more than 7 years. These funds demonstrate higher price volatility to changes in interest rates in the market.

- If you are comfortable with taking on a higher credit risk, credit risk funds could be good choices. The risk is high but the return possibilities are also higher.

Moderate-risk appetite

- If you are unsure about interest rate cycles, a dynamic bond fund could be a good choice. These funds invest in securities across durations as per the interest rate cycle.

- If you are a moderate risk taker, you could also look at short to medium duration funds.

Low-risk appetite

- If you are a conservative investor, FMP or shorter duration funds are more advisable. Short duration debt funds invest in securities that typically have a duration of 1-3 years. From a risk point of view, these funds are less sensitive to changes in interest rates.

- Gilt funds have the least default risk because they are backed by the government. However, they may have interest rate risk.

- If you want to avoid default risk, it is better to invest in funds that have invested in high-rated securities or government securities.

- If you want to avoid both interest rate and default risks, overnight funds or liquid funds are safe options.

Among other things, you also need to see the time horizon of your investment. If you have a time horizon of less than 3 years and want to play safe, liquid funds, or short duration funds could be good options. For a longer time horizon, mid-term or long duration funds could be good option if you are willing to take the risk.

Summary

- Debt funds may be less risky when compared to equity funds, but they also carry risk.

- The most common risks associated with debt funds are:

- Interest rate risk

- Default risk or credit risk

- Purchasing power risk

- Call risk

- Reinvestment risk

- Zero coupon bonds are bonds that do not pay any interest and are issued at a steep discount on their face value.

- The best way to manage debt fund risks is to understand the various types of risks associated with debt securities.

In the next chapter, we’ll look at how you can switch from one mutual fund scheme to another. Exciting!

Top Mutual Funds

Top Mutual Funds

COMMENT (0)