Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

Ritika comes across a new mutual fund. She remembers that her friend, Rahul, wanted to start investing in mutual funds. So, she passes on the new fund details to Rahul. However, Rahul is new to the world of mutual fund investments. He goes through the details and has questions like what is an entry or exit load, how to calculate expenses and how he can liquidate his position.

Let’s clear these doubts for him, shall we?

New Fund Offer (NFO)

Ritika shared the details about a New Fund Offer with Rahul. An NFO is announced when a fund house launches a new mutual fund and invites investments. The fund’s NAV is fixed at just Rs 10 during the NFO period.

NFOs are generally of two types:

1. NFO For An Open-Ended Fund:

Investors can buy units at the offer price of Rs 10 per unit for a fixed NFO period after launching a new fund. Once the NFO closes, the NAV fluctuates daily based on the value of assets and the number of outstanding units. Any additional subscription and redemption take place at the prevailing NAV.

2. NFO For a Close-Ended Fund:

Investors can subscribe to close-ended funds only during the NFO period. Once the NFO closes, no additional subscription is possible and existing investors cannot redeem their allotted units. However, close-ended funds are listed on the stock exchange to provide liquidity to the existing investors.

Should you invest in an NFO or older mutual fund schemes?

Many people invest in NFOs because the NAV is low, and they assume growth will be high. However, there is no guarantee that a newly launched mutual fund will perform well. Take the time to assess if a particular mutual fund scheme is a worthwhile investment. To do this, you will have to factor in the market and the fund manager’s capabilities, among other things.

When is an NFO the right choice? Go for it if a fund has a different objective and better fund management than existing fund schemes.

What gives older schemes an edge? Existing funds have a previous track record and history. You can use this information to assess if it is a good investment. Since NFO schemes are new, they do not have this advantage.

Entry And Exit Loads

Mutual fund investments come with individual costs. While there is no entry load on mutual fund investments, there may be an exit load at the time of redemption. The AMC deducts this charge from the NAV when you redeem your mutual fund units. Whether the exit load is applicable depends on the specified holding period of the scheme.

Here’s an example to show how this works:

Zeeshan invested in an equity mutual fund scheme ten months ago. Although he would have liked to hold on to the investment for longer, he needs the cash right away because of a medical emergency. He applies to redeem his mutual fund units when the NAV is Rs 100 per unit. The AMC informs him that the applicable exit load is 1%. That means Zeeshan’s redemption will be processed at the rate of Rs 99 (i.e. Rs 100 – [1% of Rs 100] = Rs 100 – Re. 1) per unit.

Most equity mutual funds do not charge an exit load if you redeem the units after a year. Redemption before one year usually results in an exit load of 1% to 2%.

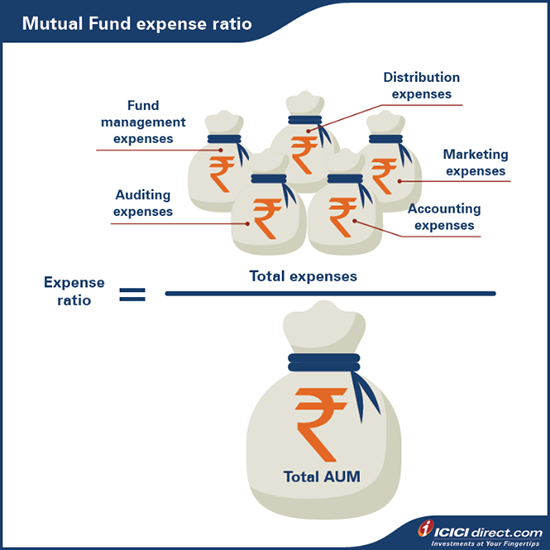

Expense ratio

Every AMC charges a nominal fee to meet expenses related to:

- Fund management

- Accounting

- Auditing

- Marketing

- Distribution, etc.

This fee is known as the Total Expense Ratio (TER). As per SEBI’s guidelines, the expense ratio can be up to 2.25% and depends on the fund size.

Did you know?

A fund with a higher AUM will mean a lower per unit expense for investors. This is because the expense will be spread across a larger number of investors.

Effective from April 1, 2020, the TER limit has been revised as follows:

|

Assets Under Management (AUM) |

Maximum TER as a percentage of daily net assets |

|

|

TER for Equity funds |

TER for Debt funds |

|

|

On the first Rs. 500 crore |

2.25% |

2.00% |

|

On the next Rs. 250 crore |

2.00% |

1.75% |

|

On the next Rs. 1,250 crore |

1.75% |

1.50% |

|

On the next Rs. 3,000 crore |

1.60% |

1.35% |

|

On the next Rs. 5,000 crore |

1.50% |

1.25% |

|

On the next Rs. 40,000 crore |

Total expense ratio reduction of 0.05% for every increase of Rs.5,000 crore of daily net assets or part thereof. |

Total expense ratio reduction of 0.05% for every increase of Rs.5,000 crore of daily net assets or part thereof. |

|

Above Rs. 50,000 crore |

1.05% |

0.80% |

*In addition, mutual funds have been allowed to charge up to 30 bps more, if the new inflows from retail investors from beyond top 30 cities (B30) cities are at least (a) 30% of gross new inflows in the scheme or (b) 15% of the average assets under management (year to date) of the scheme, whichever is higher. This is essentially to encourage inflows into mutual funds from tier - 2 and tier - 3 cities.

To calculate the expense ratio, divide the fund's total expenses by the total assets under management. Here's the formula:

Let’s say, Scheme ABC has annual expenses of Rs 15 crore and an asset base of Rs 1,000 crore. That means the fund’s expense ratio is 1.5% (i.e. Rs 15 crore/Rs 1,000 crore).

NAV declared by the AMC has to factor in all charges. So, if a fund earns 15% returns in a year and has an expense ratio of 1.5%, then the net return in an investor's hands is 13.5%.

Using Expense Ratio To Choose a Mutual Fund Scheme: The expense ratio has a more significant impact on the fund value in the long term. However, that does not mean you should choose funds with the lowest expense ratios. Instead, take a moment to study the returns after factoring in all expenses. A fund that produces better net returns despite relatively-high charges could be an excellent addition to your portfolio.

Zeeshan invests Rs. 25,000 each in two similar equity mutual funds: PQR and XYZ. PQR has an expense ratio of 1.5% and XYZ has an expense ratio of 2%. PQR provides an annualized return of 12%, while XYZ provides an annualized return of 15%. So which is the better investment?

(Hint: Calculate the net returns on each fund after factoring in all expenses.)

Despite the higher expense ratio, XYZ is a better investment.

Regular plans and Direct plans

While considering mutual funds to invest in, you may need to choose between a regular plan and a direct plan for the same mutual fund scheme. There would be no difference between the two in terms of the portfolio or fund management. Only one thing would change—who you go through to invest.

- Regular plans are offered through intermediaries. The intermediary could be a distributor, an advisor, or a broker. Note that regular plans have slightly higher expense ratios than direct fund plans.

- Direct plans are offered directly by AMCs or by very few distributors. These plans have a slightly lower expense ratio in comparison to regular plans.

Which Is The Right Plan For You?

Most of the intermediaries who handle regular plans offer advisory services to customers. This can be especially useful for investors who have little market knowledge. These intermediaries can suggest a mutual fund scheme that fits their requirements. If you are new to mutual funds or do not have the time to do a deep-dive analysis, do not compromise on the right advice by choosing a direct plan. Direct plans may cost less, but you will need to make the decisions yourself.

When should you go for a direct plan? If you are knowledgeable about mutual funds and can devote time to choosing the right fund, then a direct plan could be a good choice.

Redemption of Mutual Fund units

Open-ended mutual funds are highly liquid. Investors can redeem units in these funds as per their needs. However, you cannot redeem closed-ended mutual funds or funds which have a lock-in period as quickly. You will have to wait until the tenure or the lock-in period ends.

What Is The Procedure To Redeem Mutual Fund Units?

There are a few ways to go about it:

- Redeem the units directly from the AMC: You could physically submit the duly filled in redemption form. Alternatively, you could redeem the units online by logging into your account.

- Redeem the units through the intermediary: If you invested in the mutual fund through a distributor, a broker, or an advisor, you could submit the filled-in redemption form to them. You could also redeem the units online by logging into your account.

- Redeem the units through an RTA: In this case, you will need to submit a redemption request to an RTA like CAMS or Karvy. You can also complete the transaction online.

Know the redemption timelines. You can redeem mutual fund units at the NAV of the same day if you submit the redemption request before the cut-off time.

- The redemption proceeds are usually credited to your bank account on T+1 day for liquid funds.

- The redemption proceeds are usually credited to your bank account on T+3 day for equity and debt funds.

Did you know?

Some mutual funds offer instant redemption facilities. The funds can be credited to your account on the day you submit a redemption request.

Summary

- When investing in mutual funds, you can choose between open- and closed-end mutual funds.

- Open-ended funds are more liquid than close-ended funds because they do not have restrictions on when you can liquidate them.

- Mutual fund companies collect fees such as exit load, expense ratio, etc. which need to be factored into the final returns.

- If you liquidate a mutual fund investment before one year, you will have to pay an amount called an exit load.

- Expense ratio is an annual fee expressed as a percentage of your investment that goes toward the fund's management.

- Direct plans have a slightly lower expense ratio in comparison to regular plans. Direct plans may cost less, but you will need to make the decisions yourself.

- Mutual fund redemption is a process when you sell your mutual fund units back to the AMC to get your money.

Now that we have decoded the jargon to provide you with a crystal-clear understanding of the terms involved in mutual funds, let’s proceed to know more about mutual funds in depth in our next chapter – Types of Equity Mutual Funds.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)