Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 6: Mutual Fund Investment Choices – Switch and STP

Aman has 1,000 units in a debt mutual fund scheme. Lately, he has noticed that the equity markets are dipping. He wants to make use of this opportunity and transfer his investment to an equity scheme in the same mutual fund house. Do you think Aman can do it?

Yes, he can!

Switch in Mutual Fund schemes

Mutual fund investors have the option to “switch” or move from one mutual fund scheme to another, as long as it is in the same fund house. When an investor switches, the AMC redeems the units from the existing fund and purchases units of the same value in a new fund that they choose on the same day.

- Investors can use the switch option to transfer funds from one scheme to another to rebalance their portfolio.

- The switch option is available only within the same fund house. For instance, let’s assume Aman had 1,000 units in ICICI Prudential All Seasons Bond Fund. He can only switch to another fund from ICICI Prudential.

Did you know?

From a taxation point of view, switching from one scheme to another is considered to be separate sale and purchase transactions. Capital gains tax on sale of units will apply.

Why switch then?

- You can rebalance your portfolio quickly depending upon the market condition. If you think that the equity market is overvalued, you can switch from equity to debt and vice versa.

- You don’t lose time between money being credited to your bank account and making a new purchase.

- It’s a hassle-free and time-effective way to capitalize on market opportunities.

Systematic Transfer Plan (STP)

A systematic transfer plan is a way to transfer funds from one mutual fund scheme to another scheme in the same fund house, but over a period of time. STP can be automated. Most often, investors choose this to avoid the risk of timing the market. In this sense, STP can be thought of a little like SIPs. You transfer your investments from one mutual fund to another periodically.

- Usually, investors use the STP option to transfer funds from liquid funds or short-term debt funds to equity funds.

- As an investor, you can also choose to move from equity to liquid or debt funds to protect your gains.

There are two reasons to choose an STP:

- You want to rebalance your portfolio. As in Aman’s case, you see an opportunity in another fund in the same fund house and you want to move your investment to it over a period of time.

- You have a lumpsum amount that you want to invest in equity mutual funds. Instead of doing it that, you could invest in a liquid or debt fund and then shift to an equity fund over a period of time. This will work like a SIP in an equity fund while earning returns from the liquid or debt fund.

Let’s get into an example to understand this.

Let’s say Aman has earned an annual bonus of Rs. 1,20,000 from his employer in January. He chooses to invest it in mutual funds. He sees an opportunity in equities. Now, he can either invest it as a lumpsum or begin STP by investing the lumpsum amount in a liquid fund.

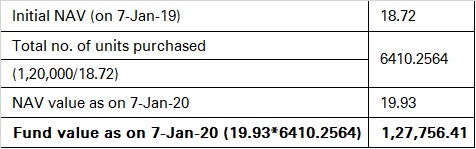

Let’s look at both scenarios. On January 7, 2019, the fund Aman wants to invest in has a NAV of Rs. 18.72. A year later, Aman decides to sell the units when the NAV rises to Rs. 19.93. This is what his gains would look like:

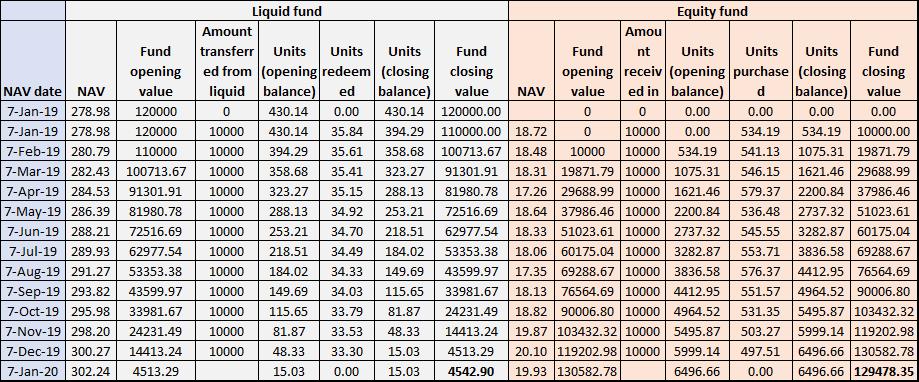

Alternatively, had Aman decided to invest the money in a liquid fund and then used the STP option to move Rs. 10,000 every month to an equity fund over the duration of a year, his returns would look like this:

Here is a summary of the transactions for more clarity:

|

STP - Transferor scheme: Liquid plan – Growth |

||||

|

Period |

STP start date |

Total no. of units purchased |

Total amount transferred to equity fund |

Amount left in liquid fund as on 7-Jan-2020 |

|

07-Jan-2019 to 07-Dec-2019 |

7-Jan-19 |

430.1384 |

1,20,000 |

4,542.90 |

|

STP - Transferee scheme: Equity fund – Growth |

||||

|

Period |

STP start date |

Total no. of units accumulated |

Total amount invested in equity fund |

Equity fund value as on 7-Jan-20 |

|

07-Jan-2019 to 07-Dec-2019 |

7-Jan-19 |

6,496.656 |

1,20,000 |

1,29,478.35 |

Total fund value in case of STP = Rs. 4,542.90 + Rs.1,29,478.35 = Rs. 1,34,021.25

As you can see, STP works better in fluctuating markets. Investors can generate higher returns through STP in such situations.

Benefits of choosing the STP option

1. Dual returns:

When you invest in debt funds, you still make a gain while transferring your investment to an equity fund. Returns from debt funds are usually higher than returns from savings bank accounts.

2. Averaging of cost:

STPs are a lot like SIPs. The difference between STP and SIP is the source of investment. STP transfers are from one mutual fund to another while SIPs are transfers from your bank account. Just like SIPs, STPs average out the cost of investment. You get fewer units at a higher NAV and more units at a lower NAV.

3. Portfolio rebalancing:

STPs are a painless way to rebalance your portfolio. If you feel that your investment in debt are high, you can reallocate money to equity funds through an STP, and vice versa.

4. Capital gain in STP

As already mentioned, STPs are considered as separate purchase and sale transactions from a taxation point of view. Any capital gain arising from redemption is liable for capital gain tax. Similarly, even when you redeem the funds from the fresh purchase, capital gains tax will be applicable.

Summary

- Mutual fund investors can switch from one mutual fund scheme to another using the switch or STP option.

- Switches can only be made within the same fund house.

- STP or systematic transfer plan is an automated way to switch mutual fund units from one scheme to another.

- From a taxation point of view, STPs are considered as two separate sale and purchase transactions.

Heard about SWPs and TIPs? Confused about what they are? Don’t worry, that’s what we’re going to cover in the next chapter.

Track your application

COMMENT (1)

Would like to invest through the process of STP

Reply