Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 6 : Different Types of Mutual Funds

A flourishing garden has many different kinds of plants – flowering shrubs, trees, grass, and so many more. They all contribute differently to the ecosystem. People have different preferences for what they’d want in their garden. Just like that, there are varying kinds of mutual funds that meet different needs and tastes of individuals.

Mutual funds can be categorized broadly into five types depending upon the assets they invest in. Let’s take a look at the types before we explore them in detail.

Types of Mutual Funds

-

Equity funds –

These mutual funds invest most of the fund money in shares of different companies. -

Debt funds –

Mutual funds that invest mainly in fixed-income securities like government bonds, corporate bonds, debentures, etc. are called debt funds. -

Hybrid funds –

Any guesses about this one? As the name may already suggest, hybrid funds invest in a mix of equities and fixed-income securities. -

Solution-oriented schemes –

These mutual funds are slightly different from the above 3. These schemes are designed to meet a specific goal, like retirement planning or to fund children’s educational expenses. -

Other schemes –

Apart from these, there are other kinds like index funds and fund of funds. Don’t worry about these just yet. We’ll cover them at a later stage.

Do you remember?

There are more than 1,700 mutual fund schemes that you can invest in.

Let’s uncover each of these mutual fund types now, starting with equity mutual funds.

Types of Equity Mutual Funds

Equity mutual funds invest a majority of the money in shares of different companies. Want to grow your money and become wealthy in the long run? Then these funds are your friends.

If you want to go on a trek to a mountain peak, you’d have to be willing to risk a few scratches at minimum. The same goes with equity mutual funds. They can give you high returns in the long run but as long as you are willing to take on a little risk. If you are able to do that, then you can make inflation-beating returns in the long run!!

Here’s a tip: Monitor an equity fund’s performance over a period of time, like 5 years or 10 years, to understand what the returns and risk may look like.

Hold on, we’re not done here! There’s more!

Even equity mutual funds are categorized further depending on the kind of companies or stocks they invest in. Let’s take a look at them:

1. Large Cap Funds

Large cap funds invest at least 80% of the fund’s assets in companies that have a large market capitalization or market cap. SEBI defines large-cap companies as the top 100 companies with the largest market capitalization listed on stock exchanges. Large cap funds are equity schemes and offer comparatively stable returns.

Note: Large cap funds are lower on the risk meter compared to other equity mutual funds. If you want minimum risk while investing in equity funds, this may be the category for you.

2. Mid Cap Funds

These funds invest at least 65% of the total fund pool in mid-cap company shares. Mid-cap companies are those that rank between 101-250 in terms of market cap. They carry more risk than large cap funds.

3. Large And Mid-Cap Funds

These funds invest in the stocks of both large-cap and mid-cap companies. They are more diversified funds that offer both growth and stability.

4. Small Cap Funds

You know the drill by now. Small cap funds are mutual funds that invest in stocks of small cap companies. Small-caps are all companies on the stock exchange that rank from 251 onwards. These funds are risky and most suited to investors looking for high growth prospects.

5. Multi Cap Funds

Remember, don’t put all your eggs in one basket? Multi-cap funds invest a minimum of 25% of total fund money in large cap, mid cap and small cap shares respectively. They have the advantage of diversification.

6. Flexi Cap Funds

Flexi-cap funds are the free rangers. These funds invest a minimum of 65% of total assets in shares of large cap, mid cap and small cap companies. There is no restriction on allocation. Basically, fund managers have the liberty to invest in companies depending on their potential.

Did you know?

- Flexi-cap funds are a relatively new category of mutual funds.

- SEBI introduced flexi-cap funds in November 2020 after they changed the definition of multi-cap funds.

- Multi-cap funds could invest like flexi-caps: a minimum of 65% in stocks of large-cap, mid-cap or small-cap companies.

7. Dividend Yield Funds

Dividend yield mutual funds has more than 65% of its asset allocated in equities and equity-related instruments of companies known to pay dividends.

8. Value Funds

Value funds follow an investment strategy known as value investing, wherein you invest in companies that are currently priced below their true potential. The fundamental idea is to invest in stocks presently undervalued in price so that you may earn good returns as the market price of stocks reaches their true value in the long run.

9. Contra Funds

Contra funds are the rebels of all mutual funds. They follow a contrarian trend, or invest in companies that are not really market favourites. They root for the underdog. The performance of these funds can go either way, depending upon the call that the fund manager takes.

Here’s a Tip: Steer clear of contra funds if you are not a big risk taker.

10. Focused Funds

Focused funds invest in a select few companies, usually a maximum of 30. The fund managers of these funds lean more towards the quality over quantity approach and aim to maximize returns depending on careful stock selection. They focus on high conviction stocks that have good growth potential. They can also be focused on large-cap, mid-cap or multi-cap companies depending on is the investment strategy.

11. Sectoral Funds

A sectoral mutual fund invests in shares of one particular sector. For example, a pharmaceutical fund will invest only in pharmaceutical companies like Cipla or Sun Pharmaceutical Industries. A banking sector fund will invest only in banking stocks. These mutual funds count on that particular sector performing well. However, they do not score high on the diversification aspect.

12. Thematic Funds

A thematic mutual fund invests in companies that follow a specific theme. For instance, a Made in India theme can invest in securities of sectors in which India has manufacturing capabilities like auto ancillary, textile, etc. Similarly, ESG funds invest in equities of companies that take environmental, social and governance factors into consideration in their functioning.

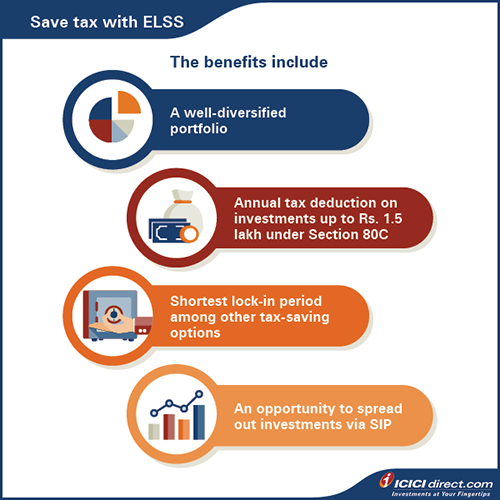

13. Tax Saver Fund or ELSS

Want to invest in mutual funds and save on tax? Then Equity-Linked Savings Scheme (ELSS) funds are for you! They work like the usual equity funds but you can claim tax benefits for your investments! According to Section 80C of the Income Tax Act, 1961, you can claim a deduction of up to Rs. 1.5 lakh for investing in ELSS funds in a financial year. However, they come with a lock-in period of 3 years. ELSS funds have the lowest lock-in period when compared to other tax-saving instruments.

Here’s a Tip: Even though ELSS funds can be sold after 3 years, it is still advisable to stay invested in them in the long term for best returns.

Summary

- Mutual funds can be categorized based on the kind of assets they invest in.

- There are broadly 5 kinds of mutual funds:

- Equity funds

- Debt funds

- Hybrid funds

- Solution-oriented funds

- Other funds like index funds

- Equity mutual funds invest a majority of the money in shares of different companies.

- Equity mutual funds can be further classified into:

- Large-cap funds

- Mid-cap funds

- Large and mid-cap funds

- Small-cap funds

- Multi-cap funds

- Flexi-cap funds

- Dividend yield funds

- Value funds

- Contra funds

- Focused funds

- Sectoral funds

- Thematic funds

- ELSS

- Equity-linked savings schemes or ELSS funds can be used to claim tax deductions of up to Rs. 1.5 lakhs per year.

That’s the gist of equity mutual funds you need to know. In the next chapter, we will look at the next type of mutual funds – debt funds.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)