Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 8: Learn Mutual Fund Portfolio Management

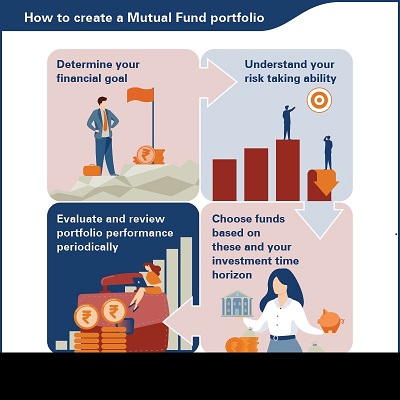

Just like a healthy diet matters to your health, a balanced portfolio is important for your financial health. You may have multiple investments in different mutual funds. Yet, to make the best of your investments, you need to manage your portfolio.

Mutual Fund portfolio management

Portfolio management is the process of choosing and readjusting your financial investments such that they meet your financial objectives. When it comes to managing your mutual fund portfolio, you need to choose funds that:

- Meet your financial goals

- Match your risk appetite

- Align with your timelines

Mutual Funds are the right vehicle for investing in multiple asset classes to achieve your financial goals. Based on your financial goals, you can choose from a variety of schemes. Your long-term goals like retirement or children’s education can have a high equity-linked allocation. Similarly, your short-term goals like buying a car or having an emergency fund can be created with the help of fixed income funds. No matter what your financial goal, there is a mutual fund solution available. The only thing you need to do is invest regularly. A disciplined approach to investing through systematic investment plans can be transformational.

Determine your financial goals

If you are hopping into a taxi, you must tell your driver to take you the right destination. When you are starting your investment journey, you need to determine your goals. Your investments need to go in the direction of those goals. They could be long-term goals like retirement or child’s professional education or short-term goals like a foreign holiday or buying a car.

Understand you risk appetite and asset allocation

To calculate your risk appetite, you need to analyze personal data, your knowledge about financial markets, your investment objective and how you behave under different market scenarios. Usually, a set of questions and your answers to them can determine your risk appetite.

Did you know?

100 minus age rule:

The 100 minus age rule is a good practice for a generalized direction for one’s asset allocation. It tells how much an investor should invest in equities and debt depending on their age.

- You simply have to subtract your age from 100 and the resulting number should be your equity allocation in your portfolio. The rest should be in debt instruments.

- For instance, if you are 30 years old, 70% (100-30) of your total investments should be in equities. The remaining 30% should be in debt instruments.

Irrespective of thumb rules, in general, your overall asset allocation of your investment portfolio should match your risk appetite. Appropriate asset allocation is a must for wealth creation. You need to know the amount of money you can invest for growth in equity assets. The balance between equity and other asset classes is the key. It is also a function of how confident you are about your future income. You can allocate more towards long-term investments in equity assets only when you are confident about your income. The allocation changes based on your life stage and risk appetite.

Choosing the right portfolio

It is essential that you choose the right funds for your portfolio. It may be helpful to follow certain thumb rules when building your mutual fund portfolio.

- If your investment time horizon is more than 10 years, you can choose to invest in an equity fund. This will give you enough time to tide over market volatilities and make good returns.

- If you want to play it safe in equity, a large cap or index fund is a good option.

- Conversely, for a short period, short-duration debt funds or liquid funds are a better option because they provide relatively stable returns.

- If you have a high-risk appetite, you can choose to invest in high-risk funds like mid-cap funds, small-cap funds and sectoral funds.

- Ideally one should invest in a mix of 4-5 different funds in each asset class to diversify portfolio and mitigate risks.

Basket investing

If you are new to investing or do not want to go through hassles of choosing from thousands of schemes, a lot of brokers put together theme-based investing. Experts choose schemes based on themes like high growth, strong fundamentals, or sectoral stocks like technology or future growth among others. These could be a combination of exchange-traded funds or mutual fund schemes. The advantage is that it saves you the trouble of going through finer details. You can make a choice based on your risk-appetite and asset allocation plan.

Evaluate and review of Mutual Fund portfolio

You know how a report card tracks the process of your academic growth? Similarly, you need to track your portfolio’s performance on a periodic basis. Ideally, you should review your fund portfolio at least once a year.

Here are some things to keep in mind while reviewing your mutual fund portfolio:

1. Compare with a benchmark

Instead of looking at a fund’s absolute returns, compare its performance with the fund’s benchmark. Sometimes, a fund’s absolute performance may not be great but upon closer inspection and comparison with the fund’s benchmark, it could be doing quite well.

- Remember that mutual fund performances are linked to the market.

- It is also important to compare with the right benchmark. Choosing a common benchmark like Nifty or Sensex for all funds is like comparing apples with oranges.

- For instance, a small cap fund needs to be compared with a relevant index like the BSE Small Cap Index.

- Look for the fund’s benchmark in the fund’s factsheet.

2. Don’t focus on short-term performance

Often, a fund performing poorly in the short-term i.e. within 6 months or 1 year, perturbs investors. Mutual funds are usually long-term investments. This is especially true for equity mutual funds.

- Look at a fund’s performance in comparison with its peers.

- Understand the fund’s portfolio and investment approach. If possible, try to go through the fund manager’s interviews and fund’s review from experts.

- If a fund is continuously performing poorly, say for 2-3 years, then it may definitely be worthwhile to consider better alternatives.

3. Look at risk-adjusted returns

Some investors tend to obsess with investing in the best funds in a category. Although that is not a wrong approach, continuously shifting from one scheme to another can affect your returns.

- A fund can’t remain on top forever. Mutual fund performance changes based on market conditions and investment strategy.

- Also, past performance is not a guarantee of future returns.

- Don’t make an investment decision solely based on returns. Consider risk-adjusted returns instead. Many times, funds that rank slightly lower may have better risk-adjusted returns compared to the top fund in the category.

4. Don’t panic

If there is one advice to follow in investing, it is “Don’t panic!” If the market is falling, don’t jump into readjusting your portfolio. Instead, consider your long-term objective and how your mutual fund investments are working towards meeting them. In fact, falling markets offer a great opportunity to make additional investment.

- SIPs are a great way to invest under different market conditions. They adjust your purchases depending on market performance.

- Market volatility and fluctuation are part of equity investments. In the long term, the best equity funds are known to provide good returns.

- Also be cognizant that you don’t fall prey to market rumours.

- Trust your investment decision and do not liquidate a fund unless you need the money.

If you follow these principles, you will be able to formulate the right portfolio to meet your financial objectives.

Summary

- Portfolio management is the process of choosing and readjusting your financial investments such that they meet your financial objectives.

- Choose mutual funds depending upon whether they:

- Meet your financial goals

- Match your risk appetite

- Align with your timelines

- Equity funds are good long-term investments.

- Short duration and liquid funds are better for the short term.

- Also calculate your risk appetite before investing.

- It is ideal to invest in a maximum of 4-5 funds in each asset class for the best portfolio diversification. You can opt for basket investing for convenience.

- To review your mutual fund portfolio:

- Compare its performance with the relevant benchmark

- Look at long-term and goal-based performance instead of short-term performance

- Consider the risk-adjusted returns instead of absolute returns

- Don’t panic during a market downturn

You’ve got the basics of mutual fund portfolio management under your belt. In the next two chapters, we will look at how to analyze and calculate mutual fund returns.

Track your application

COMMENT (0)