Learning Modules Hide

Hide

- Chapter 1: Introduction to Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

Remember Gaurav, the young IT professional who was keen to learn about debt mutual funds? Well, here are some more concepts that will make him sound like an investing pro.

For first-time debt fund investors, terms like Duration and Modified Duration can be confusing. Let’s break down the importance of these while assessing debt funds.

Duration and Modified Duration

Debt funds can be classified based on the Duration of debt securities in the portfolio. Before you choose a debt scheme, it is important to understand Duration first.

It is the weighted average time that an investor needs to hold a bond to get a sum of total present value of cash flows equal to the market price paid for the bond. The Macaulay Duration, popularly known as Duration, is measured in time units, for example, in years.

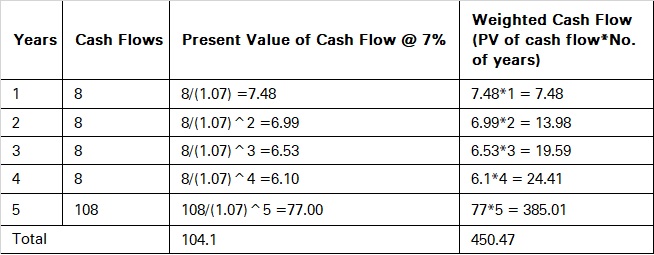

Let’s understand the Duration calculation with an example. Assume a bond has face value of Rs.100 and mature in 5 years. It offers a coupon rate of 8% and current yield in the market is 7%.

We can calculate the Duration of the bond by dividing the weighted cash flow with the bond price.

The sum of weighted cash flow is Rs. 450.47.The Price of the bond is equivalent to the present value of the future cash flow. In this case it is Rs. 104.1

So, Macaulay Duration is 450.47/104.1 = 4.33 years

We can also calculate the Macaulay Duration with the Excel function ’DURATION’.

Alternatively, you can apply the following formula to calculate the bond Duration.

where:

C=periodic coupon payment

n = time to maturity

y=periodic yield

M=the bond’s maturity value

Quick Tip: Coupon-paying bonds always have a Macaulay Duration that is lower than the bond’s time to maturity.

Why know about Macaulay Duration? You remember how we spoke about bond prices being inversely related to interest rates? When interest rates in the economy rise, bond prices fall and vice versa. A bond that has a longer Duration will be more sensitive to interest rate changes. This is why investors need to know the Macaulay Duration of a fixed income security or fund before buying it. It will tell you how long you may have to wait to recoup your investment and price volatility with respect to change in interest rates.

A better metric to look at is Modified Duration. It measures the change in the value of a fixed income security from a single percentage change in interest rates. It will tell you a security’s sensitivity to interest rates much better.

Modified Duration can be calculated from Duration with the help of the following formula:

Modified Duration = Duration/{1+(YTM/interest rate frequency)}

Bonds with longer maturity and smaller coupons have a higher Duration and thus, higher Modified Duration. Due to a higher Modified Duration, these bonds will be more sensitive to changes in interest rate. It is advisable to hold bonds with higher Modified Duration (long-term bonds) to gain the most from a falling interest rate scenario.

If you are expecting a sharp cut in interest rates, then a debt mutual fund that has a higher Modified Duration will give you a higher gain. Conversely, if you are expecting a sharp rise in interest rates, bond prices will go down and the bond with a higher Modified Duration will take a steeper hit.

Let's understand this with an example:

Bond A has a Modified Duration of 12 years and Bond B has a Modified Duration of 5 years.

Percentage change in Bond Price = Negative change in Interest Rate x Modified Duration

If there is a 50 bps (0.5%) rate cut, then the price of Bond A would appreciate by 12*0.5 = 6% while Bond B would appreciate by 5*0.5 = 2.5%. Clearly, Bond A would be a better investment if you are expecting a rate cut. The opposite is true for an interest rate hike. If the interest rate rises by 50 bps, the price of Bond A would fall more in comparison to Bond B.

Bonds with higher Modified Duration show higher price volatility.

Credit Rating

Credit ratings are just as important for bonds. Highly-rated bonds are more liquid and considered safer than lower-rated bonds because their risk is considered low. More investors are willing to purchase top-rated bonds compared to bonds with lower ratings. It is always advisable to check the mutual fund portfolio rating before investment to understand credit risk.

Do you remember?

Debt instruments are given ratings or grades from credit rating agencies depending upon how likely they are to return investors’ money, i.e. investment.

A credit rating agency (CRA) assesses a company’s creditworthiness and assigns a rating depending upon how likely the company is to repay debt. Major CRAs include CRISIL, India Ratings and Research, ICRA, CARE, Brickwork Ratings, SMERA Ratings and Infometrics Valuation and Ratings among others.

Did you know?

CRISIL is India's first and oldest credit rating agency, set up in 1987.

The below illustration is based on CRISIL ratings. Other credit rating agencies may have a different rating symbol but broadly, the meaning remains the same.

Bonds that carry a high risk of default when compared to other bonds issued by corporations and governments are called junk bonds. These bonds are considered riskier and carry a higher chance of default. We have used CRISIL ratings for representation purpose. CRISIL may apply '+' (plus) or '-' (minus) signs for ratings from 'CRISIL AA' to 'CRISIL C' to reflect comparative standing within the category.

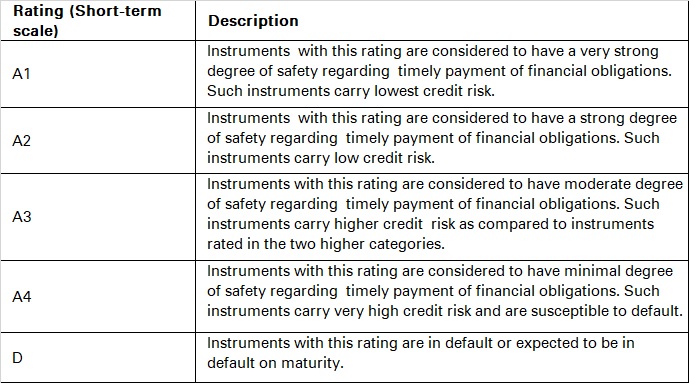

For short-term instruments, the rating scale is different and mentioned below:

Source: www.crisil.comCRISIL may apply '+' (plus) sign for ratings from 'CRISIL A1' to 'CRISIL A4' to reflect comparative standing within the category.

Summary

- Macaulay Duration is the weighted average time that an investor needs to hold a bond to get a sum of total present value of cash flows equal to the market price paid for the bond.

- Modified Duration measures the change in the value of a fixed income security from a single percentage change in interest rates.

- It is important to understand Duration of fixed income securities to understand their price sensitivity with respect to change in interest rates.

- Bonds with longer maturity and smaller coupons have a higher Duration and thus, higher Modified Duration.

- Bonds with a higher Modified Duration are more sensitive to changes in interest rates and vice versa.

- Debt instruments are rated depending upon how likely they are to return investors’ money. This is called credit rating. Credit rating agencies (CRAs) assign these ratings.

- Long-term instruments and short-term instruments are rated differently. Different rating companies may have different ratings but they largely mean the same.

In the next chapter, we will look at how to choose the right debt mutual fund based on all the metrics discussed so far.

Track your application

COMMENT (0)