Learning Modules Hide

Hide

- Chapter 1 : Learn the Basics of Mutual Funds

- Chapter 2 : Benefits of Mutual Funds

- Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

- Chapter 4 : Learn the Key Concepts of Mutual Funds: Part 1

- Chapter 5 : Learn the Key Concepts of Mutual Funds: Part 2

- Chapter 6 : Different Types of Mutual Funds

- Chapter 7 : Learn the Basics of Debt Mutual Funds: Part 1

- Chapter 8 : Learn Basics of Debt Mutual Funds: Part 2

- Chapter 9 : Learn about Duration and Credit Ratings in Debt Mutual Funds

- Chapter 10 : Learn Different Types of Mutual Funds

- Chapter 11 : Exchange Traded Funds: Part 1

- Chapter 12 : Exchange Traded Funds: Part 2

- Chapter 13 : Learn Different Types of Mutual Fund Schemes

- Chapter 14: Learn about Mutual Fund Investment Choices

- Chapter 15 : Learn How to Choose Right Mutual Fund Scheme

- Chapter 1: Decoding the Mutual Fund Factsheet

- Chapter 2: Equity Mutual Funds: Evaluation (Part 1)

- Chapter 3: Equity Mutual Funds: Evaluation (Part 2)

- Chapter 4: Equity Mutual Funds – Evaluation (Part 3)

- Chapter 5: Learn How to Choose the Right Debt Mutual Fund

- Chapter 6: Mutual Fund Investment Choices – Switch and STP

- Chapter 7: Mutual Fund Investment Choices – SWP and TIP

- Chapter 8: Learn Mutual Fund Portfolio Management

- Chapter 9: Learn Mutual Fund Return Calculations (Part 1)

- Chapter 10: Learn Mutual Fund Return Calculations (Part 2)

Chapter 3 : Learn Regulation and Structure of Mutual Funds: Guide for Beginners

Remember Ritika, the ad film producer who wanted to invest in mutual funds? When she scouts for funds to invest in, she comes across terms and regulations in fine print. Mutual funds are regulated by the Securities and Exchange Board of India. Let’s break down the regulations and structure of mutual funds for her, shall we?

Regulation of Mutual Funds in India

Market regulator SEBI oversees all mutual fund schemes in India. It issues strict guidelines that AMCs must follow while managing funds. The guidelines call for complete transparency related to a mutual fund scheme which include full disclosure of:

- fund value

- expenses

- fund utilisation as per the scheme’s objectives

What’s SEBI’s goal? To make life simpler for mutual fund investors.

As a mutual fund investor, you can access mutual fund services online through the vast network of AMC and registrar offices or through a convenient mutual fund app. You could:

- assess the fund’s portfolio holdings

- check the current fund value

- explore the facilities for investment

- learn about the redemption process

and lots more!

Important regulations to know

- Every mutual fund must be registered with SEBI.

- A mutual fund is always set up as a trust, with sponsors, trustees, an asset management company (“AMC”) and a custodian.

- An AMC of a mutual fund should have at least 50% independent directors, a separate board of trustees which includes 50% independent trustees and independent custodians so as to manage any conflict of interest among fund managers, custodians, and trustees.

- A single mutual fund can float different schemes but they have to be individually approved by the trustees and all offer documents have to be filed with the SEBI.

- SEBI lays down certain restrictions on the fees that AMCs can charge for mutual funds and there is also a cap on the expenses that can be added to the fund.

- Mutual funds can advertise, but advertisements cannot have statements that are misleading. For instance, no mutual fund can guarantee a return since returns depend on market performance.

- SEBI stipulates the following for open-ended and close-ended funds:

- An open-ended scheme needs a minimum corpus of 50 crores

- A closed-ended scheme needs at least 20 crores corpus

- SEBI checks mutual funds every year in order to make it in compliance with the regulations and guidelines.

Mutual fund regulation guidelines are hosted on the SEBI website. Click on this link to find out more.

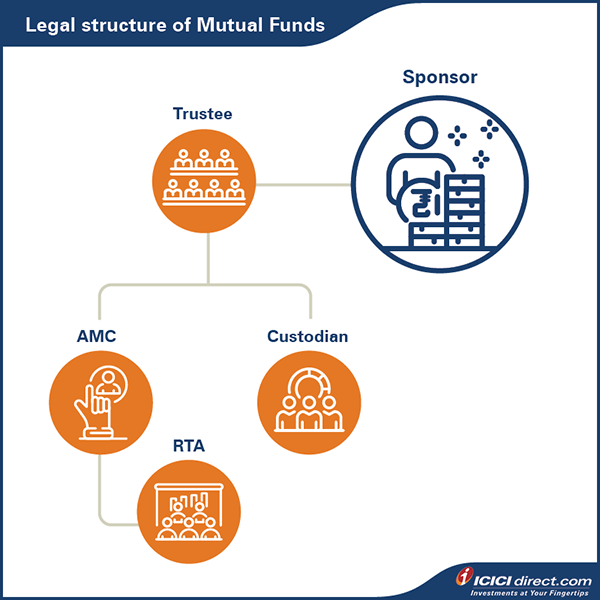

Legal structure of Mutual Funds

Legally speaking, a mutual fund has five main entities:

What role does each entity play in the workings of a mutual fund? Let’s find out!

1. Sponsor: The sponsor brings the capital to start a mutual fund. For example, ICICI Bank and Prudential Plc. are the sponsors of ICICI Prudential Mutual Fund. All sponsors must comply strictly with the SEBI guidelines.

2. Trust and Trustee: The sponsor sets up a trust and appoints trustees to manage the Trust's operations. The trustee has two main functions:

a) to ensure that all funds are executed as per the defined objectives

b) to protect the investors’ interests at all times

3. Asset Management Company (AMC): The trustee appoints an AMC to manage the investors’ funds. The AMC charges a fee for providing this service.

4. Custodian: The custodian protects the securities held by the mutual fund. The custodian also sees to it that the securities are used for the intended purposes only.

5. Registrar and Transfer Agent (RTA): The AMC often outsources its back-end operations to an RTA. That’s because RTAs are professionally managed companies with expertise in mutual fund operations investor-related issues. The RTA handles day-to-day operations such as:

- unit purchase and redemption requests

- Know Your Customer (KYC) formalities

- providing account statements

Did you know?

- A single RTA can manage the operations of multiple mutual fund companies.

- CAMS and Karvy are two well-known RTAs in India.

- Some AMCs manage back-end operations on their own without an RTA.

Know Your Customer (KYC)

KYC norms are mandatory for all mutual fund investors regardless of the amount invested. That includes existing investors and joint holders.

It is a one-time verification, and it is valid for transactions across all mutual funds. You won't need to do your KYC again and again each time you make a new investment.

Here’s a list of the documents needed to complete your KYC formalities:

KYC application form, duly filled in. (Click here to download the KYC form.)

- Self-attested copy of PAN card

- Self-attested copy of address proof (latest telephone bill (landline only)/electricity bill/gas bill/passport/updated bank account passbook/bank account statement/driving license/ration card/rent agreement)

Click here to check your KYC status.

Summary

- Securities and Exchange Board of India (SEBI) is a legal body that regulates the Indian capital markets including mutual funds.

- SEBI supervises and controls the securities market, but most importantly, it protects your interests as an investor by enforcing firm rules and regulations.

- Legally speaking, a mutual fund comprises 5 entities - Sponsor, Trustee, AMC, Custodian and RTA.

- To protect financial transactions SEBI mandates that every investor must comply with KYC norms.

Now that it's clear how SEBI monitors and regulates the mutual fund market, we move on to the next chapter where we break down the jargon and help you understand mutual fund concepts in a simple and easy manner.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)