Gold’s recent correction offers a good opportunity to enter as long-term outlook is bullish

The price of gold has come off over the past one year.

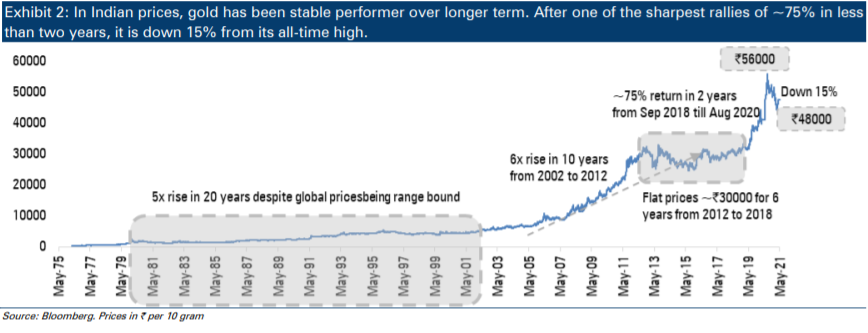

Between March 2020 and August 2020, gold rallied from levels of around Rs 39,000 per 10 gram levels to about Rs 56,000 as the COVID-19 lockdowns ravaged the world economy. Since then, however, the yellow metal has fallen about 15% to trade at around Rs 47,000 levels as the global economy reopened.

With the Reserve Bank of India slated to launch the latest Series of 2021-22 Sovereign Gold Bond, is it a good idea to invest into the security, which tracks the price of the precious metal?

To answer the question, let’s look at the outlook on gold.

- The price of gold is dictated by several factors such as the state of the global economy and global money supply

- During economic turmoil, investors withdraw capital from risky assets such as equities and park them into safe assets.

- The US dollar and gold are both considered safe assets

- Because gold and the US dollar are both safe havens, any event that creates a negative outlook for the US dollar leads to a rise in the price of gold.

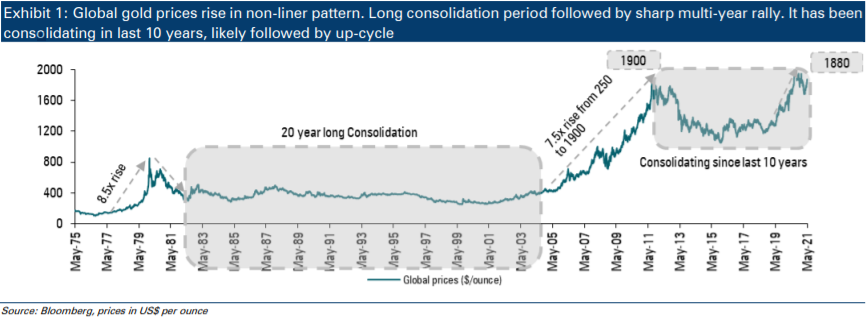

With that context, let’s look at the historical price of gold (denominated in USD).

The US dollar and gold

In the 1970s, high inflation in the US precipitated by the Gulf oil crisis caused a rapid fall in the US dollar.

- Between 1977 and 1981, gold rose 8.5 times.

- It fell after the Federal Reserve brought down inflation by hiking interest rates.

- In the following 20 years, the metal consolidated as a booming global economy left few takers for gold.

However, in the mid-2000s, a combination of factors including the Federal Reserve’s low interest rate policy eventually culminated in the 2008 crash.

- Between 2005 and 2013, gold rose 7.5 times, from about $250 per ounce to about $1,900.

- Since 2013, gold prices have again entered a consolidation, with prices falling to about $1,100 before recovering to $1,900 levels.

Gold and interest rates correlation

As a recent ICICI Direct report points out, gold and interest rates have a negative correlation, that is, a fall in interest rates tends to result in a rise in the price of gold. This is because investors who have invested in interest rate-bearing assets may struggle to even beat the rate of inflation.

This means that as investors could flock to gold, especially if there is trouble in other asset classes such as equities.

Impact of monetary easing

Besides, another thing has happened since 2008. The Federal Reserve along with central banks in other developed economies, have adopted an ultraloose monetary policy, leading some economists to believe that this could eventually lead to a sharp spike in inflation. Classical economic theory states that inflation tends to rise following an increase in money supply. The COVID-19 pandemic accentuated this trend, with global policymakers again resorting to various stimulus programs.

As a result, gold could do well in either of the two environments, a high-inflation environment as well as a low-interest rate one.

The rupee and gold

Gold, at least for Indian investors, has another factor going for it.

Since the price of gold in the country is denominated in rupees, any depreciation in the local currency against the US dollar, will increase the price of the yellow metal.

- Gold prices rose about five times between 1981 and 2002 in rupee terms, even though the USD gold price was about flat

- Over the same time period, the rupee fell sharply

- Over the long term, the rupee is expected to continue to remain pressured against the US dollar.

The theory for this is simple: over the long term, currencies of emerging economies such as India, which tend to have higher inflation rate, will fall against the currencies of developing countries such as the US, which have low inflation rates. The depreciation is usually the same as the difference in the inflation rate.

Long-term outlook for gold

The long-term outlook on gold is also looking strong if one looks at technical analysis, a school of thought in financial markets that is used to predict future prices of securities using their past performance.

According to an ICICI Direct report, gold was able to retrace all of its fall that took place between 2011 and 2018 (a seven-year period) in a matter of two years.

“Such faster retracement bodes well for primary uptrend,” the report says.

“Over the past six to eight months, prices have undergone a healthy retracement of 2019-20 rally and formed a higher base around Rs 45,000 which will act as launchpad for next structural uptrend,” the report says, adding “The robust price structure on long term charts makes us believe that prices have significant upsides towards Rs 65,000 over a period of time and investors should continue investing to benefit from multiyear uptrend.”

How to invest in gold

Investors looking to invest in gold then have many options, ranging from physical gold (jewellery, bars and coins) to digital (ETFs, e-gold and SGBs).

But a comparative analysis shows that the sovereign gold bond is among the most superior options to buy the yellow metal.

Comparison of ways to invest in gold

|

Factors |

Physical Gold |

Gold ETFs |

Sovereign Gold Bonds |

|

Liquidity |

High (Sell to jeweller) |

Very High |

Very High (tradeable on exchanges; redeemable after 5 years; matures after 8 years) |

|

Returns |

Linked to market price (but selling price will usually be lower) |

Redeemable at NAV or CMP (which is linked to market price of gold) |

Linked to market price + 2.5% interest on investment |

|

Taxation (holding period under 3 years qualifies for STCG; over 3 years is LTCG) |

STCG at marginal rate LTCG at 20% with indexation |

STCG at marginal rate LTCG at 20% with indexation |

No capital gains if redeemed on maturity. If redeemed before maturity, then STCG at marginal rate; LTCG at 20% with indexation |

|

Purity |

Not guaranteed (especially if not hallmarked) |

Backed by physical gold of 99.5% purity |

Not backed by physical gold but tracks price of 99.9% pure gold |

|

Expenses and costs |

High making charges (20-35% for jewellery); storage costs and GST |

Expense ratio and tracking error |

Zero tracking error, low cost |

|

Loan |

Allowed as collateral |

Allowed as collateral |

Allowed as collateral |

Disclaimer: ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Centre, H. T. Parekh Marg, Churchgate, Mumbai - 400020, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. AMFI Regn. No.: ARN-0845. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund related services are not Exchange traded products and I-Sec is just acting as distributor to solicit these products. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)