Union Budget 2023: Income tax Slabs rationalised in new income tax regime

Higher disposable income, auto sector, consumer durables space to benefit

- The Union Budget has allowed standard deduction of Rs 50,000 under the new personal income tax regime

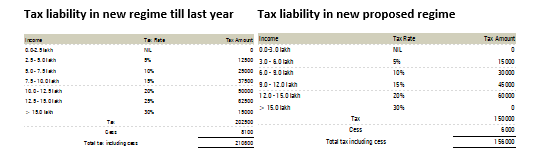

- Basic exemption limit has been raised to Rs 3 lakh from Rs 2.5 lakh earlier while slabs have been reduced from six to five with those earning up to Rs 7 lakh annually exempted from income tax in the new tax regime

- Individual salaried tax payer to save Rs 52,500 at an income of Rs 15.5 lakh

- Capital gain in excess of INR 10 crore on sale of house property cannot be used to avail exemption via property purchase u/s 54 and 54F. Impact on high ticket investors

- Tax collected at source ( on Liberalised remittance scheme ( applicable at 5% without limit is changed to 20). Similarly, for overseas tours also, TCS raised from 5% to 20% .For education and medical exp there is no change.

- Conversion of gold into electronic gold receipt and vice versa will not be considered as capital gain.

- Reduced the TDS rate to 20% from 30% on taxable portion of EPF withdrawal in non-PAN cases.

- Highest surcharge rate on income above 5 Cr to be reduced from 37% to 25% under new regime

- Tax exemption limit raised to Rs 25 lakhs on leave encashment on retirement for Non-government salaried employees

Tax savings in revised new income tax regime with new slabs is Rs 52,500 for income of Rs 15,50,000

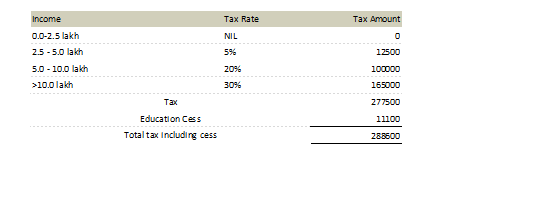

Tax liability in old regime without benefits is Rs 2,88,600, higher by Rs 1,32,600 vs. latest new tax regime, without any benefits

For 30% tax bracket assesses, if the total amount of deductions (Chapter VI-A + Housing Loan Interest+ HRA + LTA + Self NPS + Mediclaim + Standard Deduction) exceeds Rs 4,42,000 (its 30% is Rs 1,32,600), it is better to continue in the current tax regime

Key beneficiaries of rationalisation of tax slabs in new tax regime:

- Automobile Sector: Rationalisation of personal income tax slabs with higher disposable is positive for the passenger vehicle industry as well as premium 2-W space. Consequently, PV and premium 2-W space is seen growing in healthy double digits with key beneficiaries being Maruti, Tata Motors and Eicher Motors. Also, positive in the Budget was the capex push with robust allocation at Rs 10 lakh crore, which will further aid cyclical upswing in commercial vehicle space.

- Consumer durables space: The change in personal income tax slabs coupled with higher rebates under the new tax regime is likely to increase the consumers' discretionary spend towards home appliances. We believe Havells and Bajaj Electricals are the major companies will likely benefit as demand for both small as well as large home appliances would increase on account of higher disposable income.

Source: Budget documents, ICICI Direct Research

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)