Learning Modules Hide

Hide

- Chapter 1: Need for Investment - Part 1

- Chapter 2: Need for Investment: Basics of Investment Part 2

- Chapter 3: Different Investment Avenues – Equity Investments

- Chapter 4: Different Types of Debt Investment: A Guide for Beginners

- Chapter 5: Free Beginners Guide on Real Estate and Gold Investment

- Chapter 6: Risk Reward Matrix for Investment

- Chapter 7: Learn Risk Profiling and Risk Management

Chapter 2: Need for Investment: Basics of Investment Part 2

Let’s begin with a simple math problem. Don’t worry, the money part of the problem makes it quite interesting.

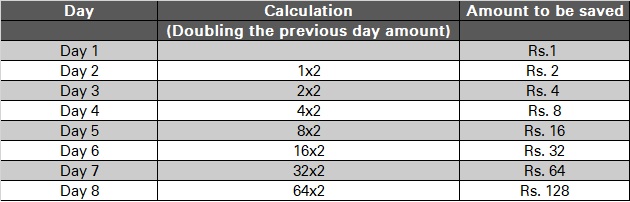

If you start saving one rupee on the first day and save double the amount on the second day and continue this pattern of saving double the amount of the previous day for 30 days, how much money do you end up with after 30 days?

Not clear enough?

Let’s look at the example -

…. and so on…

Now, going back to the question – how much money would you have saved on the 30th day?

Well, it’s a whopping amount of Rs. 53.7 Crore.

Unbelievable, isn’t it? But, it’s true. Check it yourself.

Now, this is the power of compounding.

How does it work for investing?

For the power of compounding to work for your investments, you need to start your investments at the right time and ensure you stay invested for a long period.

When is the right time to start investing?

The sooner the better.

By investing in the market early, you allow your investments more time to grow.

Did you know?

Ace Investor and the sixth richest man in the world, Warren Buffett started investing at the age of 11 but still thought he was late.

Warren Buffett like many others recognized the power of compound interest.

What is compounding in investing? How does it actually work?

Compounding is the growth that takes place when earned returns on your investments are reinvested. As returns continue to be reinvested for a long period, it results in a snowballing effect. That’s because you earn returns on your original investment and the reinvestment of dividend/interest accumulated over the years.

The power of compounding is one of the most compelling reasons to invest as soon as possible. The earlier you start investing and continue to do so consistently, the more money you would be able to make.

In short, the longer you stay invested, the higher the returns.

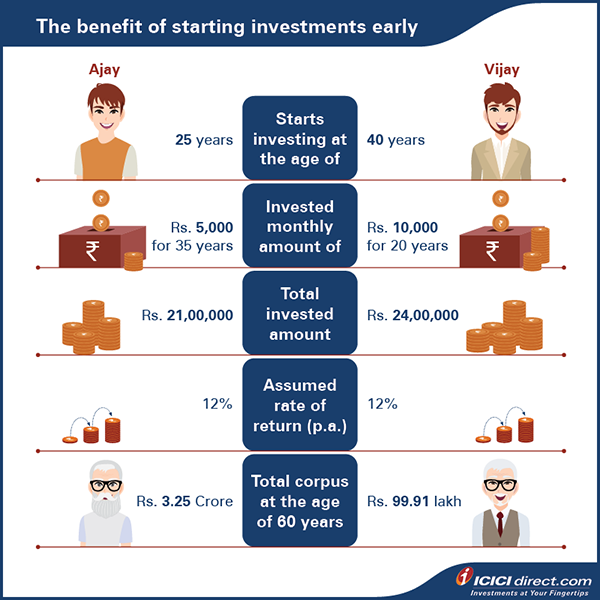

Let’s understand this concept with an example -

If you look at the image above, you would see that even though Ajay invested a lesser amount every month, thereby invested a lower amount in total; he was still able to earn three times more than Vijay. That’s because Vijay started investing late, by almost 15 years.

The reason why Ajay was able to make the most from his investments was because he stayed invested in the market for a longer period of time.

So, when it comes to investing, these are three golden rules that you would need to follow:

- Invest early

- Invest regularly

- Think long terrm

Did you know?

Albert Einstein famously said, “Compound Interest is the 8th wonder of the world. He who understands it, earns it; he who doesn't, pays it.

How much money do I need to invest?

There is no one-size-fits-all amount that you need to invest to generate adequate returns. But ideally, it would help if you invest 20-30% of your income. And the returns you earn will be proportional to the amount you’ve invested.

To understand how much and where to invest, you need to look into your:

- Financial Goal

- Time horizon

- Risk Appetite

Here’s an illustration to understand the above factors:

You plan to renovate your house sometime next year. Based on your current calculations, you would around Rs 2 lakh to get the work done.

In this case, your financial goal is home renovation, time horizon is 1 year, which means it is a short-term goal. Typically, you may not want to take on risk with short term goals, and hence, invest in debt securities. Assuming the annual rate of return for the chosen debt investment avenue is 7%, you can start investing around Rs. 16,000 p.m. to build a corpus of close to Rs. 2 lakhs.

Now you also have a goal to invest for your retirement which is 20 years away. And based on your calculations, you would need at least Rs. 2 crores to retire comfortably.

Here, since your retirement goal is 20 years away, you can choose to invest in equities that have historically proven to provide high returns despite it being risky. Assuming the rate of return is 12% p.a., you may have to invest approximately Rs. 21,000 per month for the next 20 years to build a corpus of Rs. 2 crores by the time you retire.

The above examples are simple illustrations that can help you identify your own unique goals, the time you need to achieve them and how much risk you can take when investing to accomplish your goals.

But how does this help you pick the right investment avenue?

Available avenues of investment

Well, here’s a scenario for you -

It's time to grab a bite for lunch. You get into a restaurant, and you glance at your watch to see how much time you've got left. Suddenly, you remember you've got to attend an important meeting in 20 minutes. What do you do? You quickly scan through the menu and order the dish that you believe can be served swiftly. A smart move indeed, given your time constraint.

But let's say you've wrapped up all your work and you have an hour to spare for a relaxed meal. Now, what do you do? You take your time to go through the menu and select the dish you most crave, even if it might take a bit longer to prepare. Because, of course, it’s worth the wait.

When it comes to selecting investments, almost a similar principle applies.

Choosing the right investment avenue depending upon your financial goals may ensure you get the kind of returns you anticipate in a timeframe that suits you well.

If you look around you, you'd realize there are plenty of investment avenues to choose from. So then, that makes it hard to pick the right one?

Well, not really.

When choosing the right investment tool, you need to base your choice on your risk appetite, financial goals and investment time horizon.

How can you do that?

Here’s an example -

Let's say, wish to build a vacation home sometime by the next decade. Now to make that wish come true, you need to gather a large sum of money. Well, in this case, investing in equity might be a smart move since it has the potential of getting high returns in the long run.

Yes, it may have some risks but your long-term presence in the market might help mitigate the risks. Besides, we already know that risks and returns are directly proportional to each other; the higher the risk, the greater the probability of good returns.

Indeed, equity is one of the many options. But once you understand every available investment instrument in the market, you will know that the same rule can be applied to all.

All investment instruments are broadly based on the following four primary investment areas or assets classes:

• Equity Markets

• Debt Markets or Fixed Income Securities

• Real Estate, &

• Gold

Summary

- When you reinvest the interest earned, your returns in turn starts generating more returns. And that’s the power of compounding.

- The sooner you start investing, the better.

- The three important factors to look into before investing would be -

- Your Financial Goal

- Your Investment time horizon

- Your Risk Appetite

- Broadly, there are four basic investment classes — Equity Markets, Debt Markets, Real Estate and Gold.

In the following chapters, let’s look at how these different investment classes can help you achieve all your various financial goals.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)