Learning Modules Hide

Hide

- Chapter 1: Need for Investment - Part 1

- Chapter 2: Need for Investment: Basics of Investment Part 2

- Chapter 3: Different Investment Avenues – Equity Investments

- Chapter 4: Different Types of Debt Investment: A Guide for Beginners

- Chapter 5: Different Investment Avenues: Real Estate And Gold

- Chapter 6: Risk Reward Matrix for Investment

- Chapter 7: Learn Risk Profiling and Risk Management

Chapter 3: Different Investment Avenues – Equity Investments

Let’s start with an example -

Say, you start your own manufacturing business. Right now, you have 100% ownership of the company. But you soon realise that although you are good at managing and manufacturing machines, you do not know how to market them.

So, you decide to bring in a “partner” who understands the marketing space very well and can help you build the company. Since your business is just starting, you tell your potential partner that you are willing to give him 40% of your company in return for his services. Based on this agreement, you would now own 60% of the company, and your partner, 40%. Any profits and losses from this business will be distributed in the same proportion.

But you later realise, you need more money to expand your business. What can you do?

What is equity investments?

Well, here is when you start looking for investors. An investor will invest money in your company in return for shares or company equity. This means you and your business partner will have to give up some of your shares to any investor interested in giving you money for your business. Once again, gains and losses will be shared proportionately between you, your partner and the investors.

Among long-term investment options for investors, equities or stocks are considered ideal. Even though there is a risk of loss and market volatility, if given enough time, these risks are usually mitigated due to the rise of the economy.

Hence, on average, equity investments tend to outperform all other asset classes in the long-term, in terms of returns.

Did you know?

The world’s most expensive stock is that of Warren Buffett’s company – Berkshire Hathaway which was trading at $ 6,10,460 per share as on 1st July 2024 (Class A share price).

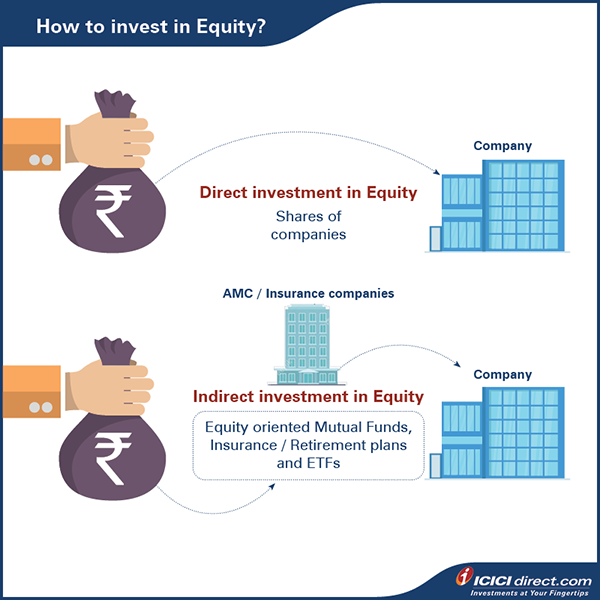

Common stocks are just one form of equity investment. They are also known as Direct Equity.

You can also invest in equity indirectly by investing via Equity-oriented Mutual Funds, Insurance /Retirement Plans and Exchange-traded funds (ETFs).

Gain and loss in equity

When investing in equities, how would you receive gains or losses?

Well, gains on equities can earned in two ways:

- Capital appreciation: Rise in the financial value of equity stocks

- Dividend: Business gains distributed by the business to equity holders

Whereas,

A loss takes place when the capital value of the equity depreciates.

Let’s understand this with an example -

Your friend Sheetal bought 100 equity shares of Fable Motors in 2015. She paid Rs. 50 per share at the time of buying. The current price of the stock is Rs. 500 per share. This is capital appreciation - the stock price increased from Rs. 50 to Rs. 500.

Every year, the firm also declared a dividend at 10% of the face value of the share which is the value of each share mentioned in the financial books and share certificates of the company. The current face value is Rs. 10.

Thus, Sheetal would receive Rs. 500 (500x10x10%) every year from the firm as a dividend. This will be called her dividend income.

In the same way, if the stock price of Fable Motors falls, the loss that Sheetal would incur may even eat into her capital investment.

Equity markets

But, how did your friend, Sheetal, find a company like Fable Motors to invest in?

The answer is – Equity Markets.

Equity or stocks can be bought and sold via IPOs – Initial Public Offerings (primary market) or stock exchanges (secondary market).

It is a platform or place where businesses looking for equity meet investors, looking to invest. On this platform, both entities engage in a transaction where investors buy equity in exchange for money. Apart from businesses, investors can also trade equity among themselves.

Thus, in short, the equity market (or stock market) facilitates the transfer of equity between businesses and among the investors.

The health and performance of equity markets are good indicators of the development and health of the country’s economy.

Did you know?

The first publicly traded stock seems to have been that of the Dutch East India Company, which was founded in 1602 and engaged in trade in and between Asia and Europe.

Usually, National Stock Indexes add a numerical value to this indicator. You can analyze the trend in the movement of this number to judge the state of the economy and decide about buying or selling equity stocks.

Types of equity capital (or equity shares in the market)

There are two types of equity stocks available in the market:

- Publicly Traded Shares

- Privately Placed Shares (Private Equity)

Publicly traded equity shares

Although any business can issue equity shares to its investors, not every business can raise funds from the public.

So, how do you know which companies offer publicly traded equity shares?

Only companies with a proven record of performance and a minimum capital size can choose to list their company in the stock exchange and raise capital from retail investors through public issues, popularly known as IPO (Initial Public Offer).

Thus, all companies that you find listed on stock exchanges are those with a long history of stable business performance. The markets are heavily regulated by Securities & Exchange Board of India (SEBI), making markets transparent and reliable for investors.

Note: In equity markets, larger firms are considered stable than smaller firms. Though these firms may offer lower growth than their smaller counterparts, they provide steady growth. These are also called Blue Chip stocks.

Private equity

There are specific requirements to be met for a company to be listed as “Public”.

What if you want to invest in the equity of a relatively new company that does not meet these criteria?

Well, you can choose to invest in them directly. Here, you will have to manage the investment directly with the company. In this space, the market is less regulated, and you bear all the business risk. Equity investments in these unlisted companies are known as Private Equity.

These companies cannot raise equity funds from the public or trade their equity shares on stock exchanges until they satisfy the SEBI's criteria for raising capital investment.

Indian stock exchanges

There are nine approved stock exchanges* in India, out of which two are National Stock Exchanges:

- The Bombay Stock Exchange Ltd. (BSE Ltd.)

- National Stock Exchange Ltd. (NSE Ltd.)

Indices BSE Sensex and Nifty 50 are considered two national stock indexes, indicating the overall health of the nation’s economy.

The BSE Sensex consists of the 30 largest publicly traded companies from major economic sectors. The Nifty 50 is an index of the 50 largest companies’ stocks from major economic sectors.

If you had invested Rs. 1 lakh in the Nifty 50 Index of NSE in January 2001, you would have approximately Rs. 1 crore by the beginning of 2021.

Did you know?

The BSE is the largest and Asia’s oldest stock exchange. It was started by a businessman named Premchand Roychand in 1875 and today holds the highest number of companies listed on the stock exchange in the world.

That is a compounded annual growth rate (CAGR) of about 12%, unparalleled by any other investment asset! Just imagine!

The other stock exchanges include –

- Calcutta Stock Exchange (CSE) – It was incorporated in 1908 and was granted permanent recognition by the Central Government from April 14, 1980.

- Metropolitan Stock Exchange (MSE) –It was notified as a "Recognized Stock Exchange" under Section 2(39) of the Companies Act, 1956 by Ministry of Corporate Affairs, Govt. of India, on December 21, 2012.

- Indian Commodity Exchange Limited – It is a SEBI regulated online Commodity Derivative Exchange.

- Multi Commodity Exchange of India Ltd. – It is the leading commodities exchange in India.

- National Commodity & Derivatives Exchange Ltd. – It is the leading agricultural commodity exchange in India.

*Details as on August 3, 2022

How to start investing in equity markets?

There are two common ways to invest in the Indian equity markets:

- Directly through a demat-and -trading account

- Indirectly, through professionally managed funds like mutual funds, ETFs, ULIPs, etc.

Summary

- Equity investments are primarily regarded as long-term investment options and have historically proven to offer better returns than other asset classes.

- Gains in equities are typically through capital appreciation and dividends.

- India has seven approved stock exchanges and among these two national stock exchanges are the Bombay Stock Exchange and National Stock Exchange.

- You can invest in equity markets through purchasing shares, equity mutual funds, ETFs, etc. or portfolio management services.

We hope you enjoyed learning about equity investments. In the second part, we take a closer look at debt investments and how you can benefit from investing in them.

Track your application

COMMENT (0)