Learning Modules Hide

Hide

- Chapter 1: Need for Investment - Part 1

- Chapter 2: Need for Investment: Basics of Investment Part 2

- Chapter 3: Different Investment Avenues – Equity Investments

- Chapter 4: Different Types of Debt Investment: A Guide for Beginners

- Chapter 5: Different Investment Avenues: Real Estate And Gold

- Chapter 6: Risk Reward Matrix for Investment

- Chapter 7: Learn Risk Profiling and Risk Management

Chapter 4: Different Types of Debt Investment: A Guide for Beginners

Rohan just received his bonus. He plans to use the bulk of the amount to renovate his home ten months later. His wife suggests, "Do you think it would be a good idea to invest it since you’re only going to need the money ten months from now?" To which Rohan replies, "I don’t think investments can be made for such a short duration. You can only invest for a long term."

Rohan, here, is mistaken. Why?

You must have heard this quote by Benjamin Franklin – “An investment in knowledge pays the best interest”.

And Franklin is right. If Rohan had done his research, he would have known there are investment avenues that cater to short-term goals and allow you to earn reasonable returns.

Yes, it's true.

You can make investments for the short term. Debt investments are one such avenue.

Let’s know more.

What are debt investments?

Say you plan to start your own business.

You have enough money to get it going. You also know that the initial amount will help to run the business for a specific time and drive in a bit of sales.

For the first few years, the capital and profits help you run business operations smoothly. But you soon realize that your business needs to grow and for that you would need more money.

So, you go to a bank and sign a loan agreement with a promise to repay the money with interest. The bank then lends you the money.

Later, when you repay the amount to the bank, you pay it to the bank along with interest.

Now, the money you received from the bank is a form of debt investment.

In simple words, debt investments are money lent to any individual, business or government institution. These are fixed-income or debt instruments issued for a specific duration to raise capital.

In debt investments, your profit is not directly related to the borrower's performance. Whether or not the business runs well, the borrower needs to pay back the money as per the agreement. So, debt is known as a safer and steady stream of income for lenders (investors).

So how does it differ from equity?

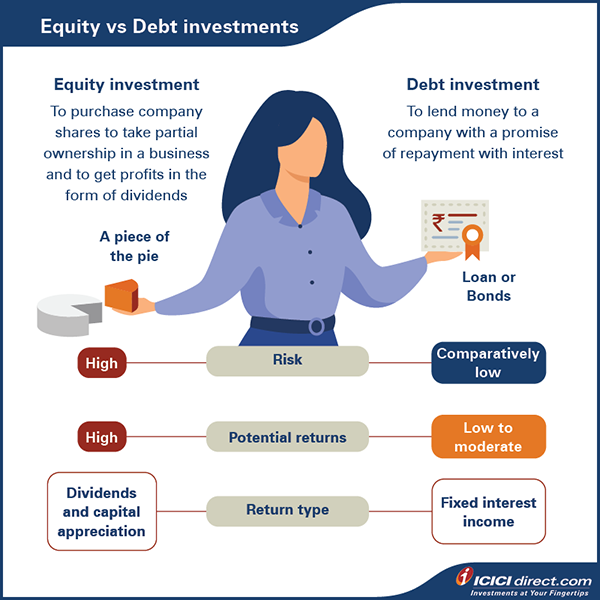

Let's look at the primary differences between equity and debt investments.

Debt is one of the two ways of investing in a business, the other being equity investments.

You can invest in debt through bonds, debentures, debt mutual funds and similar other securities.

Bonds or debt securities are also called fixed-income securities because of the fixed rate of interest they offer.

-

MythBusters

Myth: Equity or Debt? You have to choose just one.

Busted: You can Invest in both! Debt and equity investments come with their own set of qualities to help you achieve different goals during your lifetime.

Debt investors are lenders, not owners

An important point to realize that debt investments do not provide ownership stake. This is because the interest you earn from your investment is not conditional to the borrower’s business performance. So, unlike equity investors, you do not receive an ownership interest in the business with a debt investment. This further means you do not share in the losses or even the gains of the business.

When there is no connection to business performance, the interest payments is what makes debt investment a safer option over equity shares.

Did you know?

Debt funds are not entirely ‘risk-free’. They possess credit risk that means the borrower may fail to pay back the loan on time or sometimes not pay at all.

Indian debt markets

We already know about equity markets; how they run, perform and operate.

In the same manner, there is also a financial market for debt investments.

Indian debt markets include a variety of debt instruments offered by government and non-government bodies. Debt markets in India rely on the following three institutions:

1. Issuers of Securities

Large corporations, financial institutions (banks etc.) or Government bodies

2. Credit Rating Agencies

These agencies indicate the investment risk of debt security. AAA to BBB are investment grade ratings

3. Financial Institutions

Banks, mutual funds, life insurance companies and pension funds invest in debt securities on behalf of their investors

Did you know?

The Indian debt market is among the top five largest debt markets in Asia.

Type of debt securities

Following are the popular types of fixed-income securities or debt investments available in India:

- Government Bonds (G-Sec or Gilt Securities)

- Corporate bonds/debentures

- Bank or Post Office deposits

With everything going digital, you can now invest in government bonds online. You can invest in selected government bonds online through reputed brokers.

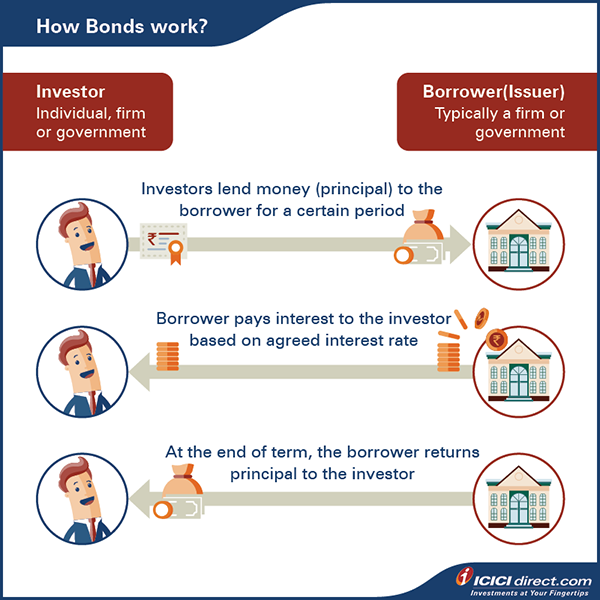

How debt investments work

When an entity or an institution lends money, a financial asset is created known as a security.

When the government issues bonds, it is a security issued by the government and sold to you—the investor, who is willing to lend money to the government in return for interest payments and principal return on the bond's maturity.

However, it is crucial to look if the debt security issuer is creditworthy before investing in debt.

How exactly are these bonds priced?

Well, there are many factors that affect the price of a bond. The price that you see in the market today at which bonds are available depends on the following factors:

- The existing market-interest rate

- The credit rating or risk level of the issuer and instrument (bonds from high-risk companies could be available at a higher discount or may offer higher coupon/interest rate)

- Demand and supply factors, to some extent

Example

Creative Enterprises is a company with an excellent balance sheet operating in a well-established marketplace. This company is less likely to default on its debts than a startup business operating in an emerging marketplace. Hence, Creative Enterprises is expected to be given a better and favourable credit rating by major credit rating agencies and in turn their bonds would have a lower interest rate.

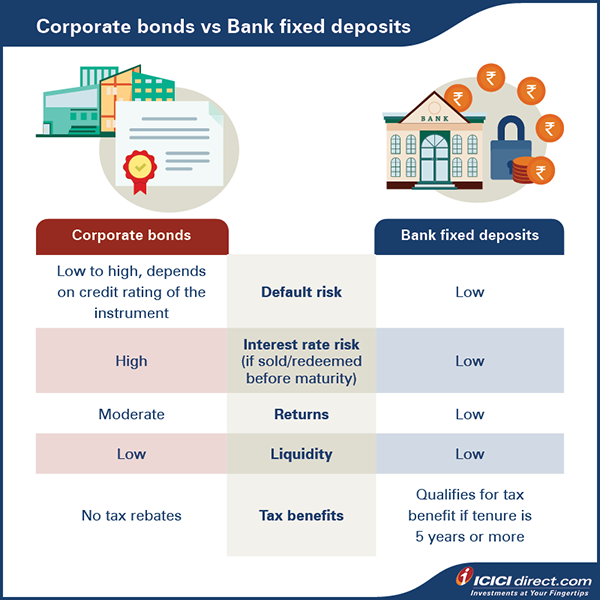

On the other hand, fixed deposits are another popular form of debt investment.

But How is a fixed deposit different from a bond?

We know what you're thinking - 'There must be conditions applied.'

Yes, there are.

When banks issue fixed deposits, it works with standard conditions declared when setting up the fixed deposit.

They are:

- The tenure of the deposit

- The deposits interest rate

- Mode of the interest payment — monthly, semiannually, annually or at the time of maturity.

Like bonds and fixed deposits, every other form of fixed income security must provide specific terms defined at the time of issuing.

Did you know?

You can get a loan against your fixed deposit. So, in case of an emergency, you do not need to liquidate your investments; instead, you can opt for a low-interest loan by using it as collateral.

Summary

- Debt securities are financial investments that allow you to receive a stream of returns through interest payments.

- Government bonds, corporate bonds, debentures, fixed deposits, etc., are common types of debt securities.

- Debt investments do not give you ownership when you invest in a company, unlike equity investments.

- The interest rate on debt investments will depend on the creditworthiness of the entity issuing the debt security and prevailing interest rate in the market.

- You can invest in debt securities indirectly through mutual funds and selected life insurance policies; and directly through government and corporate bonds available in the market.

While both debt and equity instruments have the potential to giving you good returns on your investments, there are additional investment avenues you may want to know about. Let's move to the next chapter where we discussed real estate and gold as investments.

Track your application

COMMENT (0)