Intrinsic Value of Shares: Formula, Challenges & Valuation Methods

What is the intrinsic value of shares?

The intrinsic value of a share is not the same as the share price. The price of a share fluctuates based on the sentiment of the investors in the market and is not an indicator of its actual value. So, the intrinsic or true value of a stock is different from what the investors are willing to pay for it. The intrinsic value of a share is arrived at using fundamental analysis.

Breaking Down the Intrinsic Value

The intrinsic value of a stock comprises both – qualitative aspects and quantitative aspects. The qualitative aspects include the fundamental business model, the management team, the governance, etc. On the other hand, quantitative aspects primarily include the analysis of a company’s financial statements. These quantitative metrics are then pitted against the market value to determine whether that stock is overvalued or undervalued.

Basic Formula

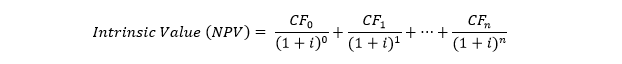

Let us now learn how to calculate the intrinsic value of a stock. There are several ways to do so, but the most commonly used is the Net Present Value Method. The formula is:

where,

NPV = Net Present Value

CFn = Net Cash Flow for the nth period (Present cash flow, n = 0)

i = Annual interest rate

n = number of periods included

It must be noted that this method relies on assumptions as future cash flows cannot be predicted with complete certainty. Hence, risk must be factored into this model.

Risk Adjusting the Intrinsic Value

There are two ways of risk-adjusting the intrinsic value of a share:

1. Using a Discount Rate: The above-mentioned formula uses the annual interest rate which is also an assumed rate. However, if we attach a risk premium to it and factor it into the annual interest rate, the cash flows will be discounted more accurately to the NPV.

Here the analyst uses a company’s WACC (Weighted Average Cost of Capital) wherein a volatility-based premium is multiplied by the equity risk premium. The logic behind this is that greater volatility implies greater risk, and a higher discount rate will therefore be applied.

2. Using a Certainty Factor: When forecasting cashflows a factor between 0 (complete uncertainty) and 100 (complete certainty) is used. It is believed that Warren Buffet deploys this method too.

A simple way to understand this is that in investment in government bonds yields definite cash flows, which is complete certainty. Hence the discount rate used in this case will be equal to the bond yield. If it were to be an IT company with high risk, maybe a 45% probability factor would get attached to the bond yield rate for a more accurate prediction of cash flows from this stock.

Challenges With Intrinsic Value

The primary challenge faced in the estimation of intrinsic value is that it is a very subjective process. There is no way to be 100% accurate as the risk factors being associated with the calculation are also determined based on individual perceptions of risk. For example, while one person considers an FMCG stock to be stable, another person may consider it to be risky. And this keeps varying from person to person.

Secondly, the future cash flows are assumed values themselves. If any of the underlying assumptions are subjected to change, the discounted NPV will also end up changing.

Thirdly, as a combination of the above two points, each person can arrive at a different NPV of the same asset due to the subjective nature of this exercise.

Valuation Methods

Of the multiple valuation methods that exist, there are primarily two methods used to arrive at the intrinsic value of an asset:

1. Discounted Cash Flow (DCF) Method: This method uses the weighted average cost of capital to discount a company’s projected flows to their present value. Using this method, the intrinsic value of a share, meaning its fair value, is arrived at based on projected future cash flows. It must be noted that this method only considers the free cash flows, which means that all non-cash expenses are excluded and the changes in working capital are accounted for.

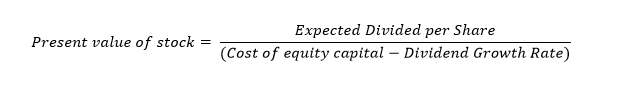

2. Dividend Discount Model: The value of a stock may also be looked at as a discounted value of all the dividend payouts it is expected to generate in the future. Here the intrinsic value is calculated as follows:

The Gordon Growth Model (GGM) is a popular variant of the dividend discount method. Here the cost of equity capital is replaced by the rate of return required by the investors. GGM is generally applied to blue-chip companies as it assumes a stable business and perpetual dividend growth.

Conclusion

Valuing an asset is a very subjective process and can yield different results for the same asset. Although the estimation of an asset’s intrinsic value is not a sure-fire way to mitigate any risks, it presents the investors with a much clearer picture of the company’s financial stability. Intrinsic value is most important to investors who enter stocks at an early stage and expect to remain invested for the long-term.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)