Payout Ratio: What It Is, Calculation & Interpretation

What Is Payout Ratio?

Shareholders are the part owners of the company. The company rewards shareholders in many ways and one of them is by paying dividends. A Payout Ratio, also commonly referred to as Dividend Pay-out Ratio (DPR), is a financial metric which indicates what portion of a company’s earnings is distributed among its shareholders in the form of dividend payments.

The total dividend payout is calculated as a percentage of its total earnings. (Sometimes also as a part of its cash flow.) DPR is a crucial indicator for investors as well as shareholders to identify how investor-friendly the company is.

How is the Payout Ratio calculated?

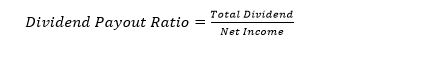

As mentioned above, the Dividend Payout Ratio is calculated as a percentage of a company’s net income. There are three ways to arrive at the DPR. We will take a look at all of them and build on each of them to understand the next one in this article:

Calculation 1:

The most basic calculation is the straightforward division of the total dividend pay-out by the net income of the company.

In order to obtain both these numbers, you will have to look at the income statement (P&L Statement) of the company.

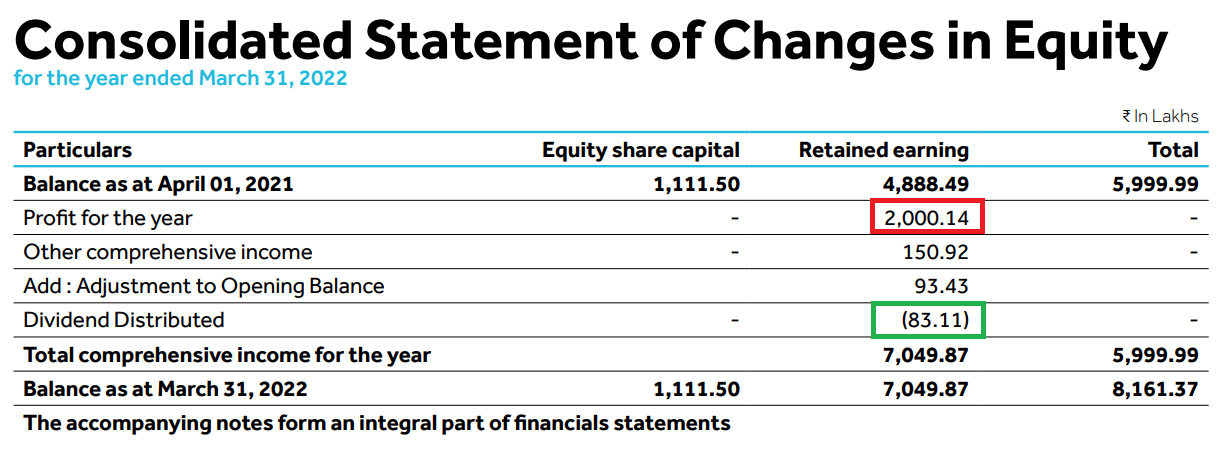

Let’s understand with an example. The below table shows the equity changes of a green energy company:

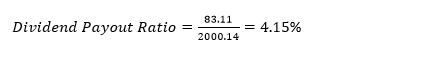

As you can see the profit for the year 2021-22 as well as the dividend payment are mentioned here. The Dividend Payout Ratio is calculated as follows:

Calculation 2:

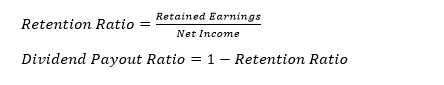

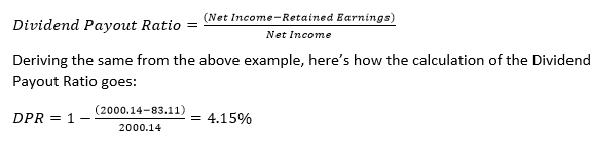

As mentioned earlier, the dividend payment is only a small portion of the company’s net income. The company also ‘retains’ some portion of those earnings, which it then reinvests into the business for expansion and growth. This portion is known as the ‘retained earnings of the company. Here’s how we arrive at the Dividend Payout Ratio through this metric:

OR

Calculation 3:

Another way to arrive at the Dividend Payout Ratio is by using two other popular ratios, i.e., Dividends per Share (DPS) and Earnings per Share (EPS). Simply dividing the DPS by the EPS will give you the DPR.

Experts do not recommend using this formula if the actual amounts of the total dividend payout and net income are available to you.

How to Interpret a Payout Ratio?

The Dividend Payout Ratio is a very critical evaluation metric for investors to make further decisions. A low payout ratio indicates that a company is retaining more earnings to reinvest in the business, while a high payout ratio may signal that a company is distributing more earnings to shareholders. However, there are some things to check for along with the DPR for added certainty.

1. Maturity Phase: This indicates which growth phase the company is passing through at that point in time. Viewing the Dividend Payout Ratio while being cognizant of the phase adds rationale to investment decisions. Let’s say that a company is in its early stages and is only beginning to grow. If it distributes a majority of its net earnings as dividends, it will not only decelerate its growth story, but also put off investors who wish to see the money reinvested in its expansion.

These expectations are due to the fact that a company is required to deploy its surplus funds in expanding the business and keeping pace with the projected growth. Dividend payouts drag it down as the otherwise available funds are now used up in part. This is viewed as incapable management and such a perception can even reflect in plummeting share prices of the company. Such companies are expected to have a very low Dividend Payout Ratio.

On the other hand, if the company has already picked up the pace and achieved most of its goals and stabilised, the earnings can be shared with its investors as a gratitude for their faith. Such a move is well received in the stock market as well and their Dividend Payout Ratio is higher.

2. Industry of Operation: While some industries are kind to new entrants in the market, some industries have established competitors waiting to jump at any available opportunity. In such industries, it becomes even more critical to stay ahead of the competition and deploy as much money as possible for growth activities. These companies may have negligible dividend payouts or extremely low Dividend Payout Ratio, which is therefore not necessarily a bad thing.

This is also why there is no one benchmark Dividend Payout Ratio that can be identified as the ideal ratio for all industries. Knowing about the industry helps investors ascertain how the company is utilising its funds in comparison with its peers, and whether its decisions are wise.

3. Maintaining a Consistent DPR: Once a company starts disbursing dividends, all investors’ eyes turn to check whether the company distributes the same proportion of its net earnings as dividend year after year. After a couple of years, a trend emerges and the company cannot afford to have a downtrend in dividend pay-outs. Maintaining a constant Dividend Payout Ratio should neither hurt the company’s finances nor disappoint its investors. The DPR must be sustainable and it should eventually attract more investors in the future.

In conclusion, the dividend payout ratio is an important financial metric that helps investors assess the sustainability of a company’s dividend payments. It is essential to interpret the payout ratio in the context of the company’s industry, growth prospects, and other financial metrics. By understanding the payout ratio and its implications, investors can make more informed investment decisions.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)