Cash Conversion Cycle: What It Is, Calculation & Interpretation

What is the Cash Conversion Cycle (CCC)?

The Cash Conversion Cycle is a valuation metric that measures the number of days taken by a company to convert its inventory and other operational resources into cash through sales. It is also called Net Operating Cycle and it effectively estimates the length of time for which each invested rupee is held up in the production and sales process before it comes back as cash, which is then used to settle its accounts payable.

The Cash Conversion Cycle is a good measure of a firm’s sales efficiency, which means how quickly the firm can buy raw materials, sell finished goods, receive cash on its sales, and pay its vendors. If the number of days is less, that means the conversion from investment to cash income & settlement is very efficient.

Cash Conversion Cycle Calculation

Cash Conversion Cycle is a three-legged calculation, consisting of:

1. Days Inventory Outstanding (DIO)

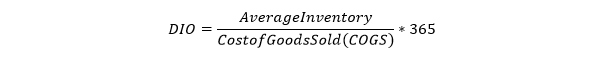

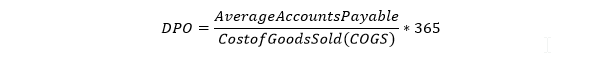

DIO is the first leg of the Cash Conversion Cycle. It is the number of days taken by the company to completely liquidate its inventory through the sale. This can also be looked at as the average number of days for which inventory is lying with the company before it is sold. The formula for DIO is:

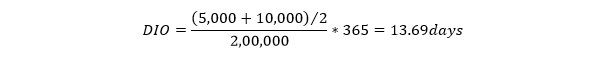

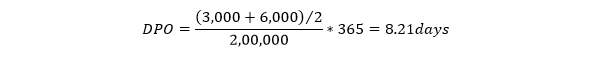

For example, let’s say the opening inventory at the start of 2022 was worth ₹5,000 and the closing inventory at the end of the fiscal year was worth ₹10,000. If the COGS is ₹2,00,000 then the DIO is:

So the company takes nearly 14 days to convert its inventory into sales.

2. Days Sales Outstanding (DSO)

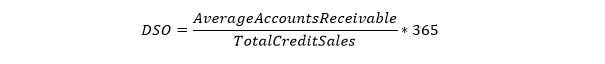

DSO is the second leg of the Cash Conversion Cycle. This is the average number of days taken by the company to collect its payments upon completion of its sale. The formula for DSO is:

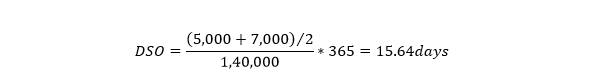

Now if the company reports starting account receivables as ₹5,000 at the start of 2022 and ₹7,000 at the end of that fiscal year with credit sales standing at ₹1,40,000, DSO will be:

This means that the company requires a little over 15 days to get its invoice on the sales.

3. Days Payable Outstanding (DPO)

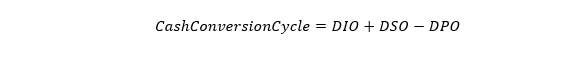

Since every company sources some materials before it can commence manufacturing activities, it also accrues some payables to its vendors. DPO measures the number of days taken by a company to settle all its payables and forms the third leg of the Cash Conversion Cycle. It is calculated as:

Similarly, if the company enters FY2022 with accounts payable worth ₹3,000 and ends the fiscal year with accounts payable worth ₹6,000, with COGS of ₹2,00,000, the DPO will be:

This means that the company clears dues on all its invoices in about 8 days.

Cash Conversion Cycle Formula

Cash conversion cycle formula is a combination of the above legs and is simply the summation of all three:

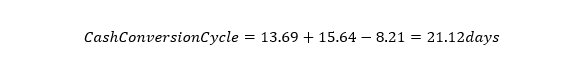

From the above example,

So, the company takes 21 days to convert it’s starting investment back into cash.

Interpretation of Cash Conversion Cycle

It is obvious that the fast the cash income, the better off a company is. Thus, a lower CCC implies that the company is very good at managing its cash flow and vice versa. Now, the CCC may increase or decrease over the previous year depending upon the market situation in that fiscal year. Here’s how the changes should be read and deciphered:

- Increasing CCC: This implies that the company has started taking longer than the previous year to convert inventory into cash. It also indicates that the cash flow efficiency observed during the previous year has worsened.

- Decreasing CCC: Since a lower CCC shows up when inventory clears out quickly, it means that the company maintains good supplier relationships and is not only able to bargain on cost, but is also able to collect payments well in time.

Cash Flow Cycles vary from company to company and are normally viewed in comparison with its peers in the same industry.

FAQs

Is there a specific CCC value that is considered good?

No. Cash Conversion Cycle is a variable metric which not only varies between companies, but also changes form industry to industry as the nature of the business changes. Simply put, a lower CCC among industry peers is considered good.

Is there a way to reduce the CCC?

There are several ways to reduce CCC and can be chosen based on the business model of the company. They are:

- Timely cash collection

- Faster deliveries

- Offering multiple payment methods

- Investing in a robust ERP software for effective tracking

Even something as routine as having a simple invoice makes a difference to the Cash Conversion Cycle.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. AMFI Regn. No.: ARN-0845. We are distributors for Mutual funds. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)