Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Risk & Return on Equity Investment

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Valuation Terms Explained – Part 1

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 - How Foreign Investments Influence Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 1: A Stock Market Guide on Equity Investment

Generally speaking,stocks and shares refer to financial equities — securities that give an investor a slice of ownership in a public business.

What does equity mean?

Equity is basically the ownership of a business. A business is divided into pieces called shares and are divided among people based on their monetary or sometimes non-cash contribution to the company.

So, when you heard your uncle mention – “I own 10% shares of Prabhat Inc.,” it simply means he owns 10% of the business.

These shares are nothing but the equity ownership of the company.

For example:

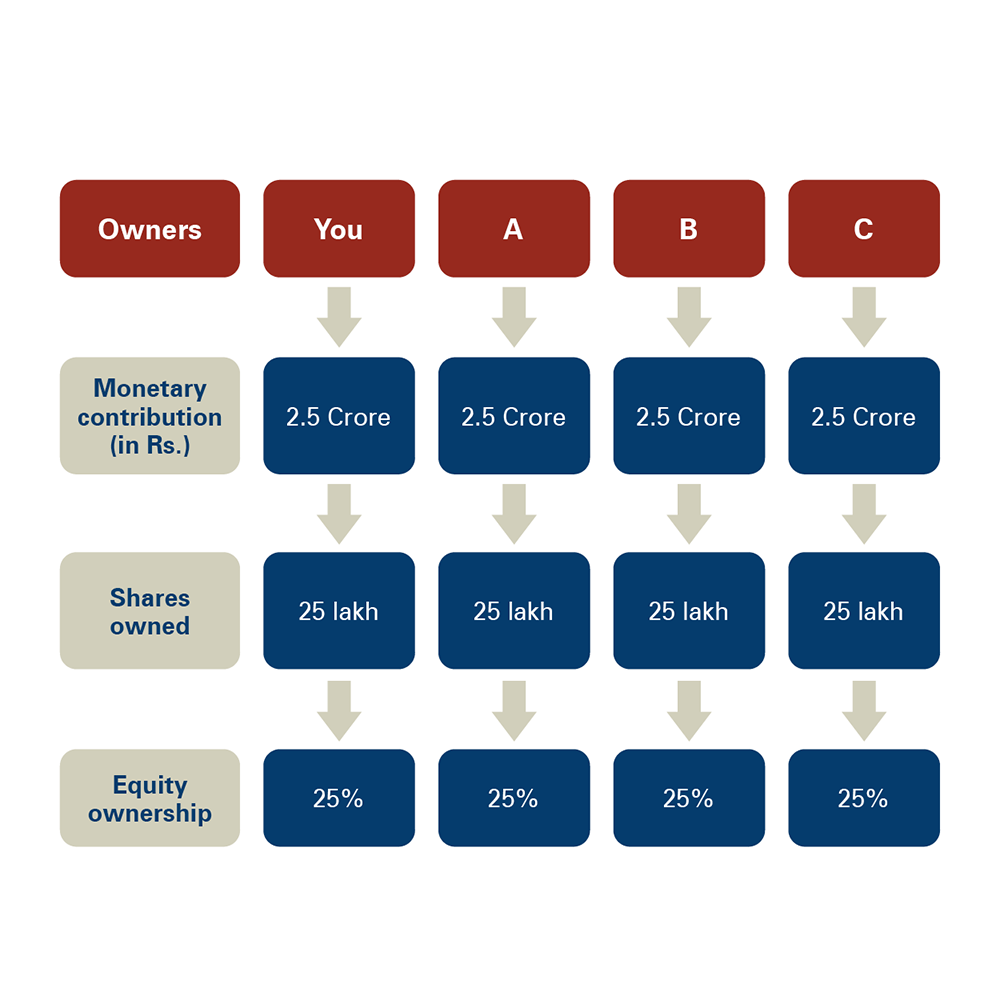

Let's say, you joined hands with three of your friends to start a new company. Each one of you invests Rs. 2.5 crore to get the business rolling, i.e. invested a total sum of Rs. 10 crore. When it's time to register your company, you divide the business into 1 crore shares of Rs. 10 each. This means that value of the share in the books of the company is Rs.10. Since it's a joint partnership with three of your friends, each of you receives 25 lakh shares equally — 25% of the ownership or equity.

Here's how it appears.

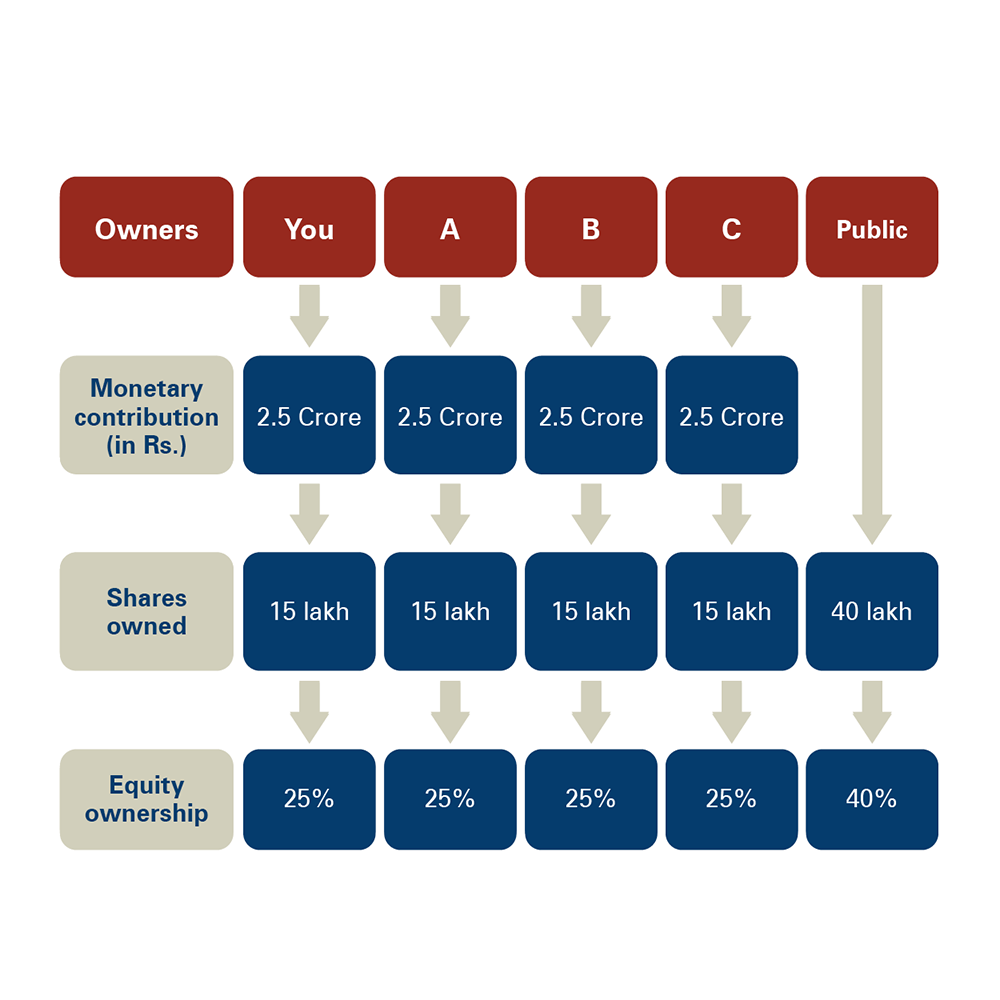

To raise the capital for business expansion, all the owners of the business unanimously decide to surrender an equal number of shares — 10 lakh. Your friends and you as equal owners, give up a specific portion of your shares in order to allow other investors to purchase in return for funds.

That means, the company announces its decision of selling 40% of its total shares to the public to raise the money as needed. But these stocks are sold at a higher price known as the market value let’s say Rs. 100. So, an investor who wants to invest in your company will have to pay a premium of Rs. 90 to purchase the share worth Rs. 10. This basically means that their ownership in the business would be equivalent to Rs. 10 only.

So, now that you and your friends own only 60% and the public own the remaining 40% here's how the updated share ownership will appear.

Now, if an investor purchases one lakh shares of your company, they become the shareholder of your company with 1% equity ownership in your business.

Hence, simply put:

Purchasing a stake in a company means investing in that company, making it an equity investment. Therefore, any investor who purchases shares or a stake in a firm owns partial ownership of that firm.

Additional Read: Types of Stocks & Investing

Importance of equity investment

Equity investments are more likely to help you achieve your financial goals and beat inflation as well as address taxes in the long-term. That’s why, if you invest entirely in conservative investment avenues like fixed deposits, it may not be enough to protect your money from inflation and taxes.

And not just that, historical data proves that investing in equities has demonstrated the potential to outperform returns offered by most asset classes like gold, debt, real estate, etc. Quite simply, it means that over the long term, no other type of investment may perform better than equities due to its high potential returns.

Here’s an example to understand the difference:

Let’s say that you invest Rs. 1 lakh in a Fixed Deposit (FD) that offers you 6% returns at 30% taxation. In this case, your post-tax return in hand will be 6%*(1 - 0.3) = 4.2%.

But what if you invested the same amount in an equity instrument? In that case, if you assume equity post-tax return as 10% p.a., then after 20 years, the value of the Rs. 1 lakh would be Rs. 6.73 lakh. As against only Rs. 2.28 lakh in the FD investment!

Here, you can see how your equity investment value is more than double the return of the FD investment.

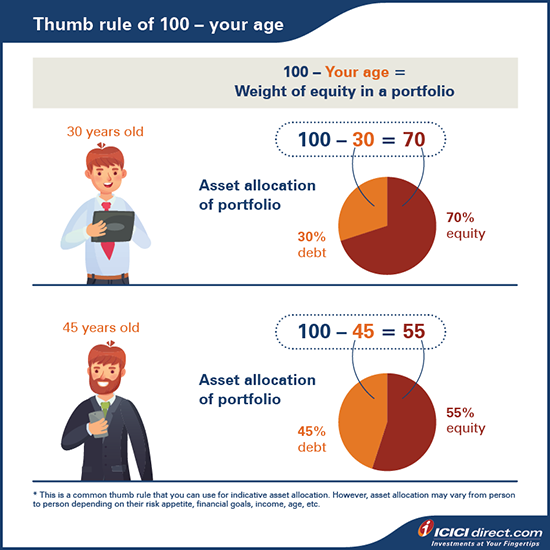

How can you find the right balance between equity and debt in your portfolio?

Here’s a common thumb rule that you can use for indicative asset allocation. However, asset allocation may vary from person to person depending on their risk appetite, financial goals, income, age, etc.

Summary

- Making an equity investment means purchasing stake in a business and receiving partial ownership in it.

- Investing in equity instruments has historically demonstrated its potential of outperforming every other asset class.

- You can use the common thumb rule of 100 minus age to figure out how to divide your investments among equity and debt.

Now that you know why you should invest in equities, in the next chapter, let’s look at how to calculate the estimated returns of your equity investments and the risks involved.

Track your application

COMMENT (0)