Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Risk & Return on Equity Investment

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Valuation Terms Explained – Part 1

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 - How Foreign Investments Influence Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 12: IPO Process- From Merchant Banker to Company Listing

Let's say you've got an outstanding talent for baking cakes. And who doesn't love cakes!

But you are not just another baker. Your friends and family vouch for your artisanal bakes, and suddenly, your close friend suggests capitalizing on your talent.

Now that sounds like a great idea!

You begin to gather information on what it would take to start the business. And you make a list. You need to make a business plan, arrange for funds, look into permits and licenses, plan on designing the logo and shop layout, order equipment, hire staff, advertise and a whole lot more.

This means, it will take you a good deal of time and planning to initiate the business.

Similarly, before an IPO can take place, it takes a long time before the IPO process really starts; in some cases, two or more years before the IPO launch.

So, what’s involved in the IPO Process in India?

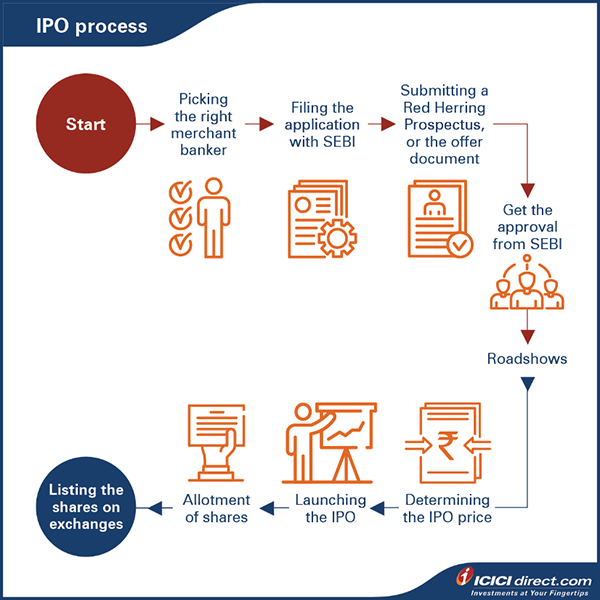

IPO process

It's a long drawn and meticulous process to launch an IPO. Here’s what it entails.

Hire merchant banker(s)

The company takes the help of financial experts known as merchant bankers to initiate the Initial Public Offer (IPO) process. These merchant bankers, also regarded as Book Running Lead Managers (BRLM), advise on the capital to raise and work as intermediaries between investors and the company.

These merchant bankers also look into important financial parameters like issue details, capital to be raised, capital structure, etc., before signing an underwriting agreement.

Register the IPO

Registering for the IPO involves preparing a registration statement. After getting in-principle approval from SEBI, the company will prepare a draft prospectus known as a Draft Red Herring Prospectus (DRHP). It is a primary registration document for companies looking to float an IPO. According to the Companies Act, it is important to submit the DRHP because it contains all crucial disclosures as required by SEBI.

That includes:

- Definitions

- Risk factors

- Use of capital raised

- Industry prescription

- Business description

- Key management personnel

- Financial statements and auditors report

- Legal details and other miscellaneous information

Before the offer can open to the public for bidding, the document needs to be submitted to the registrar of companies.

IPO approval from SEBI

As the market regulator, the SEBI then gets into verifying the disclosure of the facts raised by the company. Once SEBI approves the application, the company can then announce a date for its IPO.

Fix the price band

On completing compliance formalities, the company lays down the IPO price. This pricing is either through fixed-price IPO or through book building offering. If the company decides to go for the fixed-price friend, the price of the company's stock is announced in advance.

If the company decides to take the book building approach, a price range is announced to allow investors to place their bets within the price bracket. The maximum gap between the lower and upper price bands can be 20%. The company also decides on the IPO floor price (minimum bid price), IPO Cap Price (highest bidding price), cut off price, launch date, listing date and other details. Recently mostly, IPO has a very narrow price band, even a price difference of Re. 1.

And now all you need to do is – Create the BUZZ.

The Public cannot invest in a company if The Public doesn’t know about the company.

That brings us to one of the most important steps -

Advertising and marketing campaign

To attract potential customers, the company gets into a marketing and advertising drive by involving key business analysts and fund managers to talk about the company's prospects. It hosts a wide range of investor friendly strategies such as brochures, presentations, group meetings, question-and-answer sessions and so on.

How are the shares allocated?

The allotment of shares happens according to the rules defined by the Securities and Exchange Board of India (SEBI). The allocation is reserved category wise namely: Qualified Institutional Buyers (QIBs), non-institutional investors and retail investors.

But wait, what if the issue subscription is less than expected?

If the number of bids received for shares is less than the shares offered in an IPO, it is considered as an under-subscribed issue. It shows the demand for shares is lower.

Since before the IPO process commenced for the company, the investment bank i.e. the underwriter would be required to buy unsold shares in case of undersubscription.

If the issue is subscribed by less than 90%, it will be withdrawn from the market.

Conversely, what if the quota of shares reserved for retail investors gets over-subscribed?

As per the SEBI guidelines, in case of oversubscription by retail investors, the shares will have to be allotted to ensure that every bidder gets at least one lot* and the rest of the shares are issued on a pro-rata basis**. If the subscription is so high that allotting even one lot to every bidder seems impossible, one lot is allotted by a lucky draw.

[*A bid lot is a pre-defined minimum number of shares that have to be applied for by a single investor]

[**Pro-rata is a Latin term used to describe a proportionate allocation; it means that no applicant is rejected, but they may not receive the desired number of shares. So, if the company has received two crore share applications against the one core available share and you have applied for two shares, you may receive one share.]

Did you know?

In November 2021, Latent View Analytics Limited’s IPO was oversubscribed 326.49 times.

What would a company do in such a case?

In this situation, the company can go for the Green Shoe Option. With this, the company has the choice of issuing additional shares to meet the demand. This means that the issuer can issue up to 15% additional shares in the IPO. However, these shares are not issued to the public directly. The underwriters (Merchant Bankers) can borrow these additional shares from promoters under a separate agreement. Now, if the stock price falls below the issue price on the listing, the underwriters can start buying back these shares and offer price stabilisation to the falling stock price. But if a listed price is more than the offer price, they will not buy back these shares. As per rules, this price stabilisation can mechanism can be used for 30 days.

Did you know?

The term Green Shoe Option originated from the company — Green Shoe Manufacturing (now called Stride Rite) who used this option for the first time.

List the shares on the stock exchange

It is a tremendous milestone for the company to list its shares on the stock exchange. The listing price could be lower or higher than the IPO, depending on the demand and supply and other factors such as market sentiments.

From here on, the company is now publicly traded.

The entire IPO process is a solid and robust procedure. It takes a lot of time and attention to detail. And having such a sound process is what makes many investors flock to IPO investments.

Additional Read: Can I apply for IPO without a Demat Account?

Summary

- The IPO process involves hiring merchant bankers, registering the IPO, vetting through SEBI, fixing the price band, initiating an advertising and marketing campaign and listing the shares on the stock exchange.

In the following chapter, let’s understand how an investor like you can invest in an IPO.

Disclaimer – ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. Please note, IPO related services are not Exchange traded products and I-Sec is acting as a distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Track your application

COMMENT (0)