Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 12 – Introduction to Foreign Investments and Business Cycles

By now you already know that foreign investment is a catalyst for the economic growth of a country.

But how can a foreign entity invest in India?

Any firm who wants to invest in India has two options:

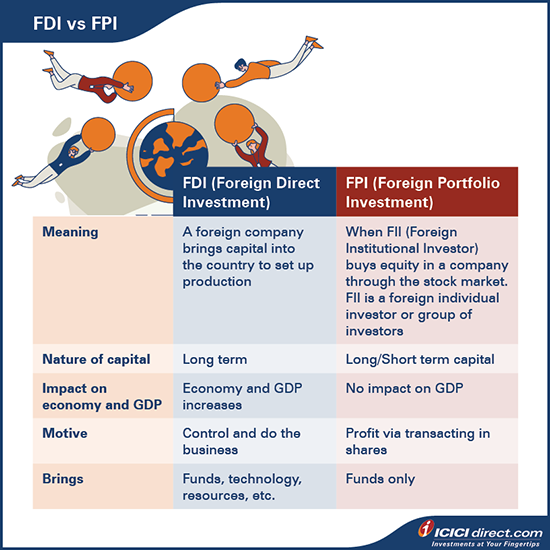

- Foreign Direct Investments (FDI)

- Foreign Portfolio Investment (FPI)

Let’s understand both with the help of examples.

Foreign Direct Investments

Let’s say a US-based company – Alphatech Services LLC. wants to invest in India. So it decides to open a subsidiary company in Mumbai and names it, Alphatech Services India Ltd. The new subsidiary is partly owned by Alphatech US and partly by an Indian company. This new arrangement will now allow the foreign company to produce and sell their goods and services in India.

Such investors (companies) seeking to invest physically in a foreign country can do so by setting up a wholly-owned subsidiary or collaborate with a local partner to carry out business.

Did you know?

Companies such as McDonald's, Coca Cola, Pepsi are actually FDIs.

Foreign Portfolio Investment

These are Foreign Institutional Investors (FII) not seeking to invest physically in a foreign country but instead looking to invest in foreign companies by purchasing a stake in them. FII is individual investors or a group of investors. Such investors are generally large fund houses or companies that include pension funds, mutual funds, insurance companies, hedge funds, private equity funds, venture capital funds and so on.

To sum up, let’s look at some basic differences between the two:

But how do FII and FDI impact the flow on markets?

Foreign Institutional Investors:

- Aid domestic investment by increasing capital inflows through secondary markets

- Invest in large amounts and that may influence market trends

- Work as catalysts for price movement if FIIs take a position. Conversely, they can also trigger a sell-off if FIIs exit from particular stocks.

Foreign Direct Investments, on the other hand:

- Provide an inflow of foreign funds and investments

- Help in the transfer of goods and services

- Increase employment rate by creating new job opportunities

Additional read: What are Foreign Currency Exchangeable Bonds?

Sovereign Rating

Do you own a credit card? Then you’ve definitely heard about – Credit or CIBIL score.

Your Credit or CIBIL score is a number ranging from 300 to 900, based on a level analysis of your credit files that represents your creditworthiness.

But did you know countries have a credit rating (score) as well?

They are known as Sovereign Rating.

It is a country’s rating by international credit rating agencies like S&P, Moody's, Fitch etc. based on per capita income, GDP growth, inflation, external debt, political stability, economic development and default history, etc.

In a nutshell, it is the creditworthiness of a nation and the government's ability and willingness to service its debt in full and on time.

Why is it important?

Sovereign ratings influence the cost of capital at which countries can obtain credit in international financial markets. A country's rating history is helpful for international organizations like the World Bank and IMF, which provide credit and aid to countries.

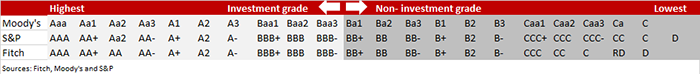

Normally, a credit rating agency will evaluate a country's economic and political conditions at the government's request and assign a rating ranging from AAA grade to D.

There are three major global credit rating agencies namely, Standard & Poor's (S&P), Moody's and Fitch. Here’s what their rating structure looks like:

By allowing external credit rating agencies to evaluate its economy, a country shows its willingness to publicize its financial information for its investors. A country with high credit ratings can effortlessly access funds from the international investors and also secure foreign investment.

Following are the ratings of some of the popular countries -

|

Country |

S&P |

Moody’s |

Fitch |

|

United States |

AA+ |

Aaa |

AAA |

|

United Kingdom |

AA |

Aa3 |

AA- |

|

Australia |

AAA |

Aaa |

AAA |

|

Canada |

AAA |

Aaa |

AA+ |

|

France |

AA |

Aa2 |

AA |

Source: theglobaleconomy.com, Data as on Feb, 2022

Many international investors and funds also monitor sovereign ratings while making investments and taking investment decisions.

Some institutional investors are only allowed to invest in debt above a certain rating level.

And this is how Sovereign Ratings affect a country's access to global capital markets and capital flow.

Did you know?

S&P retained India's sovereign rating at lowest investment grade ‘BBB- ‘, with a stable outlook (data as of 9th July 2021).

But how can one measure the fluctuations in the economic activity of a country over time?

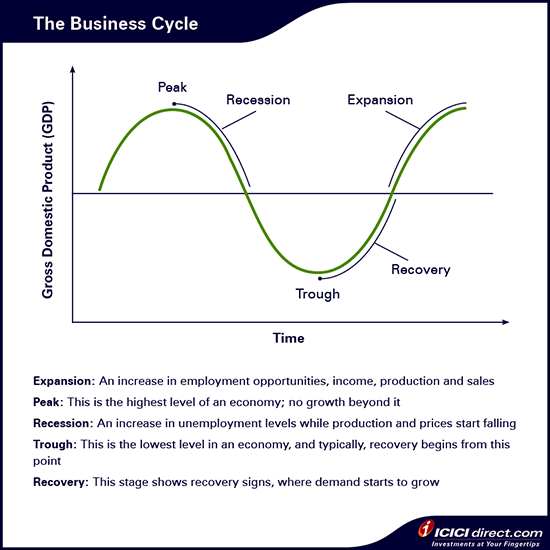

While many indicators help you analyse a country's economic activity, one graph, in particular, describes it all – The Business Cycle.

The Business Cycle

The below graph depicts the fluctuations in the economic activities over time (number of years) depending upon the production output of goods and services in the economy.

It’s classified into five stages:

Expansion: In this stage, there is an increase in employment opportunities, incomes, production and sales. In the expansion phase, the economy has a steady flow of money supply while investments earn good returns.

Peak: This is the highest level of an economy; beyond, which it becomes stagnant resulting in no growth. Inventories also start piling up due to stagnant demand.

Recession: This is also known as the period of Contraction. In this stage, the economy starts shrinking. Unemployment levels begin to rise while production and prices start falling. Income levels also eventually drop.

Trough: This is the lowest level in an economy, and typically, recovery starts from this point.

Recovery: This stage shows recovery signs, where demand starts to grow. So, this means there is an increase in price, production and employment level.

Additional read: Economics for Stock Market

What are the causes of these fluctuations in the economic activities?

There are two main reasons:

1. Static – These are natural market fluctuations caused by changes in free-market conditions such as change in consumer behaviour and business productivity. In short, it occurs when there is an imbalance between the demand and supply of goods and services.

2. Shocks – These are unpredictable events like wars, financial disasters or natural calamities, which may affect the smooth functioning of the economy. The impact of the COVID-19 pandemic is one of the recent examples of shocks that affect a country’s economy.

How long do these stages last?

It is difficult to identify business cycle stages, as the duration of these cycles cannot be assessed accurately. Typically, one cycle lasts for around four-five years, but they could be longer or shorter than the average length on several occasions. However, you can identify business cycle stages by analysing economic indicators like inflation, production demand, per capita income, unemployment data, etc.

How is a business cycle connected to the stock market?

The stock market is a leading economic indicator, which means the stock market changes before the economy's actual change occurs. In a typical scenario, the stock market always moves up when the economy is on the up-cycle. In some cases, when the economy reaches close to its peak, a fall in the stock market could indicate recession. Otherwise, temporary ups and downs are natural characteristics of the stock market.

Which sectors or industries are most affected by fluctuations in the business cycle?

Cyclical industries, where demand and profitability are directly linked to the economy, are most affected by changes in business cycles. These sectors include capital goods, infrastructure, cement, metals industries etc. On the other hand, sectors such as pharmaceuticals and FMCG are least affected by changes in business cycles.

Summary

- Foreign investments in India are usually through Foreign Direct Investments [FDI's] and Foreign Institutional Investors [FIIs].

- Foreign Institutional Investors impact the flow on markets by investing in large amounts that could influence market trends.

- Foreign Direct Investments aids in transfer of goods and services that could boost new job opportunities and increase employment rates.

- Sovereign rating is the creditworthiness of a nation and its government's ability to service the debt in full and on time.

- A business cycle is classified into five stages: expansion, peak, recession, trough and recovery.

But as an investor, how do you know where the market is headed? Well, Economic Indicators can help analyse the economic performance and predictions of future performance. So, let’s understand more about the economic indicators in the next chapter.

Disclaimer: ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Composite Corporate Agent License No.CA0113, AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. We are distributors of Insurance and Mutual funds, Corporate Fixed Deposits, NCDs, PMS and AIF products. We act as a Syndicate, Sub -syndicate member for IPO, FPO. Please note that Mutual Fund Investments are subject to market risks, read the scheme related documents carefully before investing for full understanding and detail. . ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd., ICICI Home Finance Company Limited and various other banks / NBFC for personal finance, housing related services etc. & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc. NPS is a defined contribution plan and the benefits would depend upon the amounts of contributions invested and the investment growth up to the point of exit from NPS. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)