Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

Prem and Sachin are seasoned stock market investors. They keenly follow the market and have been investing for a long time.

Prem: “I have been keenly eyeing Seema Corporation Limited for a long time, and I've finally picked it up at Rs. 700 last month.”

Sachin: “Oh no! I think you made a big mistake. It would be best if you sold it off immediately. Financial papers are abuzz that it is not going to do well at all.”

Prem: “But it is currently trading at Rs. 540, and if I sell now, I'll be at a loss.”

Sachin: “So take the loss, no! The way the stock is falling right now, it is better to gather your losses now than later when it will go down to mere pennies.”

Prem: “Let me wait for the stock price to come back to Rs. 700.”

Sachin: “What makes you think it will return to your cost price? I think the faster you sell it, the better it will be for you.”

Prem: “No, no, let me wait.”

Prem continued to wait, believing the stock price would return to Rs. 700. But unfortunately, despite trade market analysts and financial experts sending out red signals regarding the company's prospects, Prem held onto his belief and eventually suffered a significant loss.

Prem fell prey to what we commonly call anchoring bias.

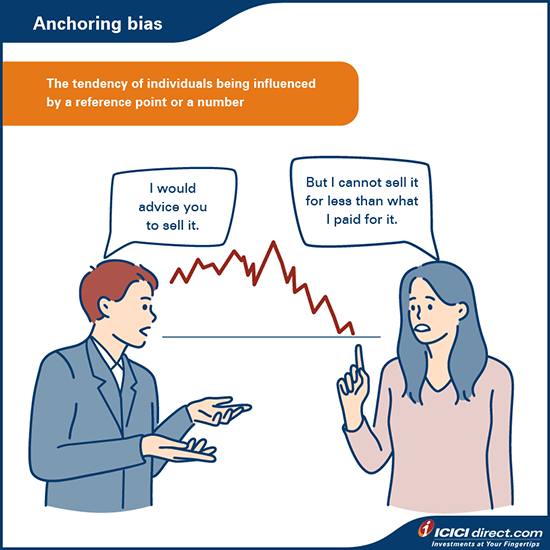

Behavioural bias#4: Anchoring bias

Anchoring bias is a common erroneous belief held by all kinds of investors, even the experienced ones.

This is when you are unwilling to sell stocks at prices lower than their purchase cost. The purchase price of the stock works like an anchor. You may believe that the company will bounce back to the original purchase price if it is trailing. And so would be unwilling to change your decision. So, anchoring bias basically the tendency of being influenced by a reference point or a number.

What can you do about it?

When investing in the stock market, it is vital to acknowledge errors and correct them. You see, the market dynamics are constantly changing. So, it’s important to consider the rapid pace of the stock market and factor in new information from credible sources to make the right decision.

Behavioural bias#5: Gambler's fallacy

Here’s a conversation between Ashish and his friend Keval about the stock he chose to invest in a few days back.

Ashish: "I thought I had picked up Brent Limited's stock at the right price."

Keval: "What made you think so?"

Ashish: "It had corrected from its peak of Rs. 2500 to Rs. 1500. According to my calculations, it had already dropped by 40%, so I thought it would not fall any further."

Keval: "But it has fallen even further down to Rs. 900."

Ashish: "I know! And I can't figure out why it is continuing to fall. I hope it will come back to my purchase cost."

Here, Ashish assumed that it wouldn't fall any further since the stock had already fallen by 40%.

This is another common bias among some investors, especially new ones.

In this bias, you may believe since the stock price has already fallen to a considerable level, wouldn't fall any further without credible backing on why you think so.

What can you do about it?

If you have substantial reasons, backed by financial analysts and experts as well as your own research, that the price will not fall any further, you can make the right decision. However, if the stock price falls by 40 to 50%, it is no guarantee that it will not lose any further.

Did you know?

Gambler's fallacy is also known as the Monte Carlo fallacy, named after the Las Vegas’ Monte Carlo casino, where this bias was first observed on 18th August 1913 when in a game of roulette, the ball fell in black 26 times in a row. This was an extremely uncommon occurrence since the probability of either red or black occurring 26 times in a row without any external intervention would be 1 in 66.6 million.

Gamblers lost millions of francs betting against black incorrectly because they assumed that the streak was causing an imbalance in the randomness of the wheel, and it had to be followed by a long line of red eventually.

Source: Wikipedia

Behavioural bias#6: Availability bias

"It's best to stay away from the stock market. I know so many of my friends who have lost money investing in shares, so why should I risk it?"

This is not the first time you may have heard such statements. It is a simple example of availability bias.

But what is availability bias?

It is a human tendency to believe and misjudge an event on its frequency and magnitude that may have taken place recently. Sometimes you tend to make decisions based on information you receive without researching or finding out the trustworthy source behind it.

This form of bias applies to many decision-making events and is not just limited to investments.

What can you do about it?

When taking an investment decision, consider all rational options available to you. Assess the pros and cons and its outcomes to find the right choice. When it comes to investing, weighing in the risks and rewards associated with the investment type as well as your risk profile is an important factor to look into that can help you make the right investment decision.

Did you know?

Nobel-prize winning psychologists Amos Tversky and Daniel Kahneman discovered Anchoring Bias and Availability Heuristic in an experiment and published their findings in 1974.

Summary

- Anchoring bias is the tendency of being influenced by a reference point or a number.

- Gambler's fallacy, also known as the Monte Carlo fallacy, is when investors believe that since the stock price has already fallen to a considerable level wouldn't fall any further without credible backing on why you think so.

- Availability bias is a human tendency to believe and misjudge an event without looking deeply into it.

In the next chapter, we will cover the remaining behavioural biases and help you understand how they can impact your investments.

Disclaimer: ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Composite Corporate Agent License No.CA0113, AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. We are distributors of Insurance and Mutual funds, Corporate Fixed Deposits, NCDs, PMS and AIF products. We act as a Syndicate, Sub -syndicate member for IPO, FPO. Please note that Mutual Fund Investments are subject to market risks, read the scheme related documents carefully before investing for full understanding and detail. . ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd., ICICI Home Finance Company Limited and various other banks / NBFC for personal finance, housing related services etc. & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc. NPS is a defined contribution plan and the benefits would depend upon the amounts of contributions invested and the investment growth up to the point of exit from NPS. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)