Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 15: Corporate Actions: Meaning, Types & Examples

"Concise Ltd. has decided to split their stock”

You stare at this headline in today's newspaper. Oh no! that's the stock you own!

And you begin to panic. You wonder if you've made the right choice buying stocks of Concise Ltd!

You look back and think of all the due diligence in researching the company and its management. You also recollect that the company ticked all the right boxes based on your financial goals and risk profile and found it a suitable investment fit for you in the long run.

But now what do you do? You’re worried if this event will impact your stock investment!

You can take a deep breath and relax.

For one, you do not need to do anything. This split will automatically be applied to your investment. But this is what Concise Ltd will do — It will publish a mandatory corporate action — something like an FYI telling you what it's doing.

This action taken by Concise Ltd is what is known as a corporate action.

Types of corporate actions

Any action taken by a company that creates an impact on issued securities is known as corporate action.

So, why does an investor need to know about the corporate actions?

It is essential to understand that these actions influence stock prices to a certain extent. When you become an investor or shareholder of the company, knowing how corporate actions can impact its stock will give you a clear understanding of its financial health and impact on its share price. It helps you get to know more about the short-term expectations from the company and their long-term aspects.

But who orders these corporate actions and is it compulsory for the shareholders to comply?

Well, there are three main types of corporate actions. They are:

-

Mandatory Corporate Action:

These actions are issued by the company’s board of directors and it is compulsory for shareholders to take part. Examples of mandatory corporate action include bonus issue, stock splits and cash dividend.

-

Voluntary Corporate Action:

These actions are issued by the company’s board of directors but gives the shareholders the choice to whether or not to participate. Examples of voluntary corporate action include making buyback offers and rights issues.

-

Mandatory Corporate Action with Options:

These are also issued by company’s board of directors but gives the shareholder a choice between different options with one as default. What that means is, if you, as a shareholder, do not make your choice, the default option would be implemented. Examples of such corporate actions include a choice between cash or stock dividends.

What are the major corporate actions and their impacts on the stocks?

Let’s look into them one by one

-

1. Dividend

Any profitable company can pay a dividend. Generally, dividends are paid out at specific periods and they are mainly a share of the company's profits given out to stock owners/shareholders. Let's understand dividends through an example.

Let's say 'Newage Technologies' announces Rs. 10 crore profit for this year and has one crore outstanding shares. The company's board of directors decided to distribute Rs. 5 crore profit to their shareholders as a dividend. It comes out as Rs. 5 per share dividend. Many times it can also be a percentage in terms of face value. If a company has a face value of Rs. 5, its dividend is 100% of the face value.

Sometimes we saw massive dividend figures like a company 'X' gives a 500% dividend, but how much would you get in terms of the rupee. So, for example, if a company has a face value of Re. 1 and announces a dividend of 500%, you will get 500% of Re. 1, i.e., Rs. 5 per share.

Usually, the share price falls post distribution of the dividend to the extent of dividend received, but this won't be true in all cases.

But remember, issuing dividends is the decision of the company’s board of directors and just because a company is doing well, it does not mean it will issue a dividend. Instead, if the company feels that it could better utilise the funds to enhance a new project rather than pay dividends to shareholders, they have the liberty to do so.

So, when do they issue these dividends?

The company can decide to pay dividends anytime during a financial year. When it's paid during a financial year, it is regarded as an interim dividend. If the company issues a dividend at the end of the financial year, it is known as final dividend. We can calculate the dividend yield by dividing the annual dividend amount by the current stock price. For example, if a stock has paid a yearly dividend of Rs. 5 and the current market price is Rs. 500, its dividend yield will be 5*100/500 = 1%.

But yes, you need to ensure that you have the share(s) of the company in your demat account on the record date to be entitled for the corporate dividend. We discuss in detail regarding the same in the following chapters.

Did you know?

The dividends can only be paid out of the company’s profits. It could be the current financial year’s profit or undistributed or accumulated profits of the previous years.

-

2. Stock split

Let’s say you visit a bakery with your friend to buy a cake. both of you wish to purchase two 500gm cakes at Rs. 800 each.

But the bakery only has one 1kg cake priced at Rs. 1600. But you don’t need a 1kg cake. And it is also way over your budget.

So, what do you do?

Your friend and you decide to split the 1kg cake into a 1:2 ratio.

That means both you and your friend get what you wanted; a 500gm cake at Rs. 800 each. With this split, you get the needed quantity at the price you can afford.

Now, let’s apply the same to your stocks.

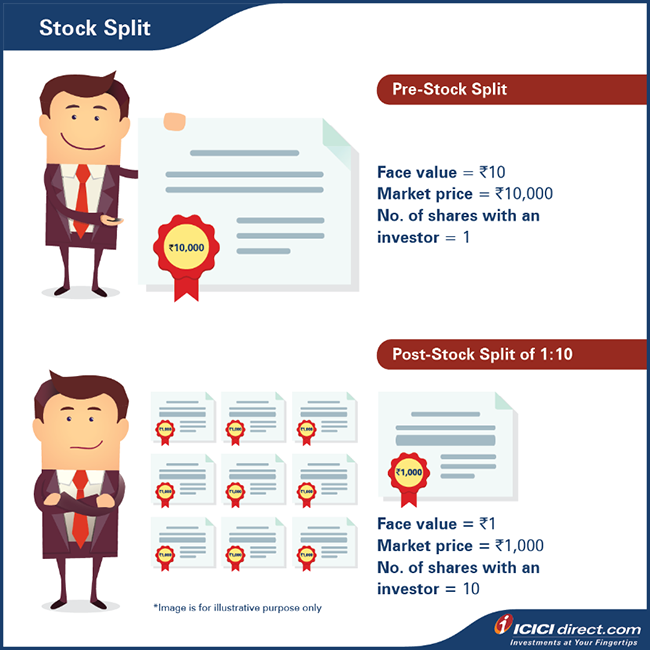

A stock split is a situation where a company may choose to increase the number of its outstanding shares and at the same time decrease its face value proportionally.

Simply put it means the stocks you hold will actually split.

Oh no! So that means less money?

Not at all! In fact, the total value of the shares will remain the same compared to the pre-split cost, because a stock split announcement does not add any actual value. Post stock split, share price also reduced proportionately.

Let's understand this with an example.

Let's assume the face value of Rising Sun Ltd stock is Rs. 10. Now the company announces a stock split in the ratio of 1:2. When this happens, the face value of Rising Sun Ltd stock changes to Rs. 5. That means, as a shareholder of Rising Sun Ltd, you formerly owned one share before the split, but now you will own two shares after the stock split announcement. Simultaneously, the stock price will be reduced to half.

This form of corporate action helps the company to divide its existing shares into multiple shares and helps increase the liquidity of the shares.

But there are times when a company may announce a stock split to lower the trading price of its stock. At the same time, it splits the stock in a range that is comfortable for most investors.

But won’t that increase the demand for that stock?

You are absolutely right. A stock split can sometimes result in an increase in the per share price (i.e., in comparison to the post-split calculated share price) immediately after the stock split. That's because the demand for these stocks increases as it's now more affordable to investors.

Did you know?

Eicher Motors, the parent company of Royal Enfield, announced a stock split of 1:10 effective August 24, 2020. After the stock split, the shares of the company began to trade at Rs. 2,300 per share compared to Rs. 21,700 per share before the stock split. But these gains were pared off before the market close.

Summary

- Companies initiate corporate actions to help affect the securities issued by the company in a positive light.

- Generally, corporate actions are agreed to by the company’s Board of Directors and on authorization by the shareholders.

- There are three main corporate actions – mandatory corporate action, voluntary corporate action and mandatory corporate action with options.

- Dividends are part of the profits given by the companies to their shareholders.

- Companies issue stock splits when they want to increase the liquidity of their shares by reducing the share price proportionally.

Let’s wind up the rest of the popular corporate actions in the second part of this chapter.

Top Mutual Funds

Top Mutual Funds

COMMENT (1)

Extraordinary expalation with simple examples.

Reply