Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

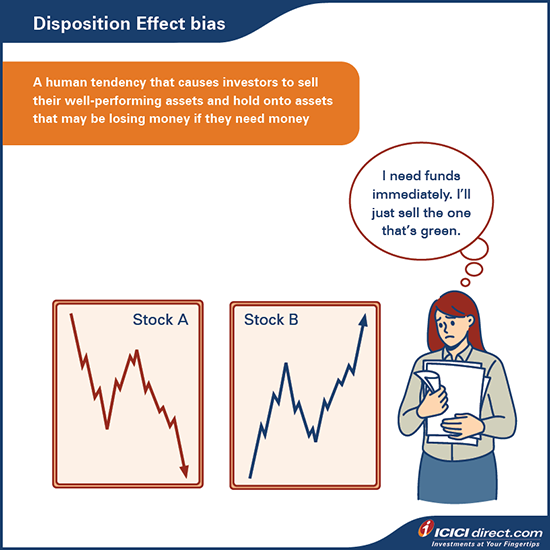

Behavioural bias#7: Disposition effect

Let’s start off with an example to understand the next type of bias – Disposition effect

Paromita invested Rs. 5 lakh in two stocks in 2019 — Arcsoft Limited and New Horizons Limited.After two years, the stock value of Arcsoft Limited has risen to Rs. 7 lakh. But New Horizons Limited is down to Rs. 4 lakh.

To meet an emergency, she needs to withdraw some money and so, decides to sell the stocks of Arcsoft Limited because she will book a profit.

She believes that if she sells New Horizons Limited stocks, she will be booking a loss, which she does not want to do. This behavioural bias is known as the disposition effect.

So what is disposition effect?

It is the tendency of investors looking to sell their shares of stocks whose price has increased while maintaining the assets that are dropping in value.

This bias you may prefer to sell your winning investments to make a profit while holding on to your losing investments hoping that they may become profitable in the future.

What can you do about it?

To avoid this anomaly in behavioural science, you need to think rationally and avoid making decisions based on emotional reactions. One way to overcome this culpable bias and disregard your prejudices is through improving your investing acumen.

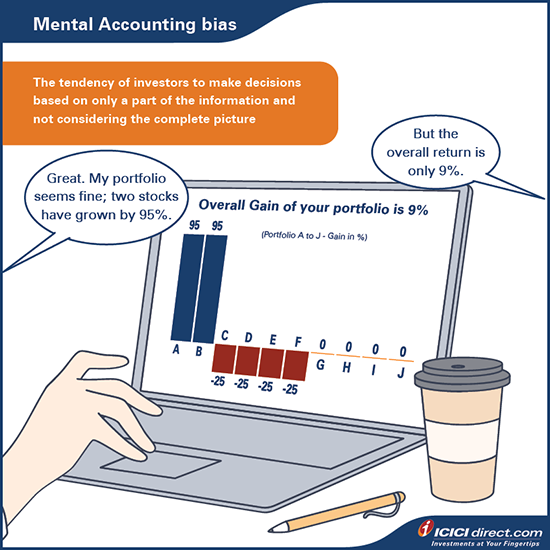

Behavioural bias#8: Mental accounting

Heena: "Out of 10 stocks in my portfolio, 2 have risen 95%!"

Saif: "Wow, isn't that a good thing? But what about the others?"

Heena: "That's the problem! Four of them are giving negative returns and are down by 25% each. The remaining four have not moved at all."

Saif: "What do you plan to do?"

Heena: "I can control the losses of a few stocks to 25%."

Saif: "But have you looked into how much you own on your portfolio on the whole?"

Heena: "I am just happy that out of the 10 stocks in my portfolio, at least two are giving me 95% returns."

Like Heena, many investors are simply satisfied that a handful of their assets is giving them excellent returns out of all the stocks in their portfolio. This is known as mental accounting. It is basically when people make decisions based on only a part of the information and not considering the complete picture. It can distort your perceptions of money and lead you to make decisions based on your intuition rather than on sound reasoning.

Let’s consider Heena’s investment portfolio, assuming she has invested an equal amount in all the ten stocks:

|

Stocks |

Invested amount (in Rs.) |

Stock returns |

Stock value after a year (in Rs.) |

|

Stock 1 |

1,00,000 |

-25% |

75,000 |

|

Stock 2 |

1,00,000 |

-25% |

75,000 |

|

Stock 3 |

1,00,000 |

-25% |

75,000 |

|

Stock 4 |

1,00,000 |

-25% |

75,000 |

|

Stock 5 |

1,00,000 |

95% |

1,95,000 |

|

Stock 6 |

1,00,000 |

95% |

1,95,000 |

|

Stock 7 |

1,00,000 |

0% |

1,00,000 |

|

Stock 8 |

1,00,000 |

0% |

1,00,000 |

|

Stock 9 |

1,00,000 |

0% |

1,00,000 |

|

Stock 10 |

1,00,000 |

0% |

1,00,000 |

|

Total portfolio value |

10,00,000 |

10,90,000 |

|

|

Portfolio return = (10,90,000 – 10,00,000)/10,00,000 = 9% |

|||

As you can observe, even though two of the stocks in Heena's portfolio gave 95% returns, the four stocks earning negative returns decreased the portfolio return to a mere 9%.

However, if two stocks give 50% returns in a portfolio, four stocks give 10% returns and four stocks do not move, the portfolio return would be 14%.

|

Stocks |

Invested amount (in Rs.) |

Stock returns |

Stock value after a year (in Rs.) |

|

Stock 1 |

1,00,000 |

10% |

1,10,000 |

|

Stock 2 |

1,00,000 |

10% |

1,10,000 |

|

Stock 3 |

1,00,000 |

10% |

1,10,000 |

|

Stock 4 |

1,00,000 |

10% |

1,10,000 |

|

Stock 5 |

1,00,000 |

50% |

1,50,000 |

|

Stock 6 |

1,00,000 |

50% |

1,50,000 |

|

Stock 7 |

1,00,000 |

0% |

1,00,000 |

|

Stock 8 |

1,00,000 |

0% |

1,00,000 |

|

Stock 9 |

1,00,000 |

0% |

1,00,000 |

|

Stock 10 |

1,00,000 |

0% |

1,00,000 |

|

Total portfolio value |

10,00,000 |

|

11,40,000 |

|

Portfolio return = (11,40,000 – 10,00,000)/10,00,000 = 14% |

|||

What can you do about it?

As an investor, you need to concentrate on portfolio returns. That means you need to ensure that all the stocks in your portfolio are giving you returns. Having more winners in your portfolio is far better than having a combination of large movers and losers. It would be best to make a concerted effort to break this bias by being deliberate about your money. Think critically about your overall portfolio and find ways to make room for winners while cutting down on losses.

With this, we wind up on the prevalent behavioural biases that you can effectively conquer.

Now that we are wrapping up the entire Equity Course Series, here are some common pitfalls you may need to avoid when it comes to investing your money.

- Do not consider low-priced and low-quality stocks.

- Establish a system or set of rules before you set out to invest.

- Don't allow emotions or ego to come in the way of a sound investment strategy.

For instance, you may think it foolish to purchase a stock at Rs. 60 and sell it at Rs. 55 only to repurchase it at Rs. 65. Keep aside that emotion and view it as a good learning experience. You may have jumped at buying the stock earlier, but avoid hesitation if you feel the time is right. Selling a stock must have no bearing on whether you wish to purchase it at a later date. Remember, every decision is a new one.

- When looking to invest in equities, think long-term and not short-term.

- Avoid making unplanned investments without setting clear objectives and time frames to achieve them.

- Patience is a virtue when investing. Allow your investments to reap the rewards in the long run, and do not let market hearsay and rumours influence your decision about existing stocks.

- Be careful of what is taking place in the market.

- Knowledge is power, especially when it comes to investing, and it can give you great comfort. However, when looking for information, get into the details and understand the subject deeply.

- Avoid putting all your eggs in one basket — keep diversification on the top of your mind.

- Margin is a deep-seated risk — and not a luxury. When looking into margin trading, view your risk profile and employ margin trading smartly. If you borrow too much, you could lose control of your investments.

- It is dangerous to be greedy. It could wipe out all the gains you have already made. Once you've made a reasonable profit, look to exit the market.

Summary

- Disposition effect relates to the tendency of investors looking to sell stocks whose prices increase to while holding onto losing assets.

- Mental accounting is a bias that distorts investor perceptions and leads them to make decisions based on only a part of the information without considering the whole picture.

- There are many common pitfalls you may need to avoid when investing your money.

We hope you've gained a firm footing and a solid foundation to begin your journey into the stock market. Revisit any of these chapters at any time to familiarize yourself with the basics and boost your understanding. Happy investing!

Disclaimer: ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Composite Corporate Agent License No.CA0113, AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. We are distributors of Insurance and Mutual funds, Corporate Fixed Deposits, NCDs, PMS and AIF products. We act as a Syndicate, Sub -syndicate member for IPO, FPO. Please note that Mutual Fund Investments are subject to market risks, read the scheme related documents carefully before investing for full understanding and detail. . ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd., ICICI Home Finance Company Limited and various other banks / NBFC for personal finance, housing related services etc. & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc. NPS is a defined contribution plan and the benefits would depend upon the amounts of contributions invested and the investment growth up to the point of exit from NPS. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)