Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 2: Learn Risk & Return on Equity Investment in Detail

“What would the weather be like today?”

“Will there be traffic on our way to the office?”

Now, what’s common about the above queries?

They are all calling for a prediction. Although it is difficult to predict the future, it doesn’t mean you can’t have an answer to these questions. All you need to do is carry out a proper investigation based on the factors involved and all the available information.

Return from equity investments

Now let’s look at the question you have been waiting to ask – How much return will you earn from your equity investments?

Like the questions regarding the weather and the traffic, there is no definite answer to this question. However, proper research and analysis of the various factors involved may help you evaluate the returns you may earn from your investments.

And the many factors that your investment returns depend on include domestic and global economic factors, inflation, interest rate, the state of the economy, political environment, fiscal policy and regulations, etc.

How does one estimate the returns?

Before investing in company shares, your goal is to find the right value. Ideally, you need to do thorough research, review the company's fundamentals, look into its historical performance and conduct proper analysis before investing.

It can also be a good idea to look at how the company is faring against its competitors and its advantages to stand out among its peers. Also, looking into the company's growth prospects and the effectiveness of its executive leadership can give you valuable insights into the company’s future potential.

Typically, these are just some of the basic components that determine your return on investments in a business. It is also important to look into the long-term strength of the company and its stability.

Did you know?

Historical performance indicates that returns of broad equity indices are around 12% p.a. in the long term. Source: bseindia.com, Sensex has given an annual return of 12.58% between 1 Jan2001 - 1 Jan 2021.

Risk associated with equity investments

Although there are many potential benefits, there are risks as well, when investing in equities.

For instance, market risks could impact your equity investments directly. That means, share value will often rise or fall based on market forces, leading to the probability of capital loss and unstable returns.

But when it comes to equities, with great risk comes a greater probability of high returns. And that's why equity investments have historically proven of growing one's investment into wealth in the long run.

Did you know?

One of the most successful investors of all time, Peter Lynch once said, “The real key to making money in stocks is not to get scared out of them.

When it comes to equity investment, there are two risks you need to know:

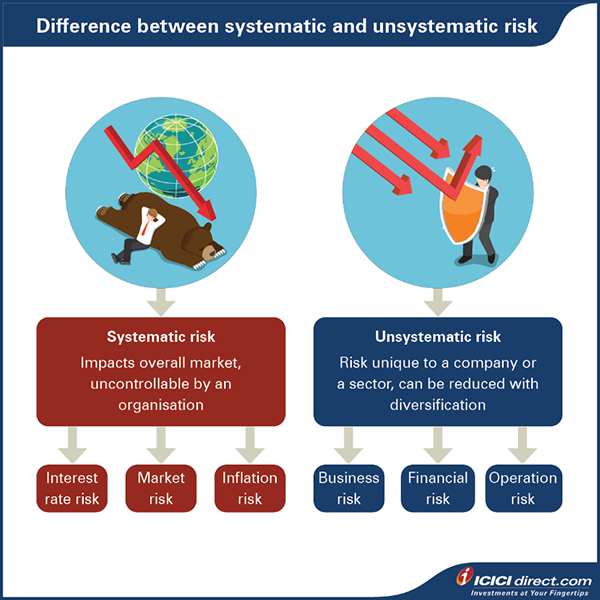

Systematic risk

is also known as market risk which impacts all the stocks in some way. This risk affects the overall market and is not specific to a particular company or industry. Generally, systematic risk is viewed as unpredictable and difficult to avoid. Some common examples of systematic risk include economic and political environment, interest rate, inflation, etc. are examples of market risk.

Unsystematic risk

is the risk unique only to a particular company or industry. These risks emerge if there is some uncertainty present in the company or industry. Common examples of unsystematic risk include shift in core management or breakdown of management, product recalls, new competitor with the potential to take substantial market share, financial reports, internal strikes etc.

How can you control risks in equity investments?

Since systematic risk is unpredictable and almost impossible to avoid, there are ways to reduce the impact of this specific risk.

You can mitigate systematic risk by allocating assets based on your investment goal, time horizon and risk tolerance. You may want to ensure that your investment portfolio includes a wide range of asset classes that will react differently to any event which may affect the overall market.

Since unsystematic risk is specific to a company or industry, the right way to mitigate this form of risk is through proper diversification.

Sounds complicated?

Don’t worry, we break it down for you.

Let’s look at the three golden rules that can help minimize the risk of your equity portfolio:

Invest for the long-term –

When you choose a long-term investing approach, it means you are accepting a specific amount of risk in the pursuit of receiving high rewards. Given its potential for capital appreciation, you may want to invest in equity for the long-term.

Diversify your portfolio –

Spreading your investments around can prevent exposure to any one kind of asset. This is known as diversification. Diversifying your assets and building a well-diversified investment portfolio can help reduce the volatility and risk of your portfolio over time.

Take advantage of rupee cost averaging –

Rupee cost averaging occurs when you invest a fixed amount of money at regular intervals and you buy more shares when the prices are low and less when the prices are high. You can do it with Systematic Equity Plan (SEP) for equity investments and Systematic Investment Plan (SIP) to invest via mutual funds

Now that you have a clear picture of what to expect from equity investments, let's look at how you can start investing in them -

Ways to invest in equity

There are two ways you can invest in equity:

- Direct investment in shares/stocks of companies

- Investment through equity mutual funds

To help you decide the right option, let’s evaluate their differences

|

|

Direct Shares/Stock |

Equity Mutual Fund |

|

Knowledge Required |

Requires in-depth knowledge, analytical data and experience before making stock picking decisions. |

Since fund managers manage active mutual funds, investing in mutual funds doesn’t require in-depth knowledge, and hence, can be ideal for new and experienced investors. |

|

Control over stock |

Investors have complete control on the type of stocks they wish to buy or sell. |

Fund managers invest in stocks that sow the potential of high return, based on their analysis and expertise. |

|

Volatility and Return |

Stocks are highly volatile. Your returns would depend on several factors affecting market volatility. |

Since you are investing in multiple companies via a single fund, the risk involved may be lower than direct stocks. |

|

Prerequisite |

You need to open a bank account, a Demat Account (to hold your securities in electronic form) with any Depository Participant (DP) and a Trading Account (buy and sell securities) with a stock broker. |

You need to complete the Know Your Customer (KYC) process with either an Asset Management Company (AMC), KYC Registration Agency (KRA) or broker to start investing. |

If you are a new investor, benefit from the advice and suggestions of a financial advisor to choose the best stocks as per your need. Alternately, research recommendations from a well-established, firm is also recommended.

Mythbusters

Myth: You Need to Be Rich to Invest in Equity Markets

Busted: As mentioned before, you can now step into the equity market via direct equity or mutual fund with as low as Rs. 100. Thanks to both SIP and SEP.

Are you wondering how investments in equity are paid out?

Well, there are two ways you can receive the returns earned from your equity investments:

- Dividend: As the shareholder, you receive a periodic payment made from the company's profits.

- Capital appreciation: The price of a stock appreciates due to the growth posted by the company, resulting in capital appreciation.

Additional Read: How to Choose the Best Equity Mutual Fund

Summary

- Remember to check the various market and company-specific factors before making an equity investment.

- You can invest in equity directly through company stocks or through equity mutual funds.

- Equity investments pay out returns in the form of dividend or capital appreciation.

Now that you're excited about investing in equity instruments, getting started in the stock market is one way to go. But before you enter stock investments, let's look at the elements that form the stock market.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)