Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 4: How Does the Stock Market Work?

Let’s start this chapter with an interesting ‘true’ story.

It’s always better when it’s true, isn’t it?

Anyway, let’s begin:

In 1611, the Dutch East India Company employed many ships to trade gold, spices, porcelain and silks worldwide. But trading around the globe was no small feat and definitely not cheap. So, in order to fund their operation, the company reached out to private citizens who could pay for the journey in exchange for a part of the ship’s profit. This allowed the Dutch East India Company to carry out the operations smoothly worldwide and thereby increasing the profits for themselves and the citizens who invested in the ship.

And this is how the Dutch East India Company became the world’s first company to issue stocks.

Stock exchange in India

The BSE Limited (BSE) and the National Stock Exchange of India Ltd (NSE) are the two primary exchanges in India.

Did you know?

On 31 August 1957, the BSE became the first stock exchange to be recognized by the Indian Government under the Securities Contracts Regulation Act.

The additional operational stock exchanges in the country, are:

- Calcutta Stock Exchange

- Metropolitan Stock Exchange of India

- India International Exchange (India INX)

- NSE International Exchange (NSE IFSC)

- National Commodity & Derivatives Exchange

- Multi Commodity Exchange of India (MCX)

- Indian Commodity Exchange (ICEX)

However, the BSE and NSE have established themselves as the two leading exchanges and account for the significant share of the equity volume traded in India. Most key stocks are traded on both the exchanges and hence investors can buy them on either exchange.

Did you know?

The NSE is the world’s largest derivatives exchange by volume for two consecutive years - 2019 and 2020 according to the Futures Industry Association (FIA).

Source: bseindia.com

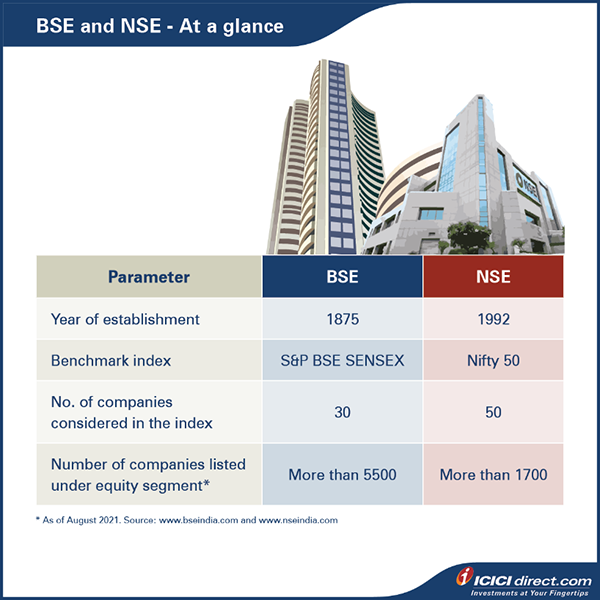

Let’s look at some facts about BSE and NSE -

While the BSE Sensex is older and more widely followed, both indices are calculated on the basis of free-float market capitalization and contain heavily traded stocks from key sectors.

If you are wondering what free-float market capitalization is, don’t worry. We will cover it in the upcoming chapters.

How to trade in stock exchanges?

If you are a movie buff, you would have seen several Hollywood movies showcasing floor hand signals on the New York Stock Exchange. Until recently, floor hand signals were used to trade at the stock exchanges. This method of communication was known as the Open Outcry method.

The open outcry method was how investments in the stock market were carried out. But not anymore.

Both exchanges have switched to fully automated computerized modes of trading known as BOLT (BSE On Line Trading) and NEAT (National Exchange Automated Trading) System respectively.

They aim to facilitate efficient processing, automatic order matching, faster execution of trades and transparency. The key regulator governing them in the Indian secondary and primary markets is the Securities and Exchange Board of India (SEBI).

So, who can invest in a stock market?

Stock market is not limited to just individuals. Even institutions can invest in the stock market on behalf of individuals.

So, you can say, there are two types of investors in the stock market :

- Retail Investors

- Institutional Investors

Retail investors

They are individual investors who invest for their personal benefit via brokerage firms or other mediums. They tend to invest their own money and invest regularly in small amounts. An investor who invests less than Rs. 2 lakh in an IPO is considered a retail investor in an IPO.

Institutional investors

Institutional investors however, constitute financial institutions (both domestic and foreign), banks, insurance companies, asset management companies (Mutual Fund AMC), etc. that invests in large quantities for individual investors. Their movements have the potential to impact the market.

What if you plan to move abroad or maybe you have been living outside for a long time, could you invest in the Indian Stock Market?

Well, of course you can.

However, you will need to get a Portfolio Investment Scheme (PINS) license from the Reserve Bank of India-designated banks. You will also need to open an NRO (Non-Resident Ordinary) or NRE (Non-Resident External) account with a broker registered in India. NRI can also invest in few securities with Non-PINS accounts.

And what if you had a demat account before gaining an NRI status?

In this case, you can just turn your demat account into an NRO account and your broker will transfer the shares from the old demat account to the new NRO account.

Now, isn’t that convenient?

But can a foreigner invest in the Indian stock market?

Yes, they can. They will have to invest as a Foreign Portfolio Investor (FPI). FPI can invest in Indian securities after registering with Designated Depository Participants (DDP).

Summary

- There are nine recognized stock exchanges in India, with the BSE Limited (BSE) and the National Stock Exchange of India Ltd (NSE) are two leading stock exchanges in India.

- The BSE and the NSE have fully automated automatic modes of trading known as BOLT (BSE On-Line Trading) and NEAT (National Exchange Automated Trading) System, respectively.

- The stock market is not limited to just individuals. Even institutions can invest in the stock market on behalf of individuals.

In the next chapter, let’s look into the importance of having a demat account and the process of investing in the stock market.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)